Travis Texas Borrowers Certification of Inventory is a legal document that verifies the accuracy and completeness of the inventory provided by borrowers located in Travis County, Texas. This certification serves as an essential part of loan applications, real estate transactions, or any other situation where a detailed inventory is required. Borrowers are obligated to accurately list and describe all items included in their inventory to ensure transparency and avoid any potential discrepancies. The Travis Texas Borrowers Certification of Inventory plays a crucial role in several scenarios, including mortgage applications, refinancing, or foreclosure proceedings. It assists lenders and other parties involved in assessing the value and condition of the inventory, protecting the interests of both borrowers and lenders. The certification form requires borrowers to provide detailed information about the inventory, including but not limited to furniture, appliances, electronics, valuable assets, and personal belongings. Specific details such as make, model, condition, year of purchase, and estimated value may be necessary, depending on the purpose of the document. Different types or variations of Travis Texas Borrowers Certification of Inventory may exist to cater to specific situations or loan types. For instance, there could be separate forms designed for residential properties, commercial properties, or even automobile inventories in Travis County, Texas. Each type of form would encompass the necessary fields to capture the relevant details specific to that category. Completing the Travis Texas Borrowers Certification of Inventory accurately is crucial to ensuring a smooth loan process and protecting the interests of both borrowers and lenders. It acts as a legal declaration that all items listed are true and valid, eliminating any potential misunderstandings or misrepresentations during property transactions or loan applications. In conclusion, Travis Texas Borrowers Certification of Inventory is an essential document used in various financial and real estate sectors in Travis County, Texas. It provides a comprehensive and accurate description of the inventory, giving lenders and other parties involved an assurance of the borrower's assets. By incorporating detailed information about the items, the certification enhances transparency, minimizing the risk of fraud or disputes during loan procedures.

Travis Texas Borrowers Certification of Inventory

Description

How to fill out Travis Texas Borrowers Certification Of Inventory?

