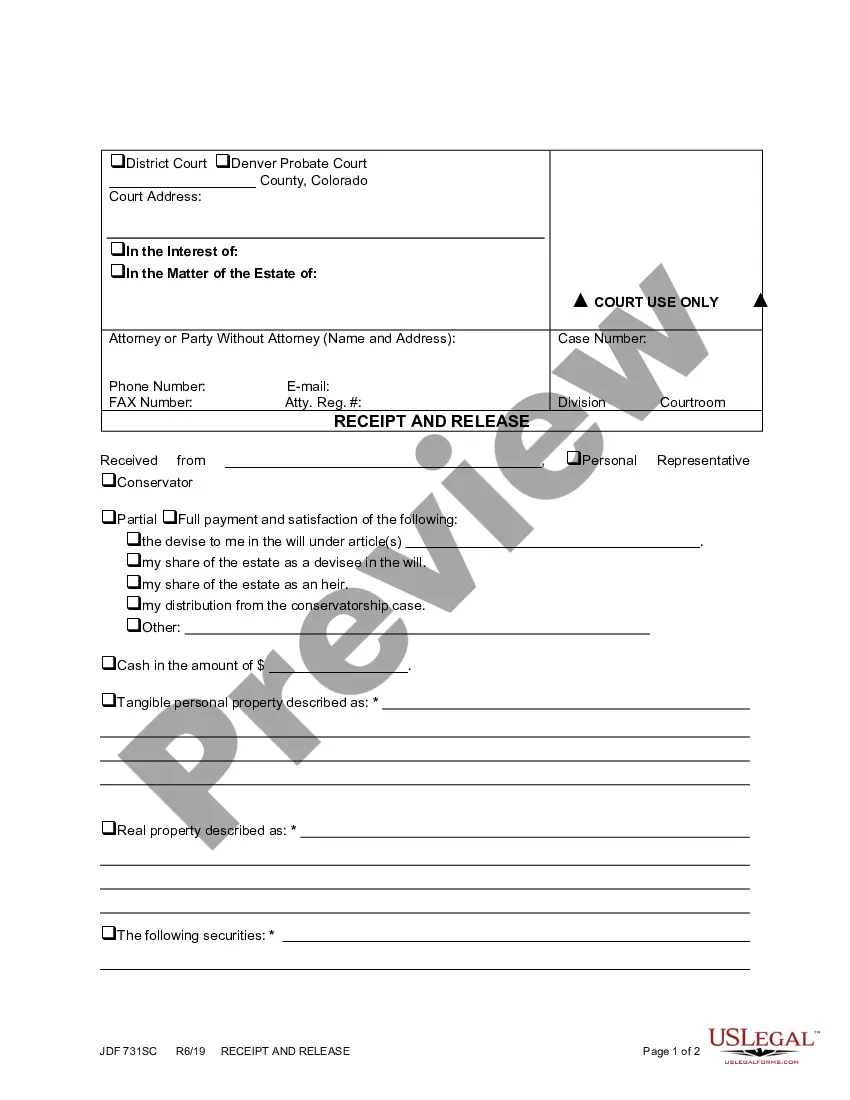

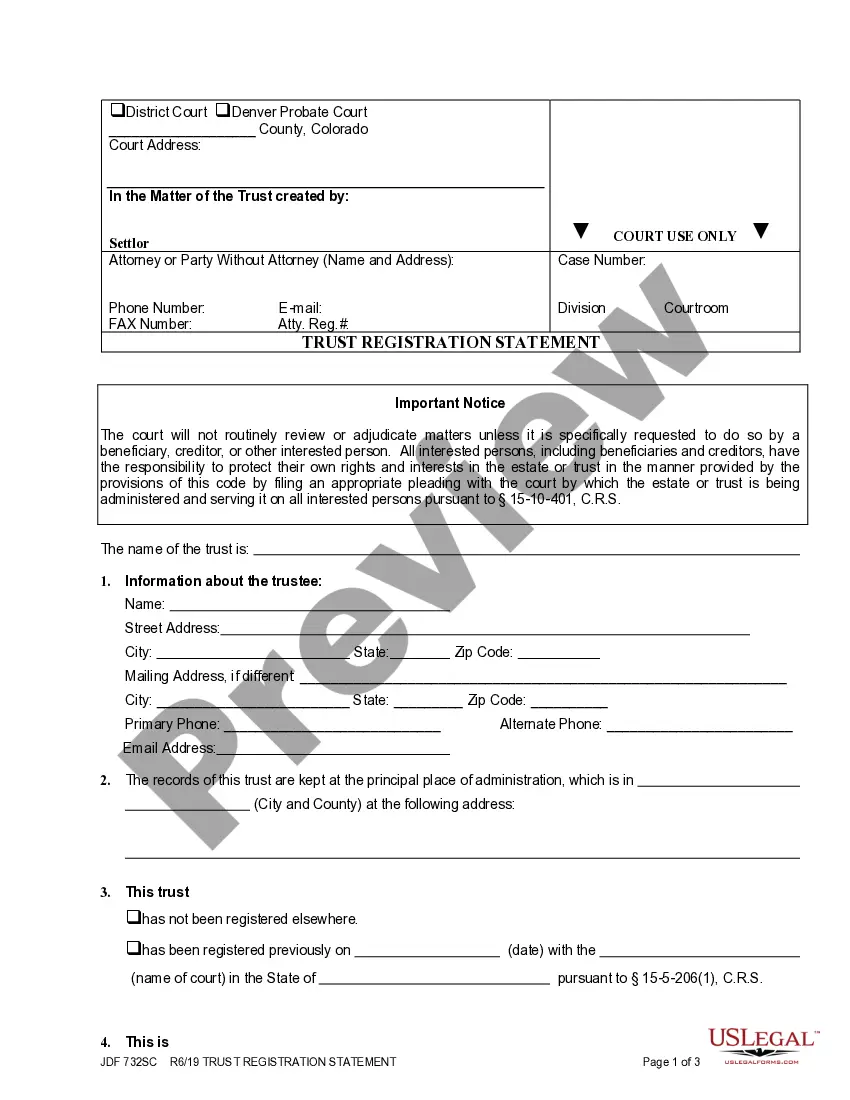

Kings New York Borrowers Certification of Inventory is a crucial document that serves as a detailed inventory report and verification of assets for borrowers in the state of New York. This certification plays a significant role in various financial transactions, including loans, mortgages, and property sales. This certification is designed to ensure accuracy and transparency in financial dealings and protect the interests of both lenders and borrowers. It outlines the borrower's personal and financial information, as well as valuable assets and liabilities associated with the loan or mortgage. The document contains a comprehensive list of all the borrower's assets, such as real estate properties, vehicles, stocks, bonds, valuable possessions, and bank accounts. By submitting this certification, borrowers are confirming the existence and value of the mentioned assets. Lenders rely on this document to evaluate a borrower's financial situation and assess the risks involved in the loan or mortgage agreement. It helps lenders determine the borrower's ability to repay the loan and make informed decisions regarding creditworthiness. There might be variations of Kings New York Borrowers Certification of Inventory depending on the specific loan or mortgage type. Some common types include: 1. Residential Mortgage Borrowers Certification of Inventory: This certification is specifically used for residential mortgage agreements. It focuses on personal assets, residential properties, and other pertinent details crucial for mortgage approval. 2. Commercial Loan Borrowers Certification of Inventory: This type of certification caters to borrowers seeking commercial loans. It emphasizes commercial properties, business assets, cash flows, and other essential factors relevant to commercial lending. 3. Automobile Loan Borrowers Certification of Inventory: Designed specifically for borrowers seeking auto loans, this certification primarily includes information on vehicles. It covers vehicle make, model, year, condition, and value, ensuring lenders have an accurate inventory of the borrower's automobiles. 4. Investment Portfolio Borrowers Certification of Inventory: This specific certification is applicable to borrowers who pledge their investment portfolios as collateral. It requires detailed information about stocks, bonds, mutual funds, and other investment assets held by the borrower. In conclusion, Kings New York Borrowers Certification of Inventory is an essential component of loan and mortgage processes, outlining a borrower's assets and serving as a vital tool for lenders. It ensures transparency, accuracy, and accountability, fostering trust in financial transactions.

Kings New York Borrowers Certification of Inventory

Description

How to fill out Kings New York Borrowers Certification Of Inventory?

