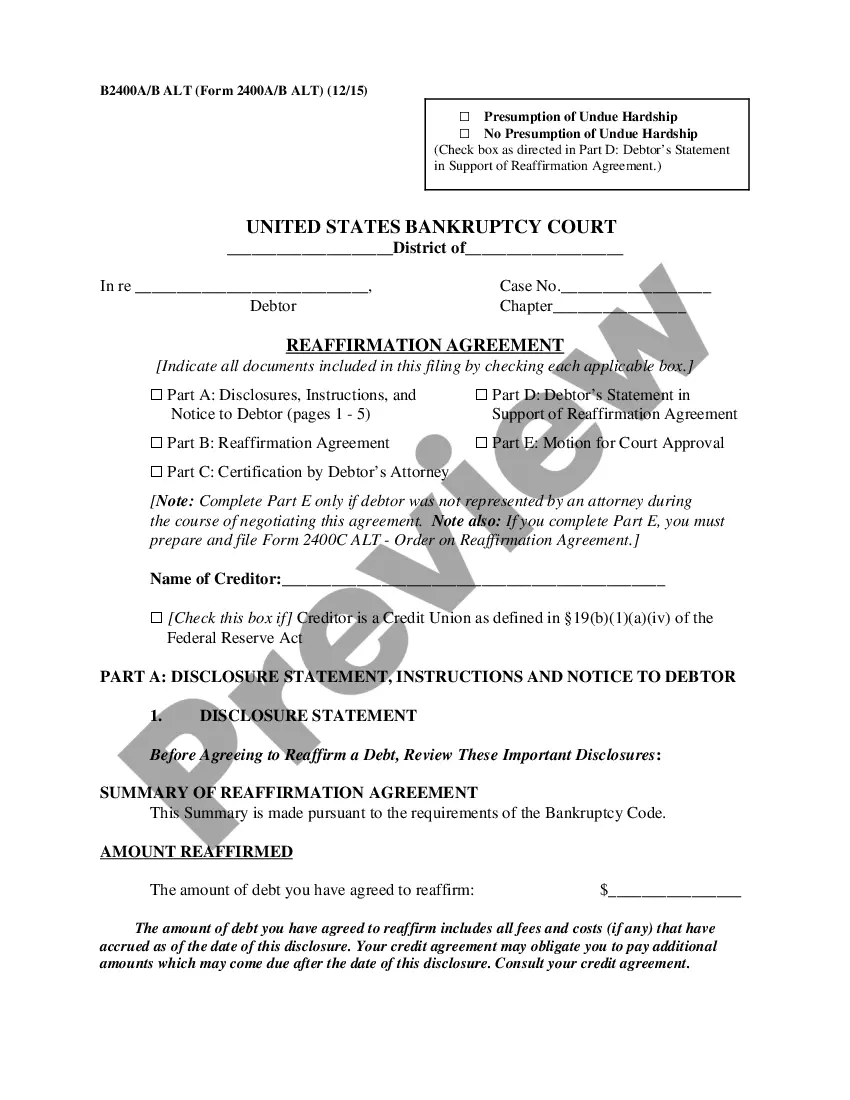

Subject: Seeking the State Attorney's Opinion Regarding Taxation in San Jose, California Dear [State Attorney's Name], I hope this letter finds you well. I am writing to request your expert opinion and guidance concerning taxation matters within the city of San Jose, California. As a diligent taxpayer and concerned resident, I believe your esteemed office's insights will be invaluable in addressing certain tax-related queries that have arisen. San Jose, a vibrant city located within the state of California, is renowned for its technological advancements, diverse population, and thriving business environment. As a hub for innovation and entrepreneurship, it is crucial to ensure the tax system remains transparent, fair, and conducive to economic growth. Being a responsible citizen, I understand the importance of adhering to tax laws and fulfilling obligations towards local, state, and federal authorities. However, in recent times, there have been uncertainties and ambiguities surrounding certain tax regulations within San Jose. It is in this regard that I kindly request your expertise in clarifying the following matters: 1. Local Taxation Policies: San Jose is known for having certain specific local taxes that differ from the state and federal tax codes. Can you shed light on the nature of these local taxation policies and any recent changes that have been implemented? Moreover, it would be greatly appreciated if you could delineate the various categories and rates of these local taxes. 2. Property Tax Assessment: Given the increasing property values in the region, there have been concerns regarding the accuracy and fairness of property tax assessments in San Jose. Could you provide information on the assessment process, any mechanisms in place to handle disputes, and your opinion on the overall fairness of property tax evaluations? 3. Taxation on Small Businesses: San Jose is home to a multitude of small businesses that contribute significantly to the local economy. However, complexities within the tax system can burden these enterprises. I would be grateful if you could elucidate any specific provisions or exemptions available to small businesses in San Jose, along with your recommendations for simplifying the tax process for them. 4. Tax Incentives and Economic Development: San Jose has showcased its commitment to fostering economic growth through the provision of tax incentives and programs. Could you please outline the existing tax incentives, such as enterprise zones or tax credits for businesses in certain industries, and highlight their impact on local businesses and the overall economic landscape? 5. Compliance and Reporting: Understanding and fulfilling tax obligations can be daunting, particularly when it comes to complex tax codes. As taxation laws continually evolve, it is crucial to be aware of updated reporting requirements and compliance measures in San Jose. Any pertinent information you can provide on the latest reporting procedures or significant changes to tax regulations would be immensely beneficial. I acknowledge the demanding nature of your role and the potential constraints on your time. Should it be necessary, I am ready to schedule a meeting or provide any additional documentation to facilitate a thorough examination of the aforementioned tax matters. Your expert opinion will help guide the public in their adherence to tax laws as well as facilitate informed decision-making by the local authorities. Thank you in advance for your attention to this critical matter. The residents of San Jose, California, will greatly appreciate your insight and expertise in resolving the tax-related concerns impacting our community. Yours sincerely, [Your Name] [Your Address] [City, State, ZIP] [Phone Number] [Email Address]

San Jose California Sample Letter for Request of State Attorney's opinion concerning Taxes

Description

How to fill out San Jose California Sample Letter For Request Of State Attorney's Opinion Concerning Taxes?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life scenario, finding a San Jose Sample Letter for Request of State Attorney's opinion concerning Taxes suiting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. In addition to the San Jose Sample Letter for Request of State Attorney's opinion concerning Taxes, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your San Jose Sample Letter for Request of State Attorney's opinion concerning Taxes:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Jose Sample Letter for Request of State Attorney's opinion concerning Taxes.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!