Title: Clark Nevada Sample Letter for Settlement of Outstanding Bill of Deceased — Explained | Types, Importance, and Templates Introduction: A Clark Nevada Sample Letter for Settlement of Outstanding Bill of a Deceased individual plays a vital role in handling financial obligations after the person's demise. It serves as a formal communication between the estate executor, family representative, or the surviving relatives and the concerned creditors or service providers. In this article, we will provide a detailed description of the importance, key components, and types of Clark Nevada Sample Letters for Settlement of Outstanding Bills of a Deceased person, along with templates to assist you in drafting an effective letter. Keywords: Clark Nevada, sample letter, settlement, outstanding bill, deceased, formally communicate, financial obligations, estate executor, family representative, surviving relatives, creditors, service providers, importance, components, types, templates. Importance of Clark Nevada Sample Letter for Settlement of Outstanding Bill of Deceased: 1. Legal Obligation: Settling the outstanding bills of a deceased individual is a legal obligation as it ensures that the person's debts are repaid from their estate's funds. 2. Clear Communication: The sample letter provides a clear and professional method to communicate with creditors and service providers, avoiding any confusion or misunderstandings. 3. Documentation: The letter serves as important documentation, providing evidence of the estate executor or representative's efforts to settle the deceased's outstanding bills. 4. Protection of Assets: By addressing outstanding bills promptly, the estate can protect its assets and prevent any legal action against the deceased's estate. Key Components of Clark Nevada Sample Letter for Settlement of Outstanding Bill of Deceased: 1. Introduction: Begin the letter with a formal salutation and clearly state the purpose of the letter. 2. Deceased's Information: Provide details about the deceased, including their full name, date of death, last known address, and any relevant identification numbers. 3. Executor or Representative Information: Clearly identify yourself as the executor, family representative, or surviving relative responsible for settling the deceased's outstanding bills. Include your contact information for further communication. 4. Creditor/Service Provider Information: State the name and contact details of the creditor or service provider, along with the outstanding balance and any relevant account numbers or references. 5. Request for Outstanding Bill Settlement: Request a final bill statement and specify the preferred method of payment or any negotiation arrangements, if applicable. 6. Supporting Documents: Enclose any relevant documents, such as a copy of the death certificate or the deceased's will, if required. 7. Closing: End the letter with a professional closing statement expressing gratitude for their cooperation in settling the outstanding bill. Types of Clark Nevada Sample Letters for Settlement of Outstanding Bill of Deceased: 1. Medical Bills: Sample letters specifically designed for settling outstanding medical bills incurred by the deceased. 2. Credit Card Bills: Sample letters suited for dealing with outstanding credit card bills of the deceased. 3. Utility Bills: Sample letters to address outstanding utility bills, such as electricity, water, or phone bills. 4. Loan or Mortgage Bills: Sample letters dedicated to settling outstanding loan, mortgage, or other financial obligations. 5. Miscellaneous Bills: Sample letters that can be customized to settle any other outstanding bills, such as insurance premiums, car loans, or personal loans. Conclusion: A Clark Nevada Sample Letter for Settlement of Outstanding Bill of Deceased is an essential tool in properly handling the financial obligations left behind by a deceased individual. By formatting the letter appropriately and including all the necessary information, the executor, family representative, or surviving relatives can ensure smooth communication with creditors and service providers. Utilizing the templates provided can streamline the process and lead to efficient settlement of outstanding bills.

Clark Nevada Sample Letter for Settlement of Outstanding Bill of Deceased

Description

How to fill out Clark Nevada Sample Letter For Settlement Of Outstanding Bill Of Deceased?

