[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [State Attorney's Name] [State Attorney's Office] [Address] [City, State, ZIP] Subject: Request for State Attorney's Opinion on Tax Matters in Middlesex, Massachusetts Dear [State Attorney's Name], I hope this letter finds you well. I am writing to request your professional opinion as the State Attorney regarding certain tax matters that have recently become a cause of concern for the residents of Middlesex, Massachusetts. Middlesex County is not only one of the most populous counties in the state but also one of the largest in terms of land area. It encompasses several cities and towns, each with its own unique tax considerations and issues. Therefore, I believe it is essential to seek your expert guidance to ensure that the applicable tax laws are being interpreted and implemented correctly and fairly across the county. There are several specific areas that require clarification and guidance: 1. Property Taxes: Middlesex County residents have raised concerns about the fairness and accuracy of property tax assessments. Given the significant fluctuations in property values and the complexity of the assessment process, it would be immensely helpful if you could provide your opinion on the best practices, legal requirements, and guidelines for property tax assessments. 2. Municipal and Sales Taxes: We seek your opinion on the correct interpretation and application of municipal and sales taxes within Middlesex County. As businesses and industries continue to grow, it is paramount that we ensure compliance, avoid double taxation, and maintain consistency in taxation practices across different municipalities. 3. Income Taxes: With regard to income tax calculations, residents are seeking further clarity on various deductions, exemptions, and exemptions for specific situations. An opinion from your office would be invaluable in guiding taxpayers, tax consultants, and local tax authorities alike. 4. Tax Assessments for Non-Residents: The county has experienced an influx of non-residents working remotely within Middlesex, Massachusetts. Uncertainties regarding their tax obligations, residency determinations, and implications for both the county and those individuals need to be addressed. We kindly request your opinion on the matter to establish clear guidelines and avoid potential confusion or disputes. [If applicable, you can add more relevant issues here.] It is important to note that the wide variety of tax-related concerns faced by individuals and businesses in Middlesex necessitates a comprehensive and detailed opinion from your esteemed office. By providing guidance and clarity on the aforementioned matters, we can ensure consistent and lawful tax practices throughout the county. We kindly request that you take our concerns into consideration and provide us with a written opinion as soon as possible. Your professional expertise and guidance will not only benefit the residents of Middlesex County but also serve as a reference for local tax authorities and professionals involved in tax-related matters. Thank you in advance for your time, attention, and consideration. We eagerly await your response and are confident that your opinion will help address the tax-related concerns of Middlesex County residents. Sincerely, [Your Name]

Middlesex Massachusetts Sample Letter for Request of State Attorney's opinion concerning Taxes

