Middlesex Massachusetts Borrowers Certification of Inventory is a legal document that serves to verify and validate the inventory of items held by a borrower in Middlesex County, Massachusetts. This certification is required in various banking and lending transactions to ensure accurate record-keeping and to protect the interests of all parties involved. The Borrowers Certification of Inventory in Middlesex County is a comprehensive checklist that includes detailed information about the borrower's assets, liabilities, and property. It primarily focuses on tangible assets, such as real estate, vehicles, equipment, and any other valuable items. The purpose is to ensure that the borrower has provided a complete and accurate representation of their inventory, minimizing the risk of fraud or misrepresentation. This certification is crucial for financial institutions as it helps them evaluate the borrower's financial stability, assess loan eligibility, and determine the appropriate collateral for the loan. By including relevant keywords, it becomes easier to understand the different aspects and types of Borrowers Certification of Inventory in Middlesex County, Massachusetts. Some of these keywords can include: 1. Middlesex County Certification of Inventory 2. Borrowers Certification of Assets and Liabilities in Massachusetts 3. Middlesex County Lending Transactions Certification 4. Inventory Verification for Middlesex County Borrowers 5. Tangible Assets Certification in Middlesex Massachusetts 6. Comprehensive Borrowers Inventory Checklist 7. Middlesex Massachusetts Financial Stability Certification 8. Borrowers Property and Asset Validation in Middlesex County 9. Collateral Assessment for Middlesex County Loans 10. Fraud Prevention through Inventory Certification in Massachusetts It's important to note that the specific types of Borrowers Certification of Inventory may vary depending on the nature of the loan or financial transaction. Different lenders or banking institutions may have their own customized forms or formats for this certification. However, the underlying purpose remains the same — to ensure accuracy and authenticity in the representation of borrower's inventory.

Middlesex Massachusetts Borrowers Certification of Inventory

Description

How to fill out Middlesex Massachusetts Borrowers Certification Of Inventory?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare official documentation that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any individual or business purpose utilized in your region, including the Middlesex Borrowers Certification of Inventory.

Locating templates on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Middlesex Borrowers Certification of Inventory will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Middlesex Borrowers Certification of Inventory:

- Make sure you have opened the proper page with your localised form.

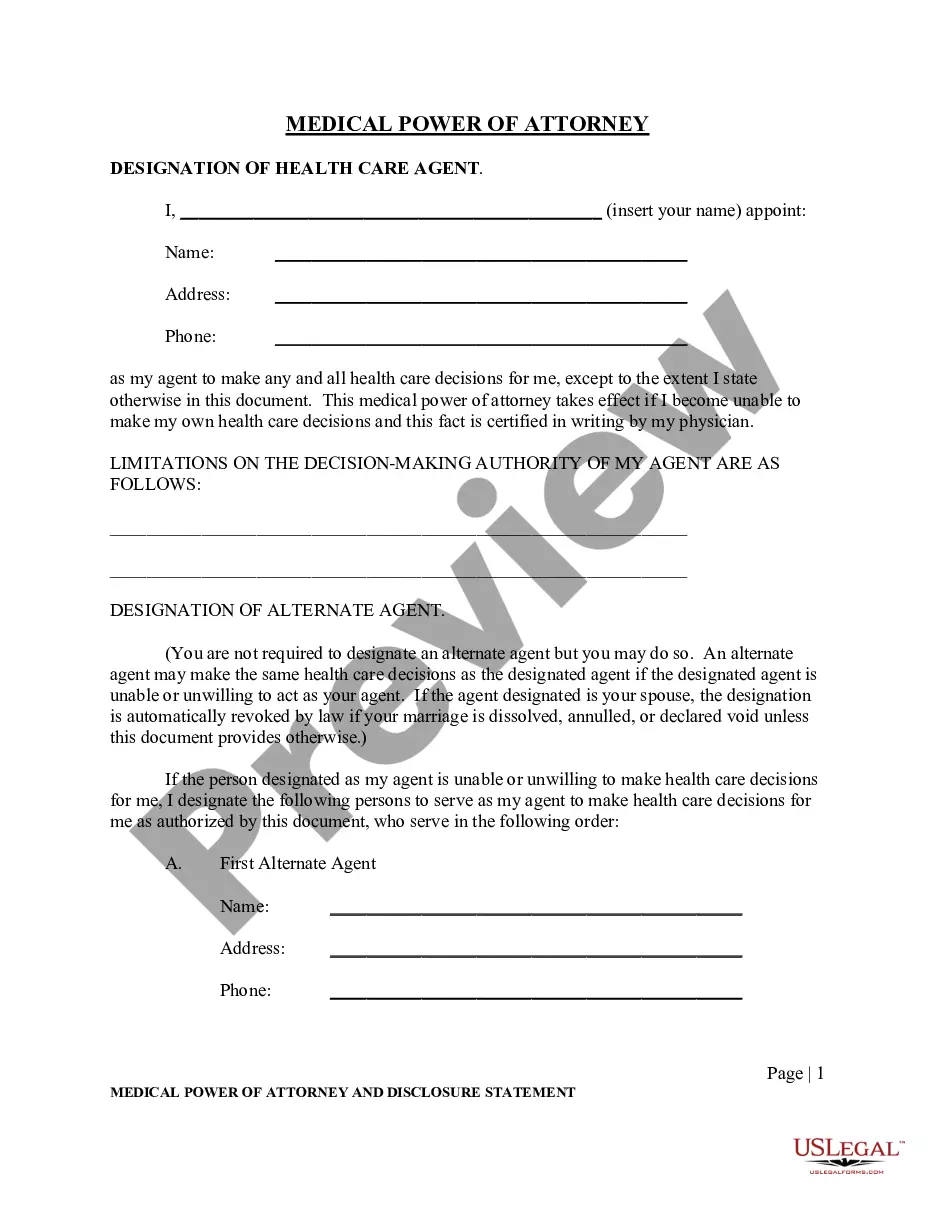

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your needs.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Middlesex Borrowers Certification of Inventory on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!