A Suffolk New York Subsidiary Guaranty Agreement is a legally binding document that outlines the terms and conditions under which a subsidiary company agrees to guarantee the obligations or debts of its parent company, based in Suffolk County, New York. This agreement serves to strengthen and secure financial transactions and provide additional assurance to creditors or lenders. The Suffolk New York Subsidiary Guaranty Agreement typically includes the identification of both the parent company and its subsidiary, along with details of the financial obligations being guaranteed. It outlines the subsidiary's willingness to provide a guarantee for the debts, loans, or contracts entered into by its parent company. This agreement acts as a form of collateral for the parent company's financial commitments, assuring third-party lenders that they have an additional source of repayment in case of default. Keywords: Suffolk New York, Subsidiary Guaranty Agreement, legally binding, obligations, debts, subsidiary company, parent company, financial transactions, additional assurance, creditors, lenders, identification, collateral, default. Different types or variations of a Suffolk New York Subsidiary Guaranty Agreement may include: 1. Limited Guaranty Agreement: This agreement specifies the subsidiary's guarantee up to a limited amount or for a specific set of obligations, providing only partial coverage. The subsidiary may choose to limit its exposure to the debts or obligations of the parent company. 2. Unconditional Guaranty Agreement: In this type of agreement, the subsidiary provides an unconditional guarantee, assuming full responsibility for the parent company's obligations without limitations. This type of agreement is commonly seen when a subsidiary has a strong financial position and wishes to provide maximum assurance to lenders. 3. Joint and Several Guaranty Agreement: This agreement involves multiple subsidiaries providing a joint guarantee, making them collectively responsible for the obligations of the parent company. This type of agreement may be used when several subsidiaries have equal or proportional involvement in the parent company's business operations. 4. Conditional Guaranty Agreement: A conditional subsidiary guaranty agreement sets specific conditions that must be met for the subsidiary's guarantee to be activated. These conditions might include the parent company meeting certain financial or operational milestones or following particular business practices. Note: The types mentioned above are for illustrative purposes, and the specific terms and variations may vary from one agreement to another based on the negotiation between the subsidiaries and parent company.

Suffolk New York Subsidiary Guaranty Agreement

Description

How to fill out Suffolk New York Subsidiary Guaranty Agreement?

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life situation, finding a Suffolk Subsidiary Guaranty Agreement suiting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. Apart from the Suffolk Subsidiary Guaranty Agreement, here you can get any specific document to run your business or individual deeds, complying with your county requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can pick the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Suffolk Subsidiary Guaranty Agreement:

- Check the content of the page you’re on.

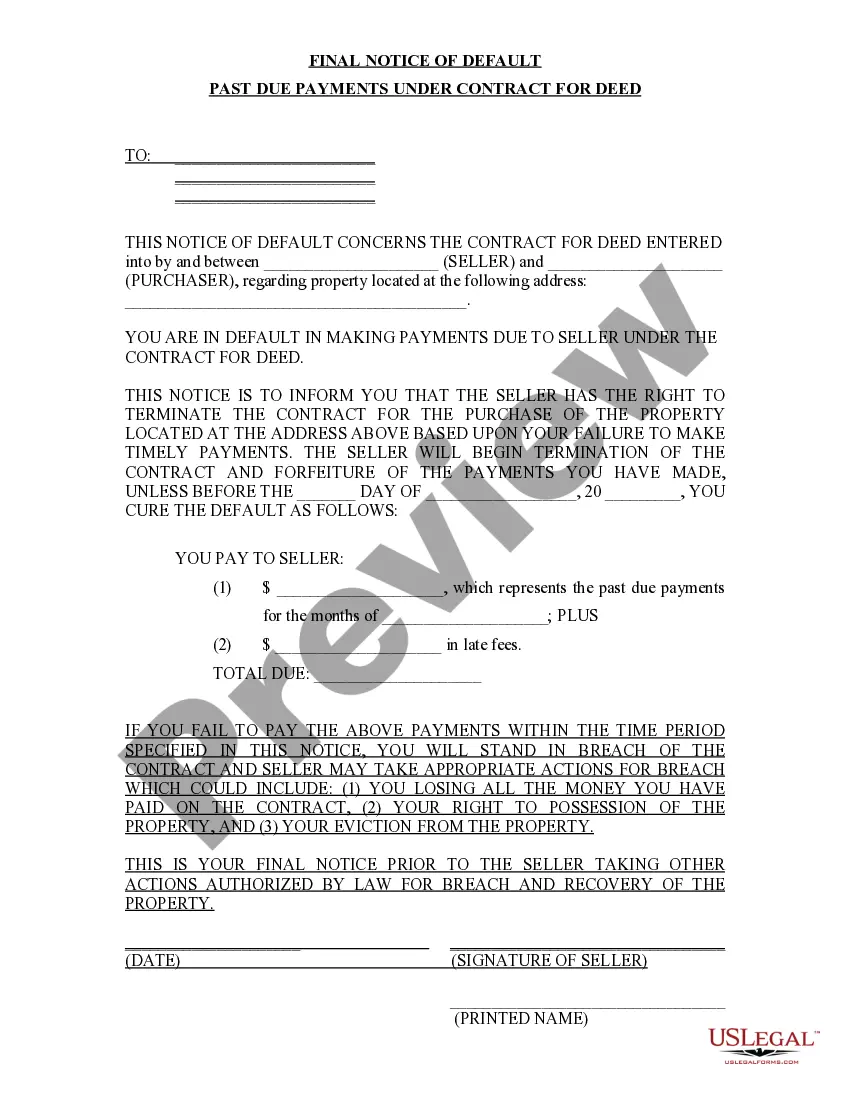

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Suffolk Subsidiary Guaranty Agreement.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!