Dear State Attorney, I hope this letter finds you well. I am writing to request your opinion concerning taxes in Fulton, Georgia. As a concerned citizen, I believe it is crucial to seek professional legal advice to ensure the appropriate application and interpretation of tax laws in our community. Fulton County, located in the state of Georgia, encompasses multiple cities and towns including Atlanta, Sandy Springs, and Roswell. With a population of over one million residents, Fulton County is the most populous county in the state. Its diverse economy, booming real estate market, and vibrant cultural scenes make it an attractive place to live, work, and do business. Understanding the complex tax system in Fulton County is essential for both individuals and businesses. Therefore, I kindly request your expert opinion on various tax-related matters that affect our community. These matters encompass but are not limited to: 1. Property Taxes: Fulton County employs an ad valor em tax system, which calculates property taxes based on the assessed value of real estate properties. As property values fluctuate, examining the fairness and legality of property assessments becomes critical. 2. Sales and Use Taxes: The Georgia Department of Revenue administers the collection of sales and use taxes. However, seeking your legal opinion on any specific provisions or exemptions that may apply within Fulton County would greatly assist both residents and business owners in complying with the law. 3. Income Taxes: Understanding the intricacies of income tax regulations is crucial for individuals and businesses alike. Your guidance regarding tax credits, deductions, and any Fulton County-specific nuances would be highly beneficial. 4. Business Taxes: Fulton County's thriving economy hosts many businesses, ranging from small start-ups to multinational corporations. Clarifying tax obligations, licensing requirements, and special tax considerations for various industries would greatly support local businesses. Apart from these specific tax areas, I would greatly appreciate any additional insight you may have concerning Fulton County's tax laws, regulations, and compliance procedures. Your recommendations could potentially streamline the tax filing process and promote a fairer and more efficient tax system for all residents and businesses within the county. Thank you for your time and consideration in reviewing this request. Your expert opinion will not only benefit me personally but will also serve as a valuable resource to the entire Fulton County community. I look forward to receiving your response at your earliest convenience. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number]

Fulton Georgia Sample Letter for Request of State Attorney's opinion concerning Taxes

Description

How to fill out Fulton Georgia Sample Letter For Request Of State Attorney's Opinion Concerning Taxes?

How much time does it normally take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, finding a Fulton Sample Letter for Request of State Attorney's opinion concerning Taxes suiting all regional requirements can be tiring, and ordering it from a professional attorney is often pricey. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. Apart from the Fulton Sample Letter for Request of State Attorney's opinion concerning Taxes, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Experts check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can get the file in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Fulton Sample Letter for Request of State Attorney's opinion concerning Taxes:

- Examine the content of the page you’re on.

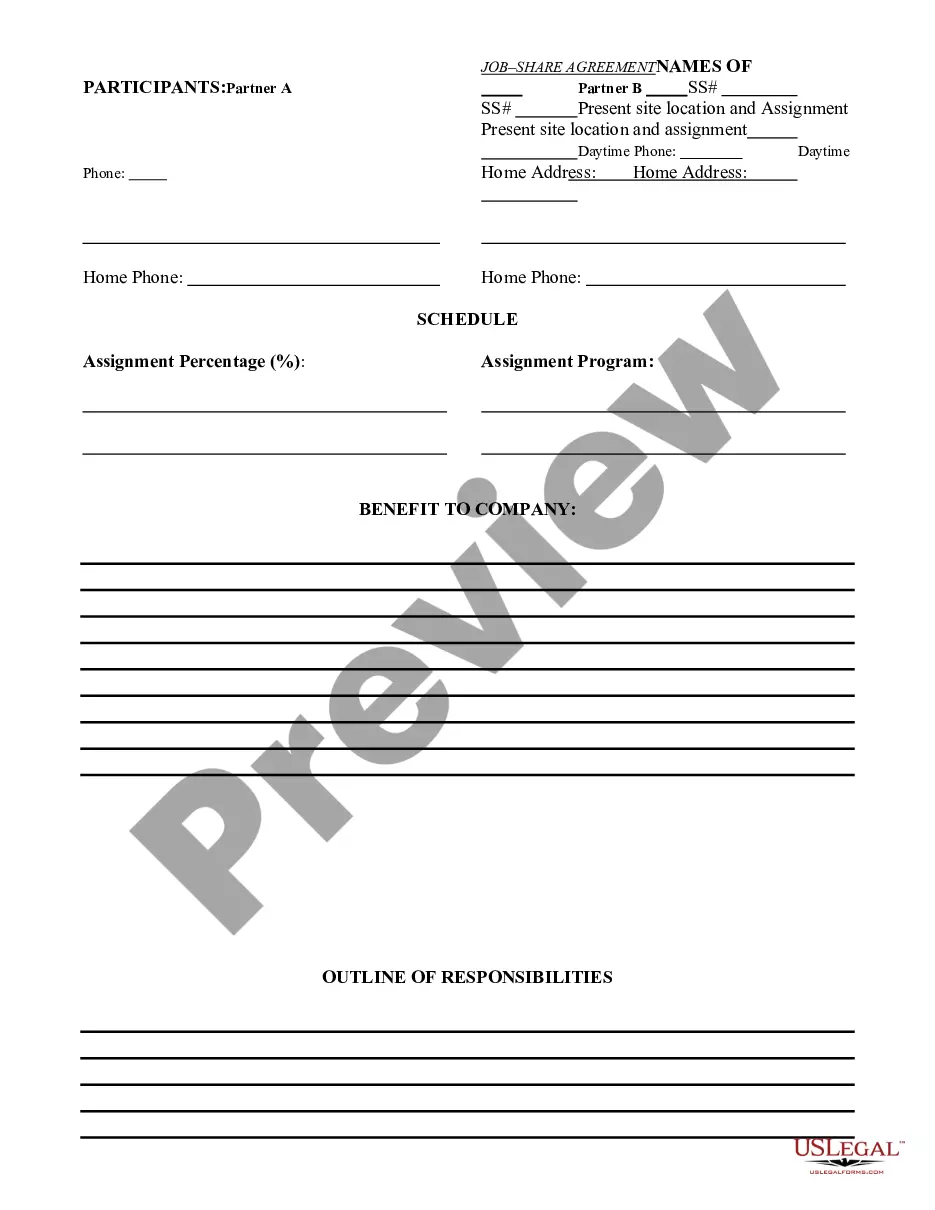

- Read the description of the sample or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Fulton Sample Letter for Request of State Attorney's opinion concerning Taxes.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!