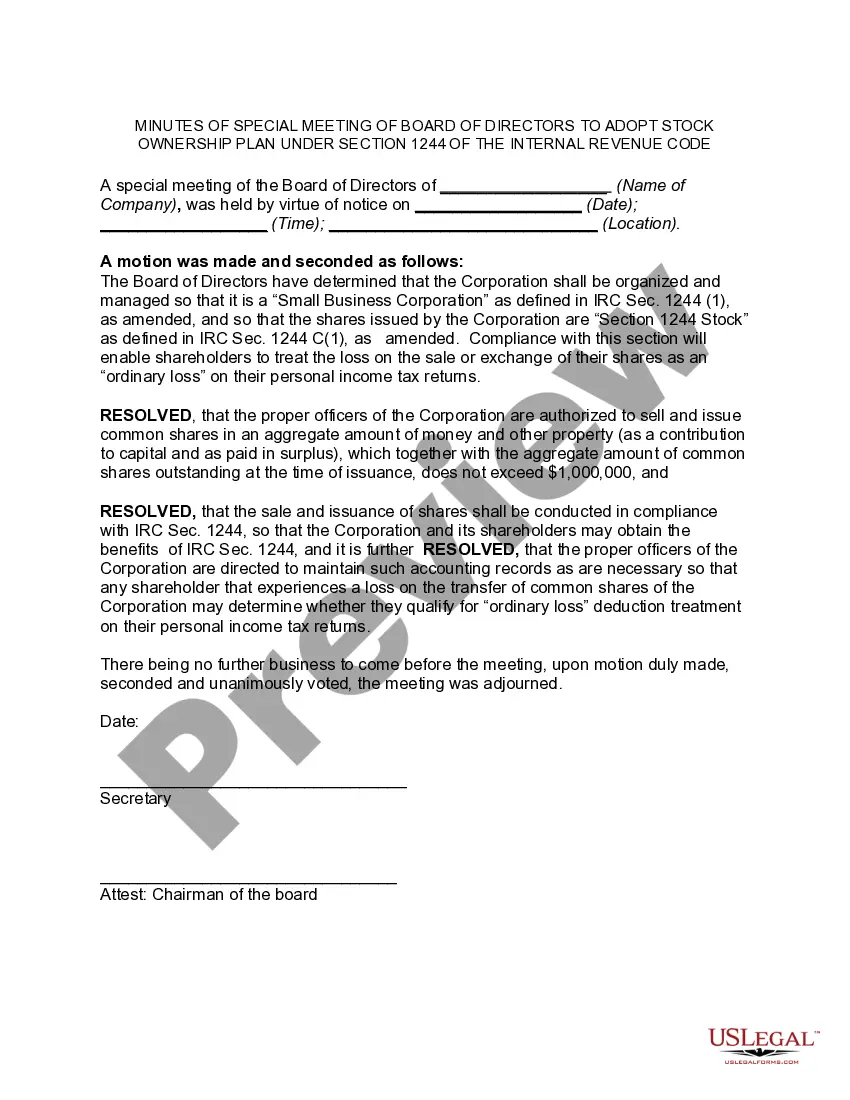

Tucson Arizona MINUTES OF SPECIAL MEETING OF BOARD OF DIRECTORS TO ADOPT STOCK OWNERSHIP PLAN UNDER SECTION 1244 OF THE INTERNAL REVENUE CODE

Category:

State:

Multi-State

City:

Tucson

Control #:

US-0752BG

Format:

Word;

Rich Text

Instant download

Description

Section 1244 stock is a classification on investments used when filing a capital loss on personal taxes with the Internal Revenue Service (IRS). It allows the shareholders to treat up to $50,000 of losses ($100,000 if married and filing jointly) from the sale of the stock as ordinary losses instead of capital losses. Usually, there is a $3,000 US Dollars (USD) limit on losses that can be counted against personal income.