San Diego California Borrowers Certification of No Material Change No Damage is a legal document that certifies the absence of any significant changes or damages to a property owned by a borrower in San Diego, California. This certification is often required by lenders or financial institutions when a borrower is seeking a loan or refinancing. The purpose of the San Diego California Borrowers Certification of No Material Change No Damage is to protect the interests of the lender. By signing this document, the borrower assures the lender that there have been no substantial alterations or damages to the property that could affect its value or the borrower's ability to repay the loan. This certification typically includes detailed information about the property and its current condition. The borrower may be required to provide specific information such as the property's address, legal description, and current market value. Additionally, the borrower may have to indicate whether there have been any renovations, additions, or damages to the property since the initial loan agreement. The San Diego California Borrowers Certification of No Material Change No Damage serves as a legally binding statement by the borrower, attesting to the property's condition at the time of certification. If any undisclosed changes or damages are discovered in the future, the borrower may be held liable and may face legal consequences. Different types of San Diego California Borrowers Certification of No Material Change No Damage may include variations in language or specific requirements based on the lender or loan program. Some lenders may have their own customized versions of this certification, while others may follow a standardized format approved by regulatory bodies. Key search terms for this content: San Diego California, borrowers certification, no material change, no damage, legal document, lender, loan, refinancing, property condition, renovations, additions, undisclosed changes, legal consequences, loan program, standardized format.

San Diego California Borrowers Certification of No Material Change No Damage

Description

How to fill out San Diego California Borrowers Certification Of No Material Change No Damage?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the San Diego Borrowers Certification of No Material Change No Damage, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the San Diego Borrowers Certification of No Material Change No Damage from the My Forms tab.

For new users, it's necessary to make a few more steps to get the San Diego Borrowers Certification of No Material Change No Damage:

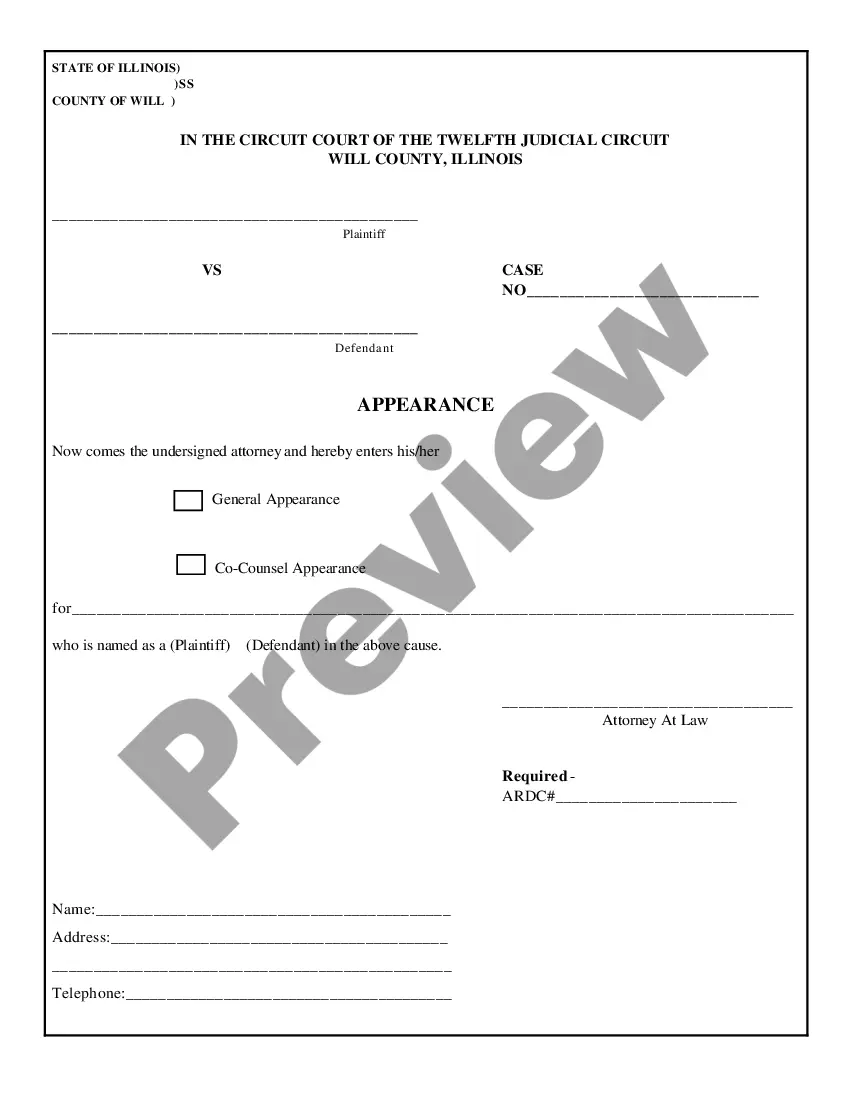

- Analyze the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!