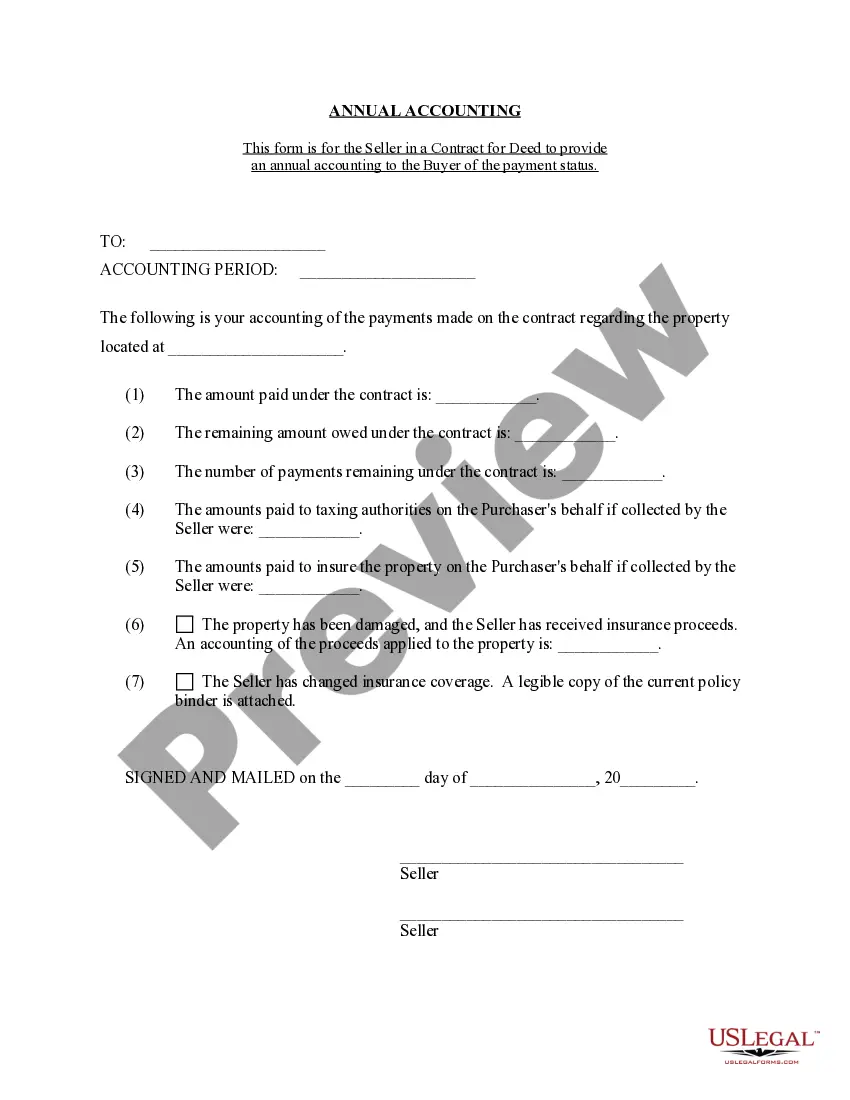

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from scratch, including Clark Sample Letter for Settlement of Outstanding Bill of Deceased, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different types varying from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find detailed materials and guides on the website to make any activities related to paperwork completion simple.

Here's how you can find and download Clark Sample Letter for Settlement of Outstanding Bill of Deceased.

- Go over the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can affect the legality of some records.

- Check the similar forms or start the search over to locate the correct file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and buy Clark Sample Letter for Settlement of Outstanding Bill of Deceased.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Clark Sample Letter for Settlement of Outstanding Bill of Deceased, log in to your account, and download it. Of course, our platform can’t replace an attorney completely. If you need to cope with an exceptionally difficult situation, we recommend getting an attorney to review your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-specific documents with ease!

Form popularity

FAQ

Inform the creditor that the deceased passed away; reference the prior call you made. Ask the creditor to place a formal death notice on the deceased credit file and to close the account. Provide information about the decedent, such as his full name, address, Social Security number, birth date and account number.

Seven Steps to Handling Your Loved One's Estate Take an inventory of property and important documents.Notify the Social Security Administration.Keep property safe from vandalism and theft.Address outstanding debt.Open claims for insurance benefits.Research additional benefits from employer.

Generally, the deceased person's estate is responsible for paying any unpaid debts. When a person dies, their assets pass to their estate. If there is no money or property left, then the debt generally will not be paid. Generally, no one else is required to pay the debts of someone who died.

Just put his name on the certificate. Names of the deceased are presented as just the name no honorific before no academic post nominals after. When they were alive they were Mr., Mrs., doctor, judge, ambassador, professor, senator, general, or captain.

Identify persons the executor should notify of your death. Include family members, close friends and business associates, including your attorney. Provide contact information for each person, as well as any final message or instructions to be given. Describe your important estate documents and their exact location.

Tips for Writing a Hardship Letter Keep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

For instance, "(Deceased) has passed away leaving no assets behind. I apologize for the inconvenience, but there is no money or assets to liquidate to pay this debt. Please do not contact me in regard to this matter; I am not responsible for this debt because (give reason)."

For instance, "(Deceased) has passed away leaving no assets behind. I apologize for the inconvenience, but there is no money or assets to liquidate to pay this debt. Please do not contact me in regard to this matter; I am not responsible for this debt because (give reason)."

When writing a meaningful condolence letter, Angela Morrow suggests using these seven components: Refer to the deceased by name.Express your sympathy.Point out something special about the deceased.Remind your friend or family member of his or her good qualities.Share a memory.Offer to help.

Place your name, address and phone number at the top of the letter, followed by the date, then the name, address and phone number of the individual or agency handling your deceased relative's estate.