Santa Clara County, located in the heart of California's Silicon Valley, is renowned for its thriving economy and technological innovation. As businesses flourish and commercial properties are in high demand, one important legal document that can come into play is the Santa Clara California Subordination Nondisturbance and Attornment Agreement (SODA). The SODA is a legal contract commonly used in commercial real estate transactions. It aims to address the interests of various parties involved, including lenders, tenants, and landlords. This agreement protects the rights of the lender in case of default by the borrower, while ensuring the continuity of lease obligations between the tenant and the landlord. In Santa Clara, there are a few types of SODA agreements that you may come across: 1. Lender-Tenant SODA: This type of agreement is typically signed between the lender (mortgagee), tenant, and landlord (mortgagor). It establishes an understanding that the lender's rights take precedence over those of the tenant in case of foreclosure. The tenant agrees to recognize the lender as the landlord, maintain lease obligations, and attorn to the lender as its new landlord. 2. Lender-Landlord SODA: Also known as an "Estoppel Agreement," this type of SODA is signed between the lender and the landlord. It generally requires the landlord to confirm the lease terms, rental payments, and any default or breach of lease by the tenant. This SODA ensures that the lender has accurate and up-to-date information on the lease, which can influence the loan agreement. 3. Tenant-Landlord SODA: This agreement is primarily signed between the tenant and the landlord, with the purpose of safeguarding the tenant's interests. It guarantees that the tenant's lease rights remain undisturbed in case of foreclosure by the lender. The tenant attorns to the new owner (lender) and agrees to fulfill the lease obligations just as before. The Santa Clara California Subordination Nondisturbance and Attornment Agreement is essential for maintaining lease continuity and protecting the interests of all parties involved in commercial real estate transactions. It ensures that lenders, tenants, and landlords have a clear understanding of their rights and obligations, and defines the hierarchy of claims in case of default or foreclosure.

Santa Clara California Subordination Nondisturbance and Attornment Agreement

Description

How to fill out Santa Clara California Subordination Nondisturbance And Attornment Agreement?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any individual or business purpose utilized in your region, including the Santa Clara Subordination Nondisturbance and Attornment Agreement.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Santa Clara Subordination Nondisturbance and Attornment Agreement will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to get the Santa Clara Subordination Nondisturbance and Attornment Agreement:

- Make sure you have opened the correct page with your local form.

