Dear [Debtor's Name], RE: Outstanding Debt before Acceleration We hope this letter finds you well. Our records indicate that there is an outstanding balance of [amount] on your account [account number] with [creditor's name]. We are writing to inform you of the situation and request immediate settlement of this debt. We understand that unforeseen circumstances may have led to this outstanding balance. However, we would like to bring it to your attention that failure to address this matter may result in legal action being taken against you. It is in both parties' interest to resolve this debt amicably and avoid further escalation. The debt in question has been accumulating interest and late payment fees as per the terms outlined in the original agreement. The total balance now stands at [current balance]. Attached to this letter is a copy of your account statement specifying the amount owed, the dates of each transaction, and the applicable fees. As a debtor, it is your legal responsibility to fulfill your financial obligations. We kindly request immediate payment of the outstanding balance to avoid any negative consequences. You have a few options for settling this debt: 1. Full Payment: You may choose to remit the full amount owed in one single payment. This ensures the debt is cleared and prevents further consequences. 2. Payment Plan: If the full payment is not feasible at this time, we are open to arranging a mutually acceptable payment plan. Please contact our office to discuss the specifics and determine a suitable monthly installment. 3. Settlement Offer: In certain circumstances, we may be willing to accept a reduced amount to settle the debt. If you are facing financial hardship and believe a settlement offer could be appropriate, please contact our office to discuss the possibility. Please be aware that the failure to respond to this letter within the next [time frame] will leave us with no choice but to consider further legal action. We highly recommend contacting our office at [contact information] to discuss and resolve this matter promptly. Our goal is to work with you towards a positive resolution while maintaining the creditor-debtor relationship. We hope to avoid any negative impact on your credit score and ensure your financial stability. Thank you for your immediate attention to this matter. We trust that you will take the necessary steps to settle this outstanding debt and prevent any further legal action. Regards, [Your Name] [Your Title/Position] [Your Company Name] [Contact Information] Other types of Lima Arizona Sample Letters for Attempt to Collect Debt before Acceleration may include: — Letter regarding validation of debt: If the debtor requests validation or proof of the debt, this letter aims to provide the necessary documentation supporting the existence and details of the debt. — Letter acknowledging dispute: In cases where the debtor disputes the debt's validity or amount, this letter acknowledges the dispute and may include the request for additional information or evidence. — Letter accepting settlement offer: If the creditor agrees to the debtor's proposal for a reduced payment or settlement, this letter confirms acceptance of the offer and outlines the agreed-upon terms for payment. — Letter refusing settlement offer: If the creditor rejects a settlement offer provided by the debtor, this letter notifies the debtor of the refusal and reiterates the importance of seeking an alternative resolution to clear the debt.

Pima Arizona Sample Letter for Attempt to Collect Debt before Acceleration

Description

How to fill out Pima Arizona Sample Letter For Attempt To Collect Debt Before Acceleration?

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Pima Sample Letter for Attempt to Collect Debt before Acceleration, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Pima Sample Letter for Attempt to Collect Debt before Acceleration from the My Forms tab.

For new users, it's necessary to make several more steps to get the Pima Sample Letter for Attempt to Collect Debt before Acceleration:

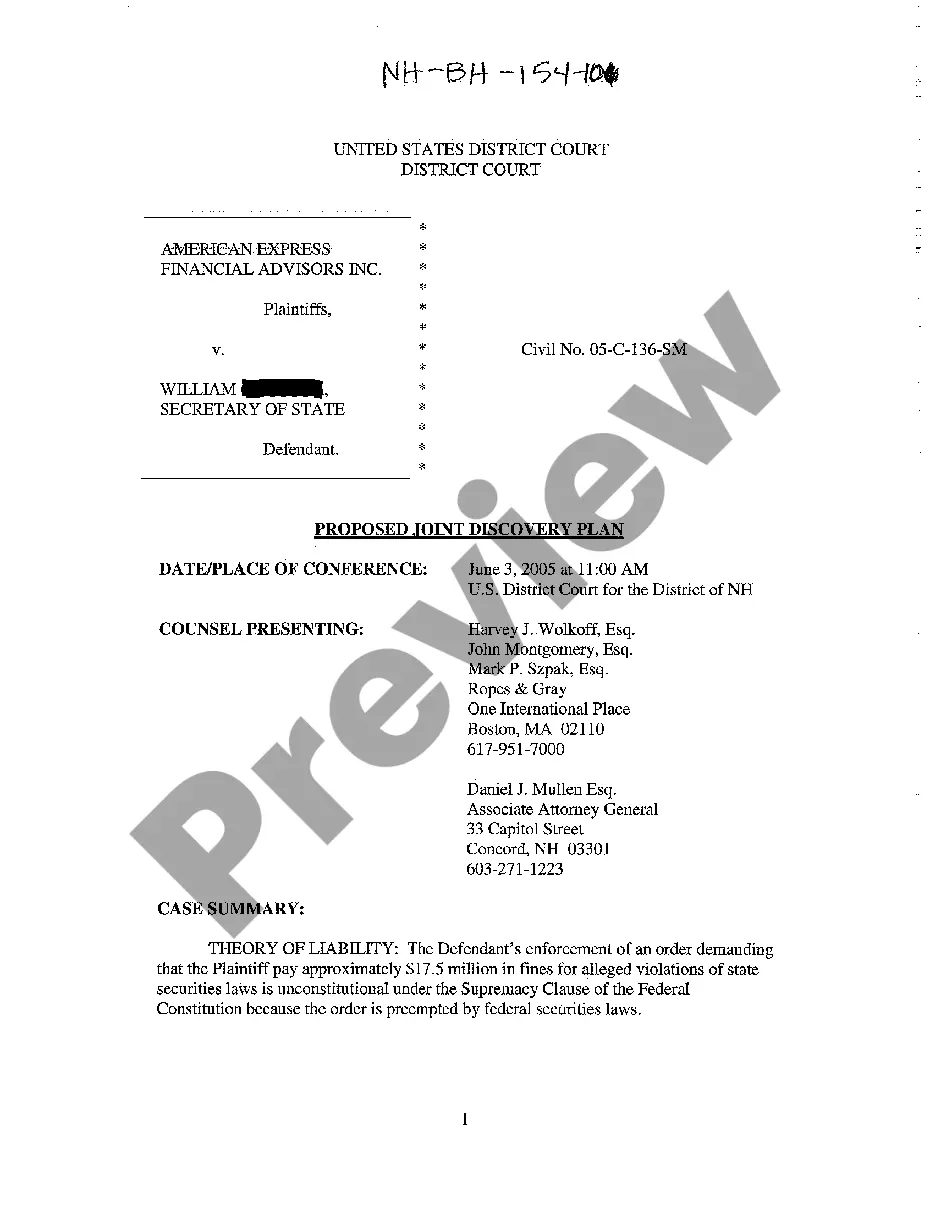

- Take a look at the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!