[Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] [Recipient's Name] [Recipient's Address] [City, State, Zip Code] Subject: [Type of Sample Letter] — Information for Foreclosures and Bankruptcies Dear [Recipient's Name], I hope this letter finds you well. I am reaching out to provide you with crucial information regarding foreclosures and bankruptcies in San Diego, California. As a resident of this vibrant city, it is important to be aware of your rights and options when facing financial hardships. 1. San Diego California Sample Letter for Foreclosures: If you are a homeowner struggling with mortgage payments and are at risk of foreclosure, please consider the following content options for your sample letter: — Request for Loan Modification: This letter template helps homeowners request a modification to their existing loan terms in order to avoid foreclosure. — Short Sale Authorization: If you are unable to make mortgage payments and want to sell your property, this letter will authorize your lender to proceed with a short sale. 2. San Diego California Sample Letter for Bankruptcies: For individuals considering bankruptcy as a solution to overwhelming debt, here are a few types of sample letters you might find useful: — Chapter 7 Bankruptcy Explanation: This letter will help you explain your decision to file for Chapter 7 bankruptcy and provide a brief overview of your financial situation. — Chapter 13 Bankruptcy Proposal: In case you choose to pursue Chapter 13 bankruptcy, this letter will outline your repayment plan proposal for approval by creditors. Please keep in mind that these sample letters should serve as a reference and may require customization based on your specific circumstances. It is always recommended seeking professional legal advice to ensure the best approach for your unique situation. Should you have any further questions or require additional assistance, please feel free to contact me at your convenience. I am more than willing to help you navigate this challenging period and provide any further information you may need. Thank you for your attention to this matter. We are all in this together, and I want you to know that support is available when you need it most. Yours sincerely, [Your Name]

San Diego California Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

How to fill out San Diego California Sample Letter Regarding Information For Foreclosures And Bankruptcies?