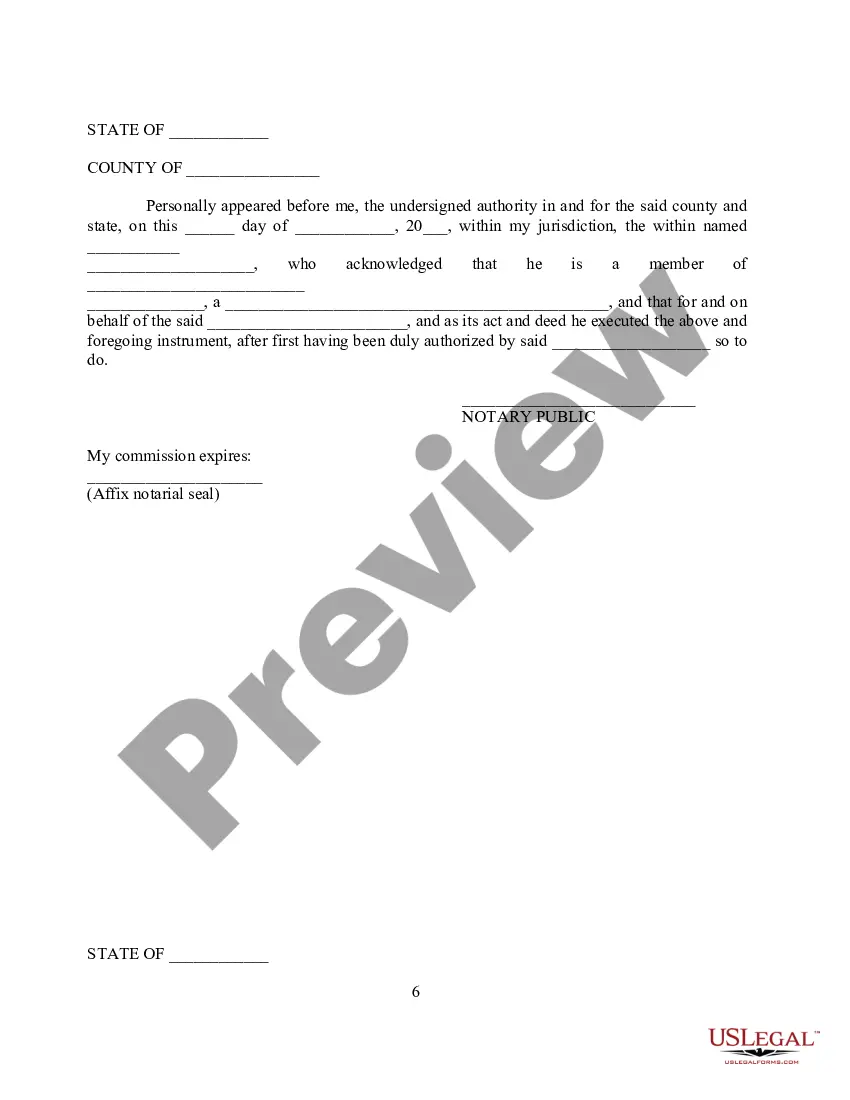

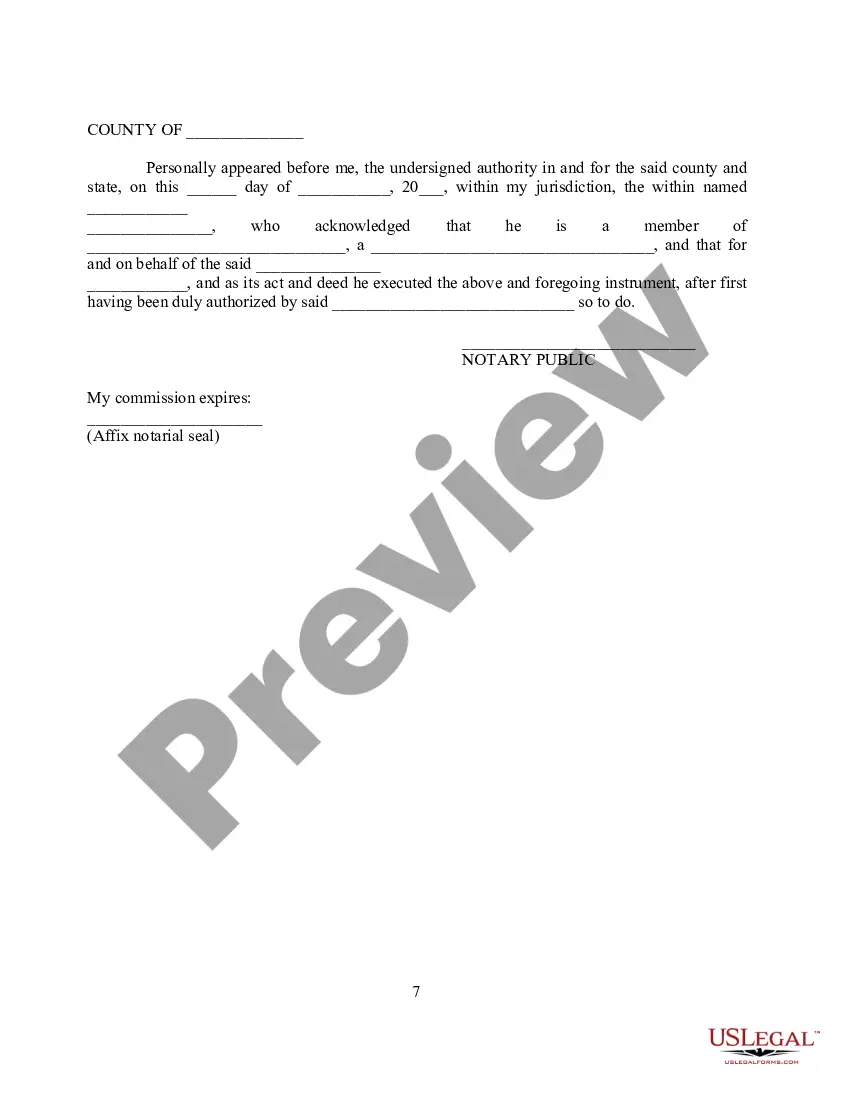

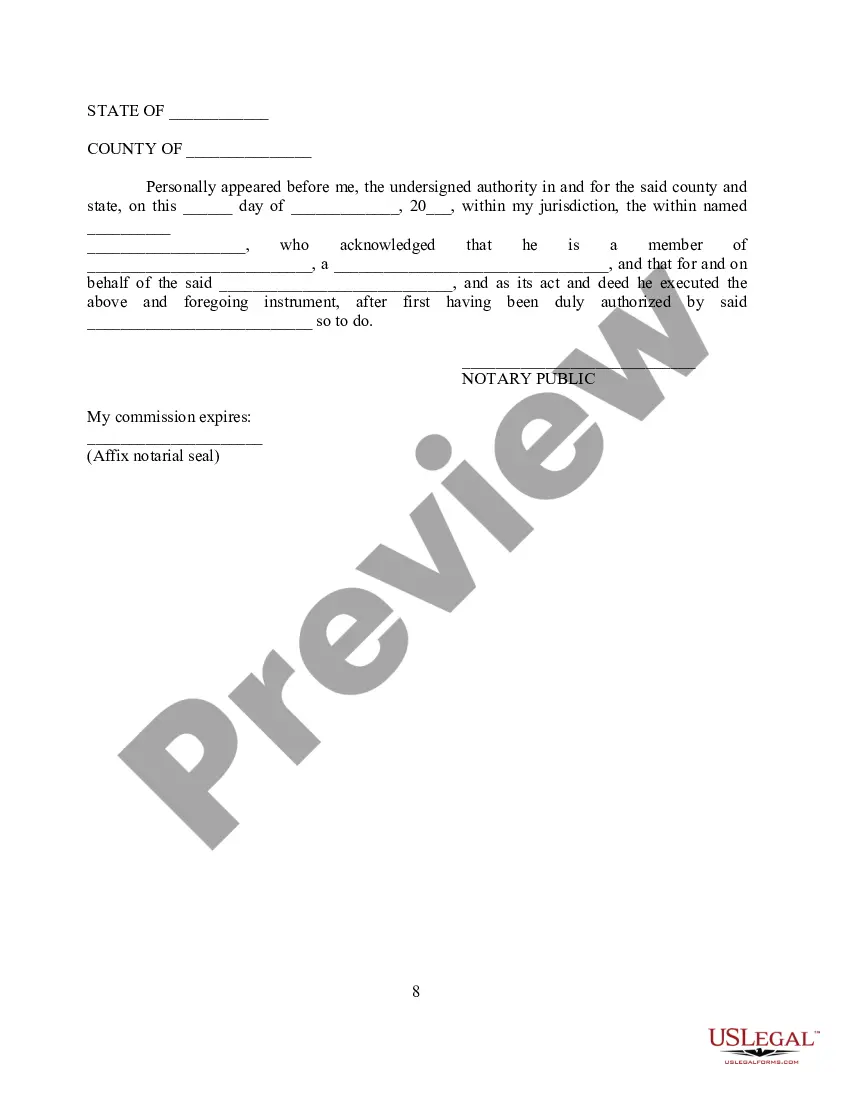

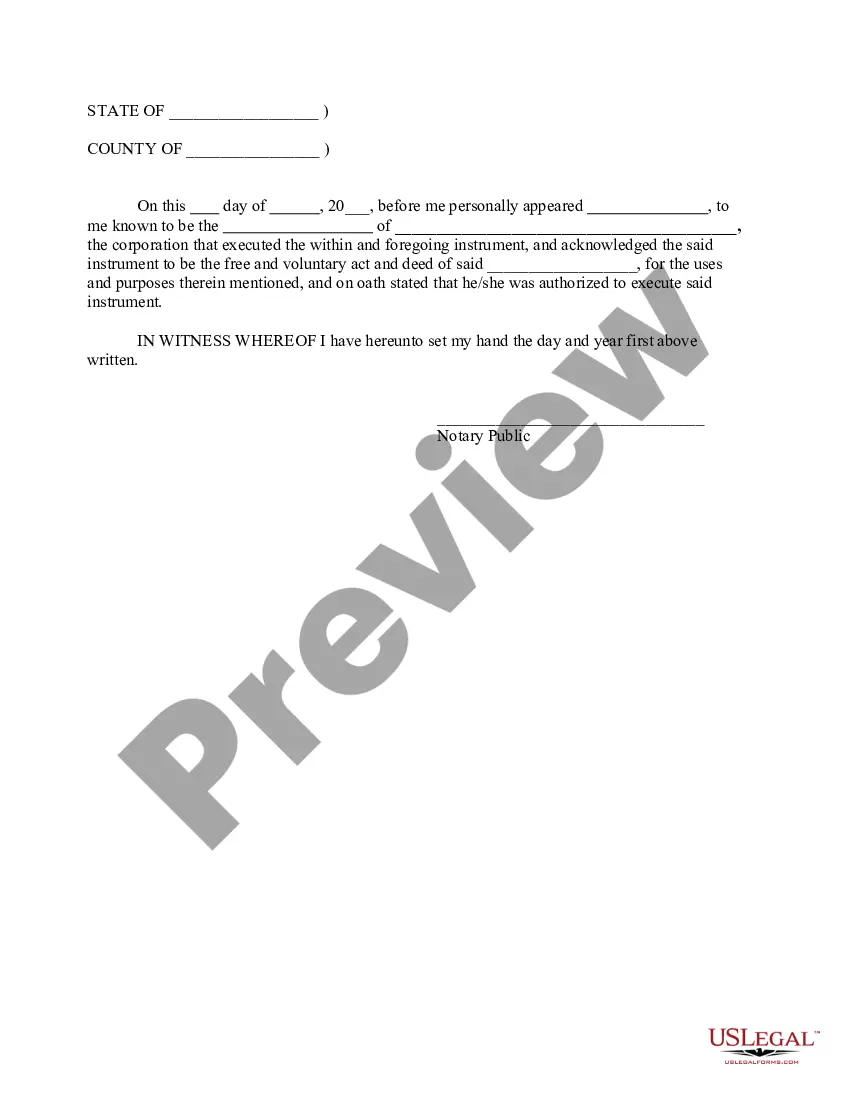

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Santa Clara Subordination Nondisturbance and Attornment Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!