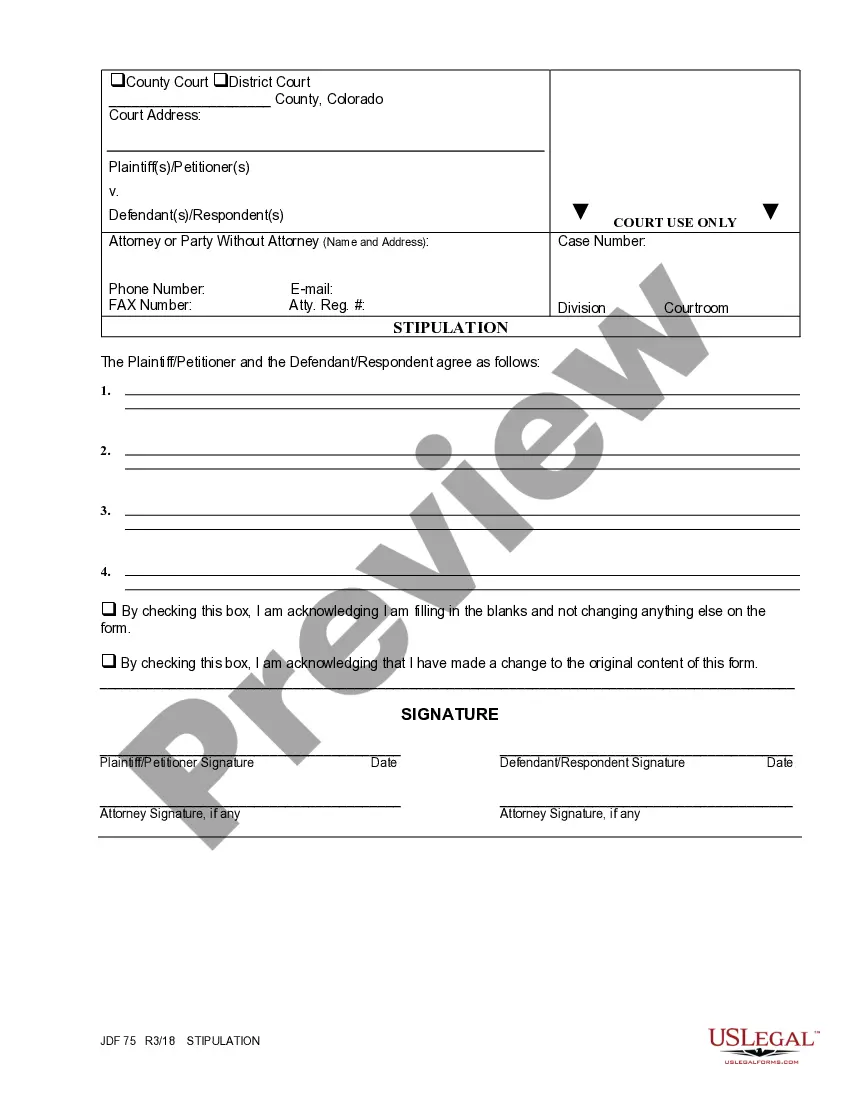

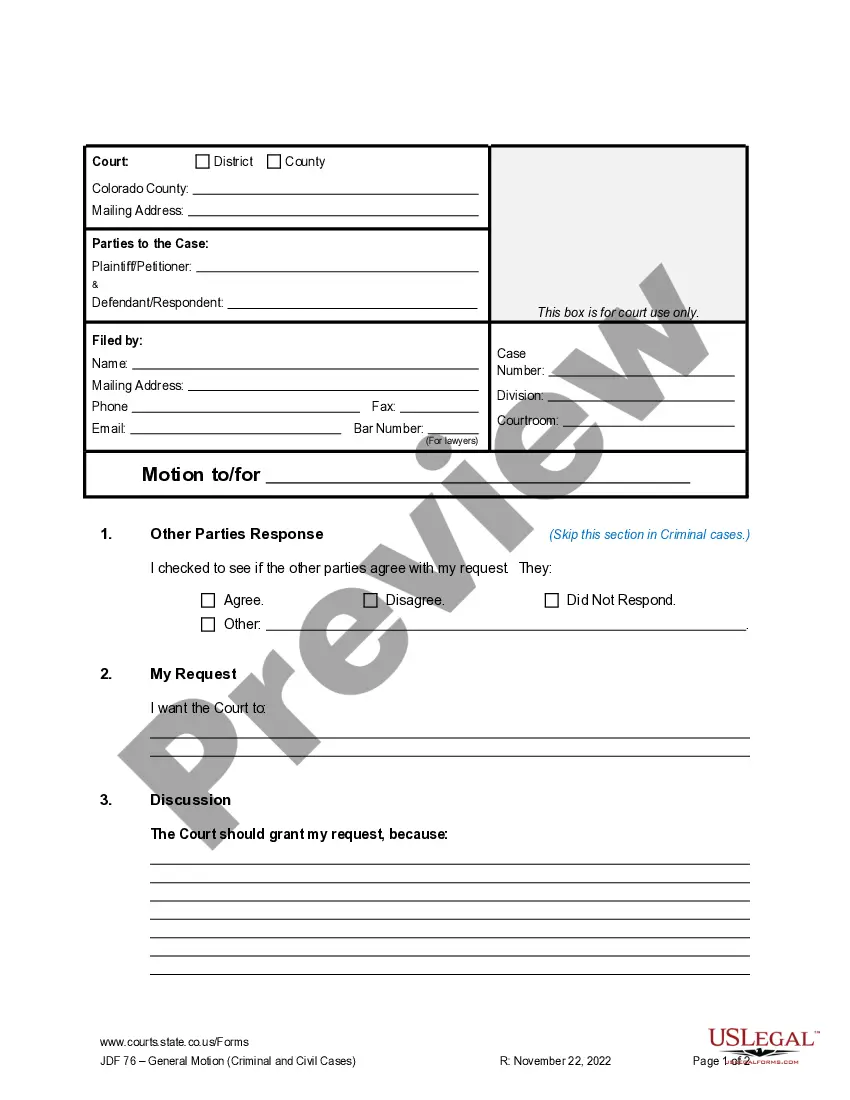

If you need to get a trustworthy legal document provider to find the Kings Borrowers Certification of Inventory, consider US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can search from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of supporting materials, and dedicated support team make it easy to get and execute different documents.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply type to search or browse Kings Borrowers Certification of Inventory, either by a keyword or by the state/county the document is created