Content: Title: Harris Texas Sample Letter for Attempt to Collect Debt before Legal Action Introduction: In Harris County, Texas, when a creditor is struggling to receive payment on a debt, they can opt to send a Sample Letter for Attempt to Collect Debt before taking legal action. This letter serves as a formal notice to the debtor, urging them to resolve their outstanding debt to avoid potential legal consequences. In this article, we will provide you with a detailed description of what a Harris Texas Sample Letter for Attempt to Collect Debt before Legal Action entails and outline its key components. Moreover, we will explore variations of this letter commonly used in different debt collection scenarios. Key Components of a Harris Texas Sample Letter for Attempt to Collect Debt: 1. Clear Identification: The letter should clearly identify both the creditor and the debtor by including their names, addresses, and any relevant account numbers or references concerning the debt. 2. Comprehensive Debt Information: It is crucial to provide a detailed summary of the debt owed, including the original amount, any interest or fees involved, and the specific date of default. 3. Timeline for Action: The letter should explicitly state a reasonable deadline by which the debtor must respond or make payment to avoid further legal action. This timeline should allow the debtor sufficient time to resolve the debt issue. 4. Consequences of Non-payment: To emphasize the seriousness of the situation, the letter should mention the potential legal actions that may be taken if the debt remains unresolved. This may include a lawsuit, wage garnishment, or the involvement of a collection agency. 5. Contact Information: Include accurate contact details for the creditor, such as a phone number and address, so the debtor can easily reach out to discuss payment arrangements or request additional information. Different Types of Harris Texas Sample Letters for Attempt to Collect Debt: 1. First Notice Demand Letter: This initial letter is sent when a debtor has failed to make payment within the agreed-upon timeline. It serves as a formal demand for payment before pursuing legal avenues. 2. Reminder Letter: If the debtor has not responded to the first demand letter, a reminder letter is sent to reiterate the outstanding debt and the impending legal action. 3. Final Demand Letter: If the debtor fails to respond to previous attempts, a final demand letter is sent as a last warning before initiating legal proceedings. This letter explicitly states that legal action will commence if the debt remains unpaid. 4. Settlement Offer Letter: In certain cases, the creditor may opt to negotiate a repayment plan or a settlement amount with the debtor. This letter outlines the proposed terms of the agreement and provides an opportunity for the debtor to resolve the debt without further legal consequences. Conclusion: When attempting to collect a debt in Harris County, Texas, sending a Sample Letter for Attempt to Collect Debt before Legal Action is an essential step for creditors. The letter helps creditors communicate the seriousness of the debt situation while offering debtors an opportunity to rectify the issue before facing legal consequences. By incorporating the key components outlined above, creditors can maintain professionalism and increase the chances of resolving outstanding debts amicably.

Harris Texas Sample Letter for Attempt to Collect Debt before Legal Action

Description

How to fill out Harris Texas Sample Letter For Attempt To Collect Debt Before Legal Action?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Harris Sample Letter for Attempt to Collect Debt before Legal Action, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Harris Sample Letter for Attempt to Collect Debt before Legal Action from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Harris Sample Letter for Attempt to Collect Debt before Legal Action:

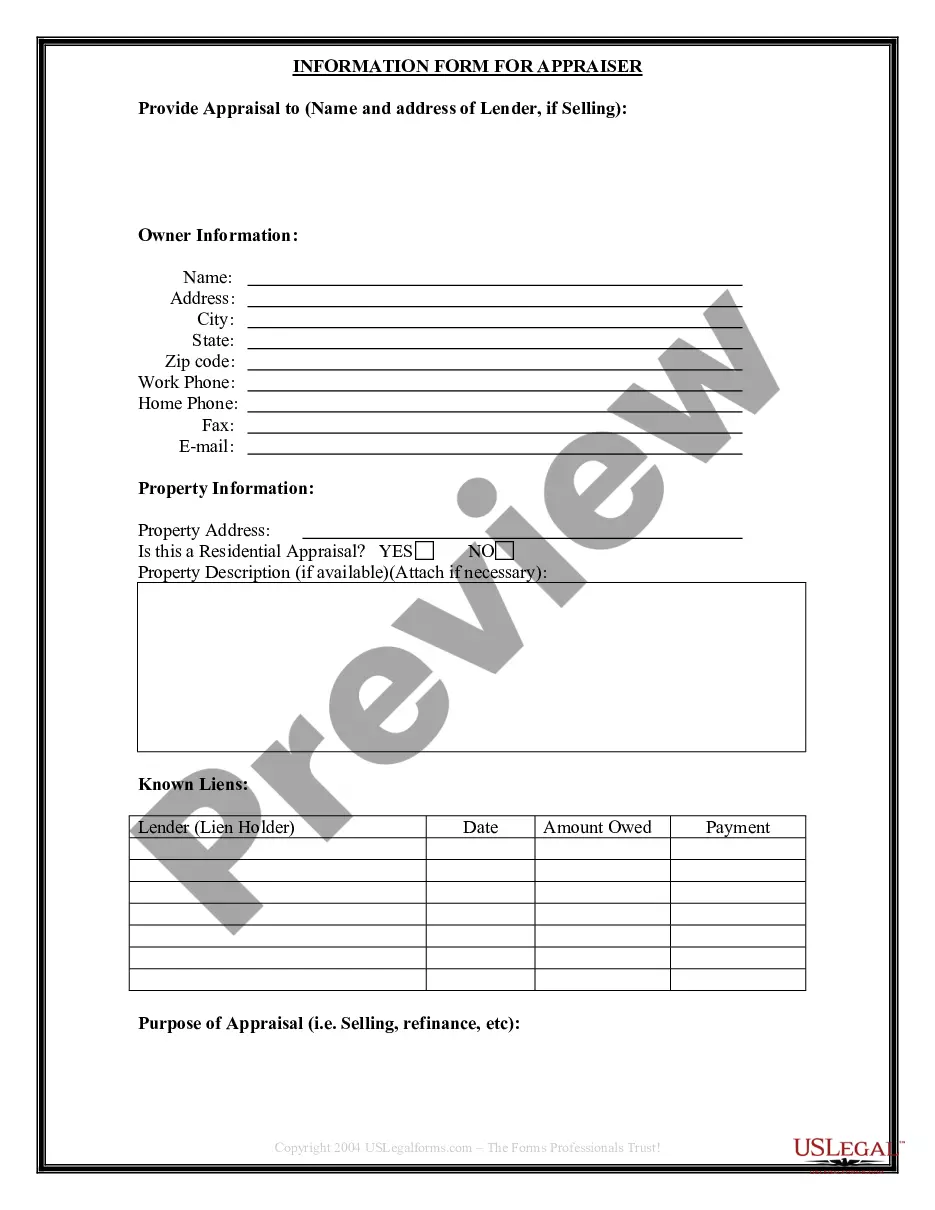

- Analyze the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

A debt collection letter should include the following information: The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or longer. Instructions on how to pay the debt.

Failing to respond to a Debt Validation Letter while continuing to collect on the debt is a direct violation of the FDCPA. You can report a debt collector's failure to respond to your state's attorney general, the Consumer Financial Protection Bureau (CFPB), or the FTC.

Collection letters should do two things: 1) retain customer goodwill, and 2) help you get paid....Your collection letter should: Tell the reason for your letter in the first sentence. Explain more about the first sentence in your second sentence. Suggest a solution. Thank the recipient.

Go to the post office and send it by certified mail with return-receipt requested then, take the cash receipt stamped with the amount and date and when your certified return receipt arrives via the mail, save both of these in a file marked Credit Disputes.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

That information includes: The name of the creditor. The amount owed. That you can dispute the debt. That if you don't dispute the debt within 30 days the debt collector will assume the debt is valid. That if you dispute the debt in writing within 30 days the debt collector will provide verification of the debt.

To take action in the Local Court to recover a debt, the creditor (plaintiff) must file and serve a Statement of Claim on the debtor (defendant). You can get legal advice about a Statement of Claim from a community legal centre, a Legal Aid office or LawAccess.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

It should be short, concise, to the point and very clear as to what you want. It's imperative that you say as much as you can with as little text as possible. Remember to include the exact amount owed, the invoice number and the due date.