Cook Illinois Borrowers Certification of Inventory is a crucial document that helps track and manage inventory for borrowers associated with Cook Illinois Corporation. This certification ensures accuracy, transparency, and accountability in inventory management processes. The Cook Illinois Borrowers Certification of Inventory serves as a reliable record of the items borrowers have in their possession. It includes a comprehensive list of inventory items, their quantities, and their current condition. Borrowers are required to regularly update this document to reflect any changes in inventory status, such as additions, removals, damages, or replacements. This certification enables Cook Illinois Corporation to maintain an organized and accurate inventory system. The document provides valuable information on the availability and condition of assets, allowing the corporation to efficiently plan and manage its resources. Additionally, it helps prevent inventory shrinkage, theft, or misplacement. Different types of Cook Illinois Borrowers Certification of Inventory may exist, tailored to specific industries or sectors. For example: 1. Cook Illinois Borrowers Certification of Inventory — Automotive: This type of certification is designed for borrowers in the automotive industry. It may include a detailed inventory list of vehicles, spare parts, and other related equipment. 2. Cook Illinois Borrowers Certification of Inventory — Manufacturing: This certification is designed for borrowers in the manufacturing sector. It may involve a comprehensive inventory list of raw materials, work-in-progress items, finished goods, and machinery. 3. Cook Illinois Borrowers Certification of Inventory — Hospitality: Borrowers in the hospitality industry may utilize this certification. It may include an inventory listing of hotel supplies, linens, furniture, kitchen equipment, and other essential items. 4. Cook Illinois Borrowers Certification of Inventory — Retail: Borrowers operating in the retail sector can benefit from this certification. It may comprise an inventory catalog of merchandise, clothing, electronics, perishable goods, and other retail-specific items. By utilizing the Cook Illinois Borrowers Certification of Inventory, borrowers can maintain efficient inventory management processes, enhance their operational workflows, and ensure accurate reporting to Cook Illinois Corporation. This documentation enables better decision-making and helps ensure the long-term success and profitability of the borrowers' businesses.