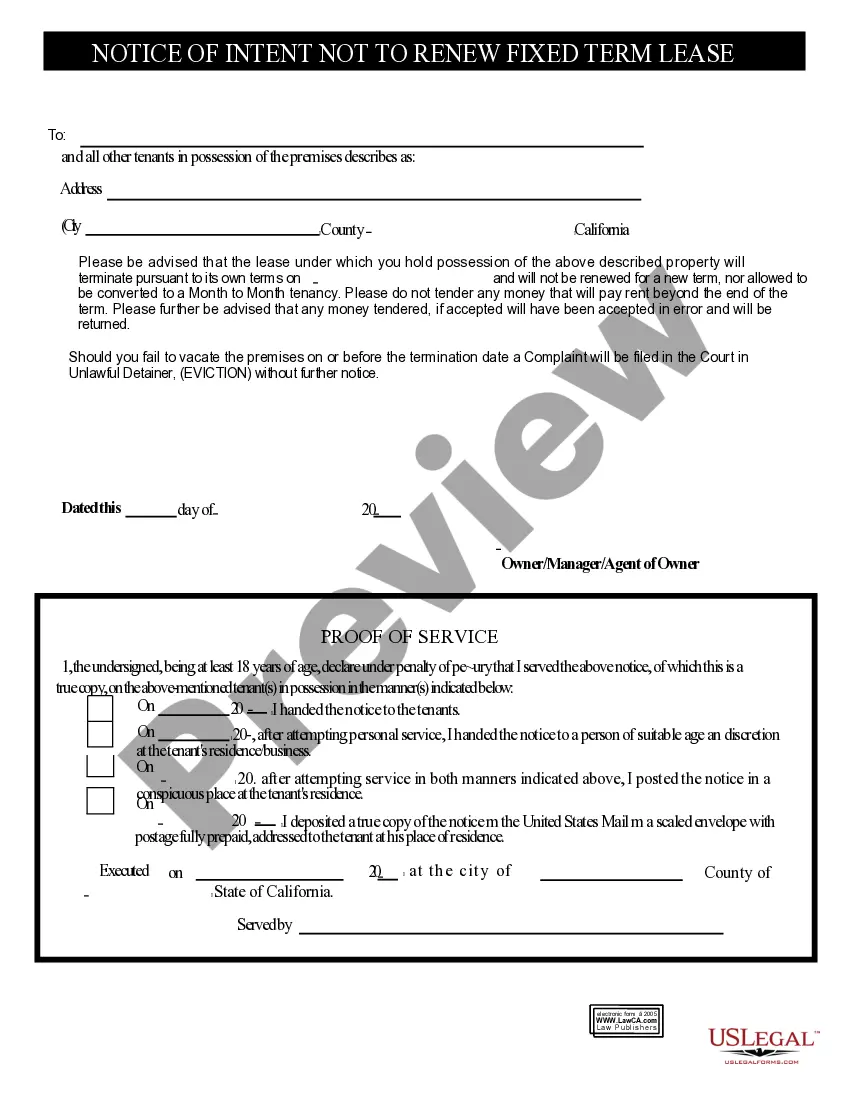

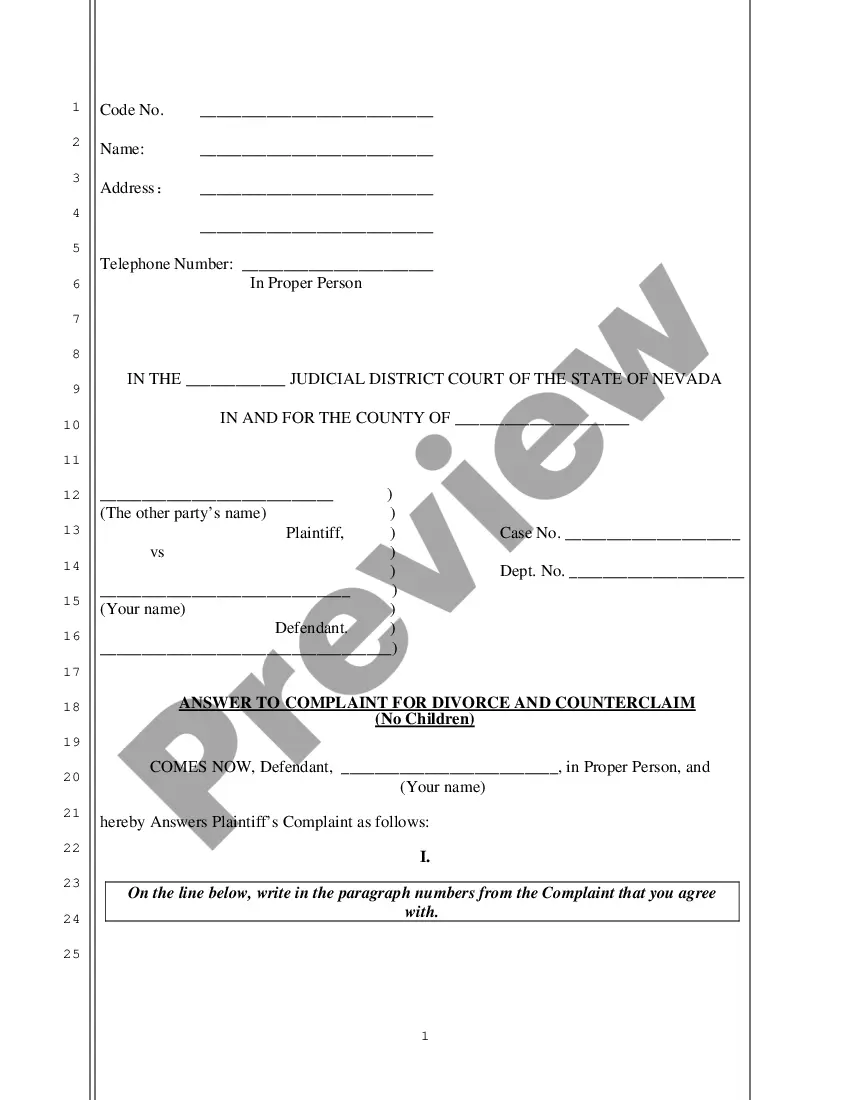

Do you need to quickly draft a legally-binding San Diego Sample Letter regarding Information for Foreclosures and Bankruptcies or maybe any other form to manage your own or business matters? You can select one of the two options: hire a legal advisor to write a legal paper for you or create it entirely on your own. The good news is, there's a third option - US Legal Forms. It will help you receive professionally written legal documents without paying sky-high fees for legal services.

US Legal Forms offers a rich collection of over 85,000 state-specific form templates, including San Diego Sample Letter regarding Information for Foreclosures and Bankruptcies and form packages. We provide templates for an array of life circumstances: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra hassles.

- To start with, carefully verify if the San Diego Sample Letter regarding Information for Foreclosures and Bankruptcies is tailored to your state's or county's laws.

- If the document includes a desciption, make sure to check what it's suitable for.

- Start the search over if the form isn’t what you were looking for by using the search box in the header.

- Select the plan that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the San Diego Sample Letter regarding Information for Foreclosures and Bankruptcies template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the documents we offer are reviewed by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Your letter should start with an introduction of who you are and what kind of loan you are applying for. Lead into your story with something like "We want to explain our foreclosure from six years ago." Then, launch right into the details that led you to lose your home. This is not the time to be shy or modest.

Your hardship letter will explain the hardship that has occurred that caused you to fall behind on your mortgage....Try to keep it simple. State the reason for the hardship in the opening paragraph.Explain how the hardship has ended, changed or is longer term.

Foreclosure Process Be sent to you by certified mail. Be published weekly in a newspaper of general circulation in the county where your home is located for 3 consecutive weeks before the sale date. Be posted on your property, as well as in a public place, usually at your local courthouse.

A demand letter simply restates the terms of the loan, and demands that the borrower rectify their accounts immediately. More common for a non-judicial foreclosure might be a breach letter, which is required before issuing an NOD.

A demand letter is a written notice from a lender to a borrower which sets out all of the following: the total amount due and payable from a borrower to a lender, including principal, interest, penalties, and other amounts. the security, if any, held by a lender.

Your letter should start with an introduction of who you are and what kind of loan you are applying for. Lead into your story with something like "We want to explain our foreclosure from six years ago." Then, launch right into the details that led you to lose your home. This is not the time to be shy or modest.

Three of the most common methods of walking away from a mortgage are a short sale, a voluntary foreclosure, and an involuntary foreclosure. A short sale occurs when the borrower sells a property for less than the amount due on the mortgage.

Here are some foreclosure prevention alternatives to consider when you think foreclosure is on the horizon. Reinstate Your Loan.Enter Into a Repayment Plan.Enter Into a Forbearance Agreement.Work Out a Loan Modification.Refinance.File for Chapter 7 or Chapter 13 Bankruptcy.

Second Mortgages Although a primary mortgage lender's ability to come after an individual following a foreclosure depends directly on the type of loan the borrower had and the laws in her state of residence, second mortgage lenders can almost always file a lawsuit after foreclosure.

The Foreclosure Moratorium has been extended one month from June 30, 2021, to the end of July. Took effect on September 1, 2020. protections to certain renters, small landlords and some homeowners who are unable to pay their rent or mortgage after being negatively affected by the COVID- 19 Pandemic.