Description

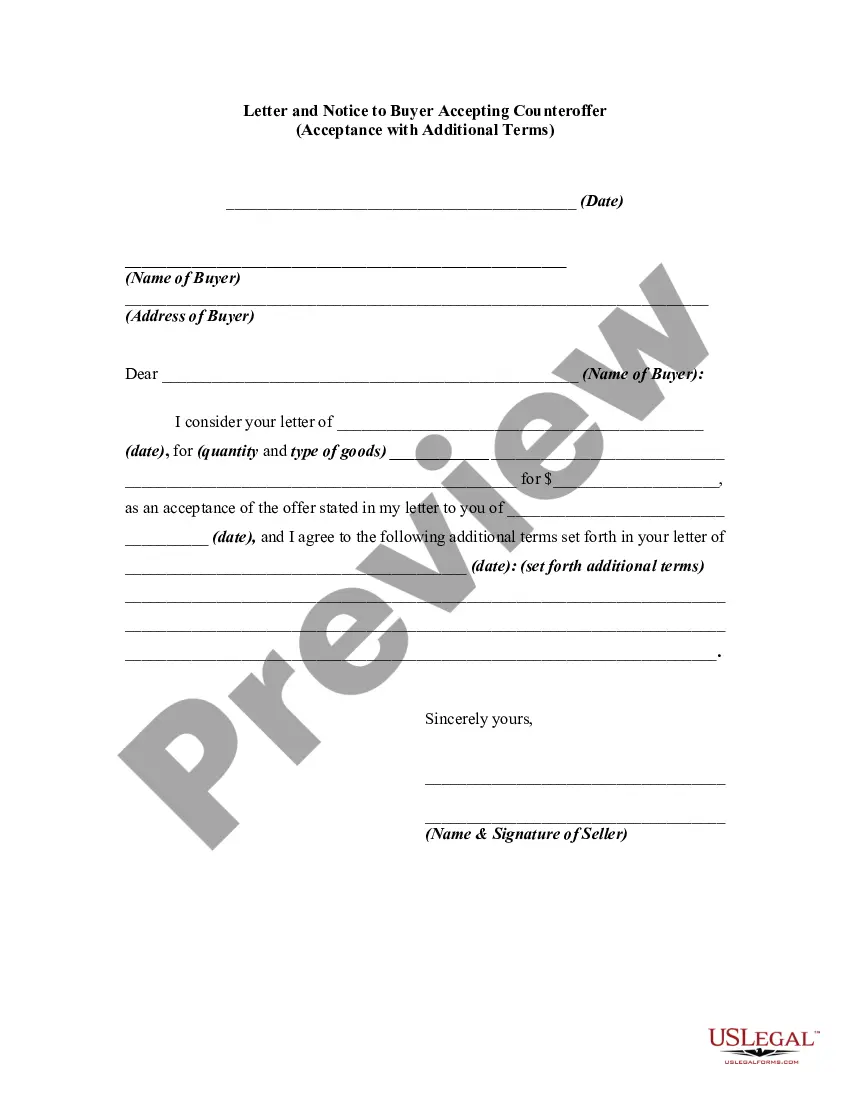

How to fill out Middlesex Massachusetts Sample Letter For Request Of State Attorney's Opinion Concerning Taxes?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Middlesex Sample Letter for Request of State Attorney's opinion concerning Taxes is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Middlesex Sample Letter for Request of State Attorney's opinion concerning Taxes. Adhere to the guide below:

- Make certain the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the file when you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Middlesex Sample Letter for Request of State Attorney's opinion concerning Taxes in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

The Application/Cross Application to Modify a Court Order is a written request in which you ask the court to change or enforce an existing court order. The court will change an order only if important facts or circumstances have changed from the time the order was issued.

Authorized requestors include: the head or board of an eleemosynary institution. the head of a state board. a regent or trustee of a state educational institution. a committee of a house of the Texas Legislature.

District Attorneys are typically elected in a general election. As such, they are traditionally entitled to be addressed as 'the Honorable (Full Name)'.

You can change an existing court order or consent order. You can also ask a court to enforce an order if your ex-partner is not following it. If you ask the court to change or enforce an order, you'll probably have to go to a court hearing. You can usually avoid this if you get help outside of court instead.

Can I appeal the court's decision? The court's decision is usually final. In certain circumstances you may be able to appeal the court's decision. You can only appeal in very limited circumstances, for example if the judge made a very serious mistake or because the judge did not follow the proper legal procedure.

What to Say Include your name, address and phone numbers at home and work. If it is not possible to type your letter, be sure your handwriting is easy to read. Make your letter brief and to the point.State what you feel should be done about the problem and how long you are willing to wait to get the problem resolved.

New Jersey eCourts. eCourts is a web based application that is designed to allow attorneys, in good standing, to electronically file documents with the courts. The Judiciary's plans for full implementation of eCourts in all trial court divisions are underway.

The US Attorney General has an online contact form, but you can also send a formal letter through the mail. The address to send a formal letter to the US Attorney General is: US Department of Justice/950 Pennsylvania Avenue, NW/Washington, DC 20530-0001.

To change or enforce your FV order, contact the Family Court in the county where your case was last heard. What deadlines do you need to meet? You must tell the other party in writing when you are requesting the motion be heard by the court. That notice must include the time and date of the scheduled motion hearing.

In order to do so in the state of New Jersey, you must file a motion known as an Order Enforcing Litigant's Rights. If they still choose to not comply with the court order, the individual can be held in contempt of court. In some cases, they can be arrested if there are no other options left.