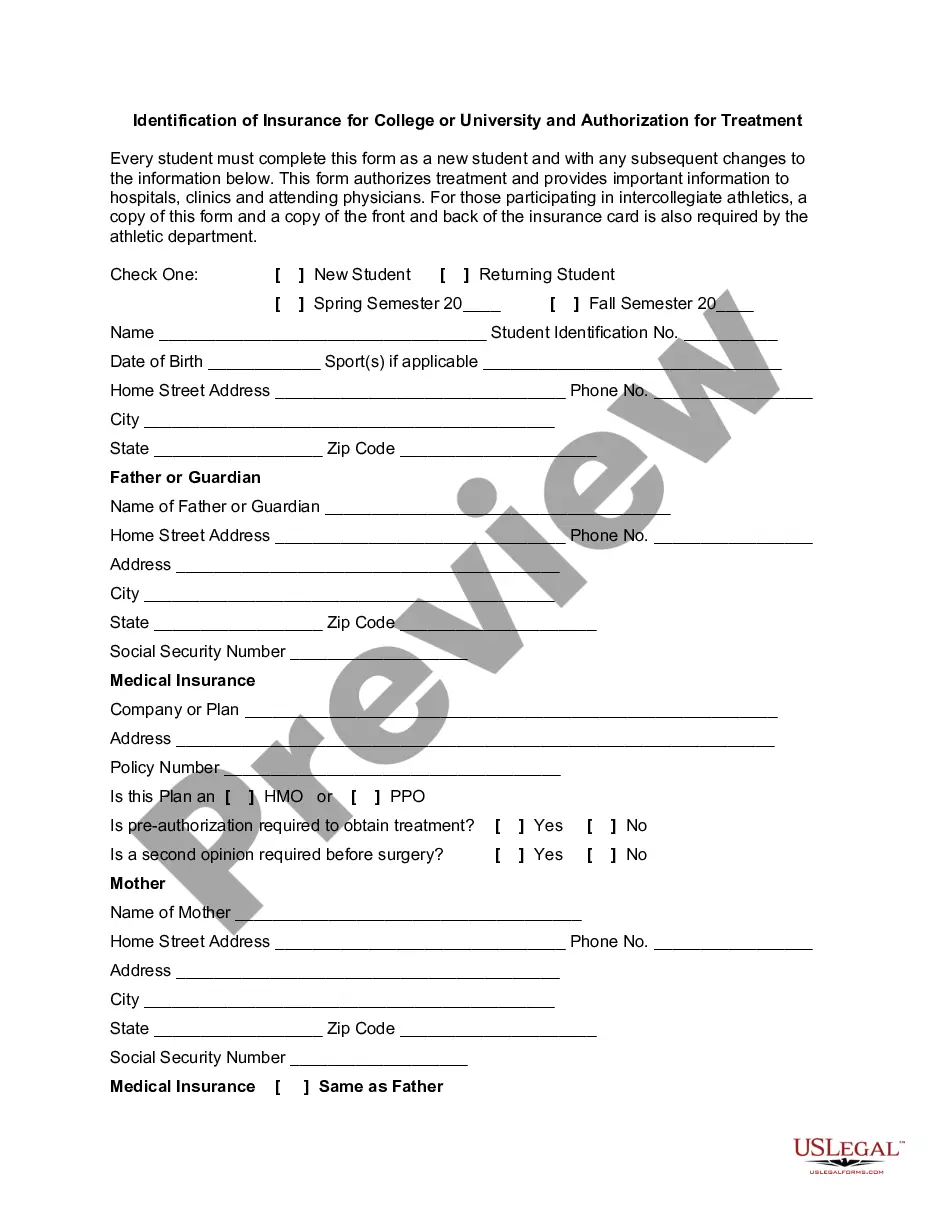

[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Debtor's Name] [Debtor's Address] [City, State, ZIP] Subject: Attempt to Collect Debt before Acceleration — [Account Number] Dear [Debtor's Name], I hope this letter finds you in good health. I am writing to bring to your attention the outstanding balance of [$XX, XXX.XX] owed on your account with [Creditor's Name]. As your account has entered a delinquent state, it is crucial that we address this issue promptly to prevent further repercussions. Our records indicate that your account has been past due for [X days/weeks]. We understand that circumstances may have contributed to this delay in payment, and we are willing to work with you to resolve this matter amicably. However, we must acknowledge that it is essential to resolve the past-due balance and bring your account up to date. Please note that as of [Date], in accordance with the terms and conditions stated in the original agreement, your debt has the potential to be accelerated if prompt action is not taken to resolve it. Acceleration may result in the full outstanding balance becoming immediately due and payable. We strongly advise you to contact our office within [X days] of receiving this letter to discuss payment options and formulate a feasible plan to settle this debt. Our aim is to assist you in finding a mutually beneficial resolution to your account that aligns with your financial capabilities. By working together, we can avoid further actions that may negatively impact your credit rating, such as collections, legal proceedings, or reporting to credit bureaus. To facilitate the resolution process, I kindly request that you provide us with updated contact information if necessary. Additionally, it would be greatly appreciated if you could furnish any relevant supporting documentation or financial hardship information that may assist us in determining a suitable repayment plan. For your convenience, we have provided various avenues through which you can reach us. You can contact our office via phone at [Phone Number], Monday through Friday, during business hours. Alternatively, you may opt to email us at [Email Address]. We assure you that any discussions regarding your debt will remain strictly confidential. While we understand that settling a debt can at times be challenging, we strongly urge you to act promptly and responsibly in addressing this matter. Our goal is to work towards a resolution that is fair and reasonable for both parties involved. Failure to respond or make satisfactory payment arrangements within the mentioned timeframe may result in the initiation of further collection efforts, which may include, but are not limited to, legal action or the involvement of a debt collection agency. Thank you for your immediate attention to this matter. We look forward to working with you to find a suitable solution to resolve this debt and reinstate your account in good standing. Sincerely, [Your Name] [Your Title] [Creditor's Name] [Creditor's Address] [City, State, ZIP]

Houston Texas Sample Letter for Attempt to Collect Debt before Acceleration

Description

How to fill out Houston Texas Sample Letter For Attempt To Collect Debt Before Acceleration?

Draftwing forms, like Houston Sample Letter for Attempt to Collect Debt before Acceleration, to manage your legal matters is a tough and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. However, you can consider your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms intended for a variety of scenarios and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Houston Sample Letter for Attempt to Collect Debt before Acceleration form. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before getting Houston Sample Letter for Attempt to Collect Debt before Acceleration:

- Ensure that your template is compliant with your state/county since the rules for writing legal documents may differ from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Houston Sample Letter for Attempt to Collect Debt before Acceleration isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our website and download the document.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment details.

- Your template is good to go. You can try and download it.

It’s an easy task to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!