Cook Illinois Borrowers Certification of Inventory

Description

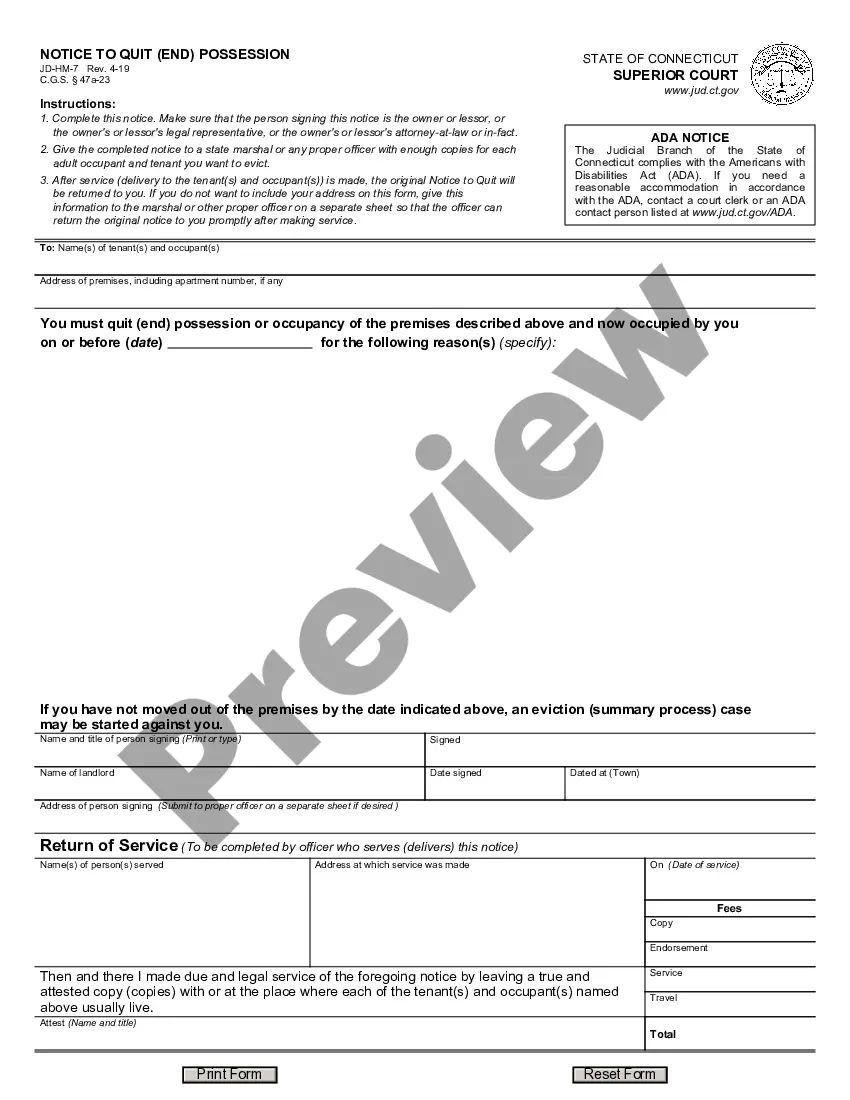

How to fill out Cook Illinois Borrowers Certification Of Inventory?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Cook Borrowers Certification of Inventory, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Consequently, if you need the current version of the Cook Borrowers Certification of Inventory, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Cook Borrowers Certification of Inventory:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Cook Borrowers Certification of Inventory and save it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

There are two main types of inventory financing: an inventory loan and an inventory line of credit. While both types of inventory financing are secured by leveraging your inventory as collateral, these two loan types mean different things for the future of your business financing.

How to get a personal loan in 8 steps Run the numbers.Check your credit score.Consider your options.Choose your loan type.Shop around for the best personal loan rates.Pick a lender and apply.Provide necessary documentation.Accept the loan and start making payments.

The SBA Loan Packager is responsible for ensuring accurate and timely review of SBA loan transactions, producing loan documents, ensuring all items needed for underwriting are obtained, and ensuring the SBA loan application is completed accurately.

Loan Package means a set of Loan documents that (a) are dated or have been completed or provided no more than thirty days from the date of Lender's receipt; (b) include an Application, Credit Report, deposit and employment verifications, appraisal, Loan Estimate, Preliminary Title Report, and other Loan documents, if

Questions such as: - What is the specific purpose of the loan? - How much of a loan are you requesting? - When and how long will you need the funds? - How will the loan will be repaid? - What collateral can be used to secure the loan? - and, Will you provide a personal guaranty? Answers to these questions, as well as

A package home loan is a home loan that combines your mortgage with other banking services. This usually includes a credit card, mortgage offset account and savings or everyday banking account. On top of this, a package home loan often gives you a discount both on the standard variable rate and on fixed-rate loans.

Tips on How to Make a Successful Loan Application Ensure that your credit score is above 750. Check the eligibility set by the lender. Fill in your personal information correctly. Furnish the relevant documents. Apply for a loan after assessing your affordability to repay the loan.

Here are some additional options to inventory financing you may want to consider: Term loans.Business credit cards.Merchant cash advances.Invoice factoring.Invoice financing.Purchase Order (PO) financing.Business line of credit - A small business line of credit is a financial tool similar to a business credit card.

Inventory financing is credit obtained by businesses to pay for products that aren't intended for immediate sale. Financing is collateralized by the inventory it is used to purchase. Inventory financing is often used by smaller privately-owned businesses that don't have access to other options.

A borrowing base certificate is used to list all of your available assets that can be used as collateral for a loan and to determine the borrowing base using the discount rate of the lender. This certificate is the formal calculation the lender uses to determine the maximum amount of financing it can offer.