for. After locating required template, you can log in and download it or retain it in the My Forms tab.

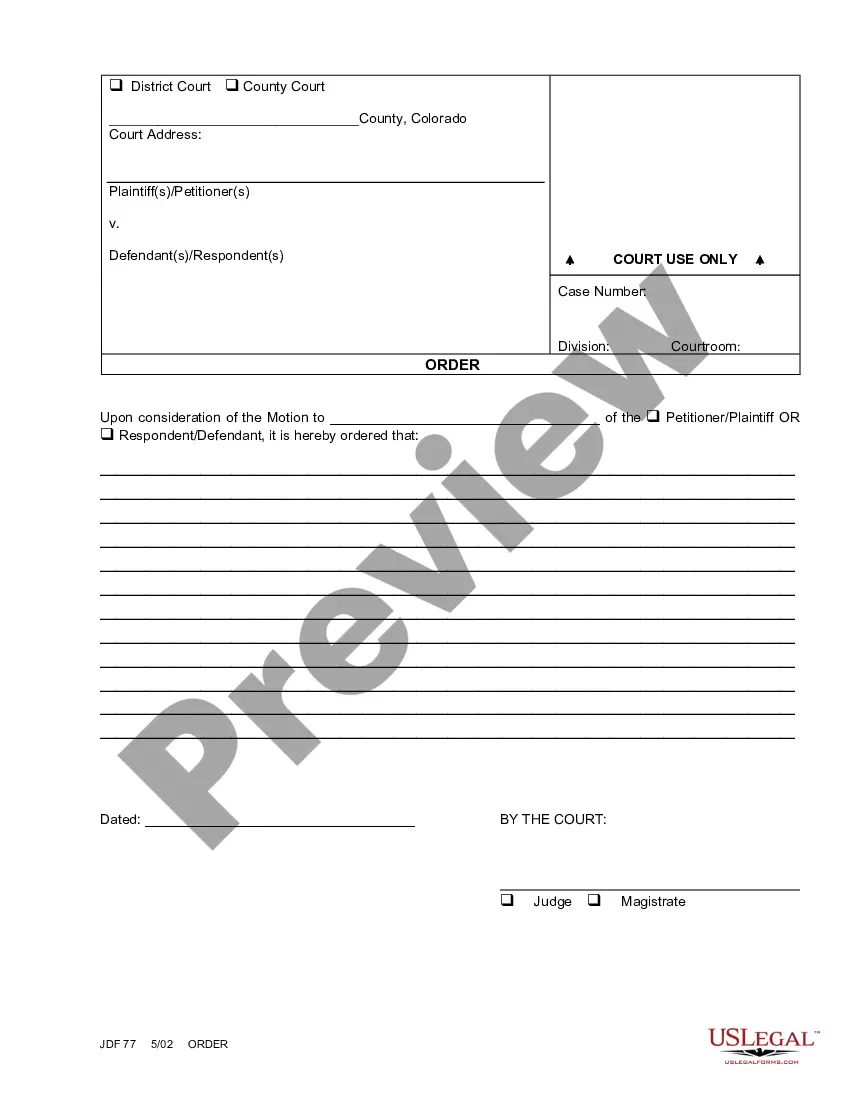

Don't have an account? It's simple to get started! Simply find the Kings Borrowers Certification of Inventory template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription option. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less costly and more affordable. Create your first company, organize your advance care planning, draft a real estate agreement, or complete the Kings Borrowers Certification of Inventory - all from the comfort of your sofa.

Join US Legal Forms now!