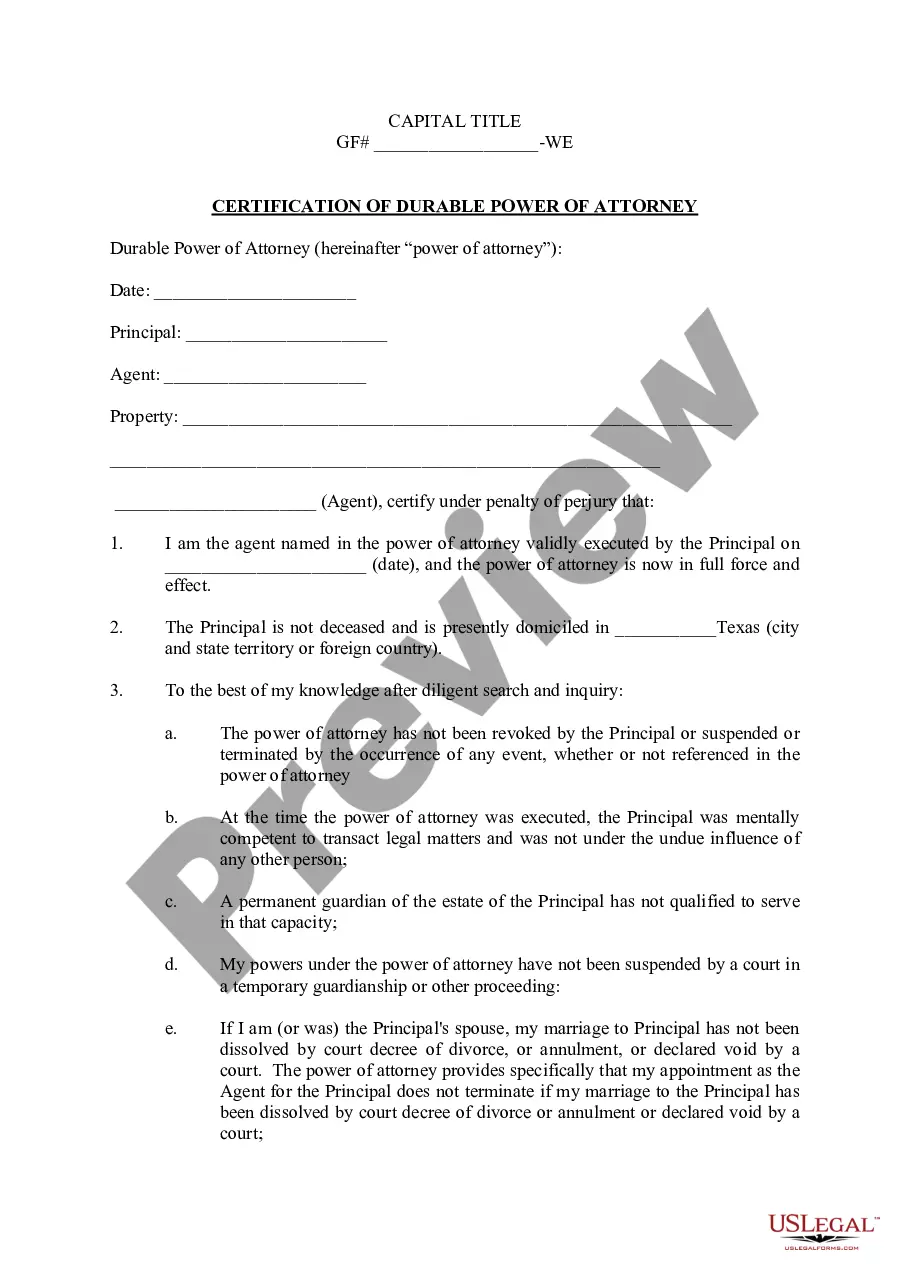

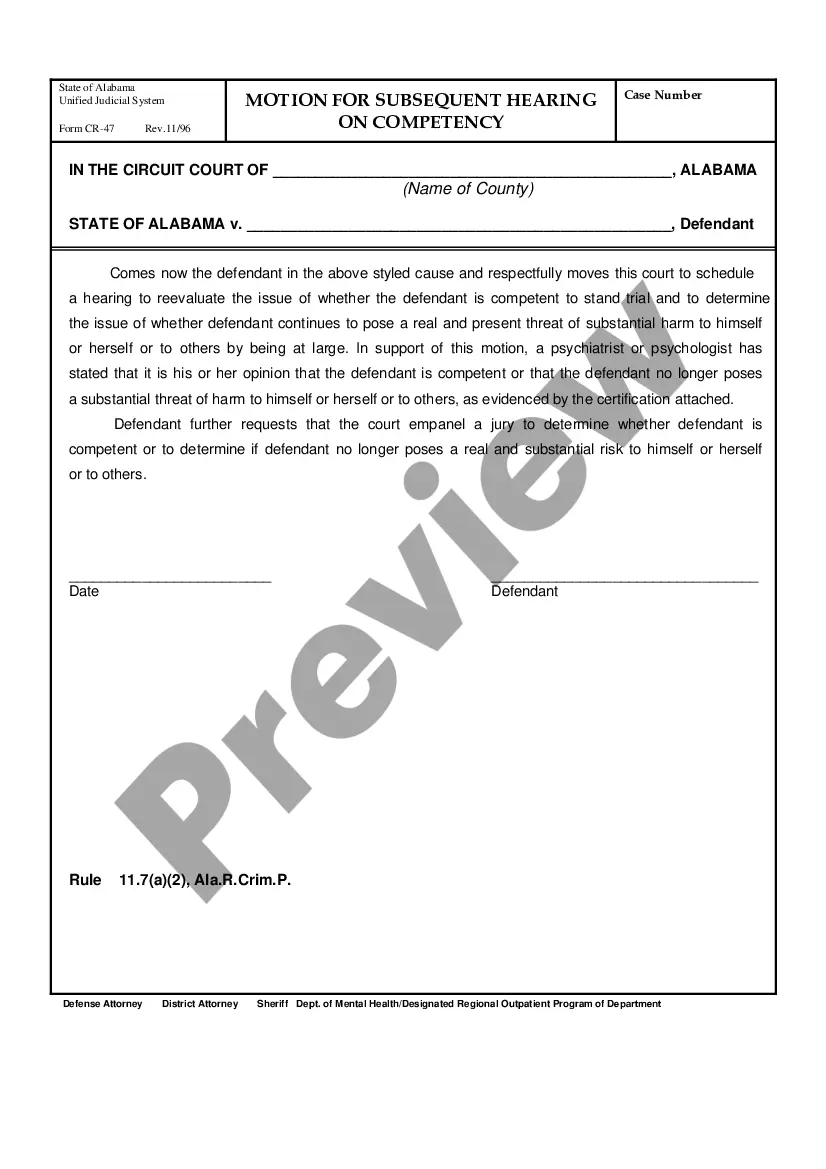

Drafting documents for the business or personal needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Travis Borrowers Certification of Inventory without professional assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Travis Borrowers Certification of Inventory on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, follow the step-by-step instruction below to get the Travis Borrowers Certification of Inventory:

- Look through the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any use case with just a couple of clicks!

Form popularity

FAQ

A loan agreement, sometimes used interchangeably with terms like note payable, term loan, IOU, or promissory note, is a binding contract between a borrower and a lender that formalizes the loan process and details the terms and schedule associated with repayment.

Subject: Application for bank Loan Clearance Certificate It is stated that I am holding account number in your bank since years. I took loan from bank for my personal use of (Rs. INR). Tenure of - years was given to me and I agreed all the terms and conditions.

A promissory note is a document that contains a borrower's promise to repay the amount borrowedPromissory notes and mortgages/deeds of trust are transferable.

A Compliance Agreement is a document in a closing loan document package in which a borrower agrees to comply with requests from the lender or closing agent to correct typographical or clerical errors and inadvertent mistakes in the loan documentation after the loan has closed.

The authorization to access employment and income history from federal or state records, including SESA records, for this transaction continues in effect for one (1) year unless limited by state law, in which case the authorization continues in effect for the maximum period, not to exceed one (1) year, allowed by law.

A third party authorization form says to your mortgage company that you allow a third party to receive information about you and your mortgage. It may allow the third party to take actions for you. There is no single form used by every mortgage company.

The mortgage, which is also called a deed of trust or a security instrument, represents the borrower's promise to repay the loan secured by the home. It is the document that permits the lender to foreclose on the property and take possession if a homeowner does not make their mortgage payments.

Authorizes us to verify any information in your application through public, private, and government sources. You may be asked to sign this form to certify that all of the information you've provided on your application is true and complete.

Definition 1: This document has the borrower certify that all the information within the loan application is correct. The borrower's certification and authorization also authorizes the lender to share information in the loan application with other parties.

Promissory notes are used to evidence a debt of the mortgagor entity incurred as a result of the development of an insured multifamily project and must receive HUD approval prior to their issuance. (As used herein, "Promissory Notes" refers to surplus cash notes and or residual receipts notes.) A.