Dear [Lender's Name], I hope this letter finds you in good health. I am writing to express my interest in refinancing my existing loan with your esteemed financial institution. I currently reside in Franklin, Ohio, and I believe that refinancing with your bank could provide me with significant benefits and a more favorable financial situation. Franklin, Ohio, is a vibrant city located in Warren County. It is known for its rich history, friendly community, and excellent quality of life. As a resident of Franklin, I have been fortunate to witness the city's growth and development over the years. However, I find myself in a position where refinancing my loan is necessary to improve my financial circumstances. Through thorough research and consultations with financial experts, I have come to understand that refinancing can provide me with several advantages including potentially lower interest rates, reduced monthly payments, and improved terms and conditions. Moreover, refinancing would enable me to consolidate any existing debts and pay them off with a more manageable and structured plan. Considering the numerous opportunities that refinancing holds, I believe that your bank can offer me the best refinancing terms suited to my unique financial goals. It would be greatly appreciated if you could provide me with a detailed breakdown of the refinancing options available in Franklin, Ohio. This would include information on different loan types, interest rates, repayment terms, and any associated fees or charges that might apply. I am particularly interested in exploring the following types of refinancing opportunities: 1. Cash-Out Refinancing: This type of refinancing option allows homeowners to extract additional funds based on the equity they have built in their property. Proceeds from this type of loan can be used for home improvements, debt consolidation, investment purposes, or any other financial need. 2. Rate-and-Term Refinancing: This type of refinancing allows me to modify the interest rate, repayment term, or both, while keeping the loan balance the same. By securing a lower interest rate or shortening the term of the loan, I can potentially reduce my monthly payments and save a significant amount of money over the course of the loan. Considering my strong payment history and creditworthiness, I am confident that I would be an ideal candidate for refinancing through your esteemed institution. I kindly request your assistance in providing me with the necessary information and guidance to proceed with the refinancing process. Thank you for considering my request, and I look forward to hearing from you soon. Should you require any additional documents or information, please do not hesitate to contact me at [Your Contact Information]. Sincerely, [Your Name]

Franklin Ohio Sample Letter for Refinancing of Loan

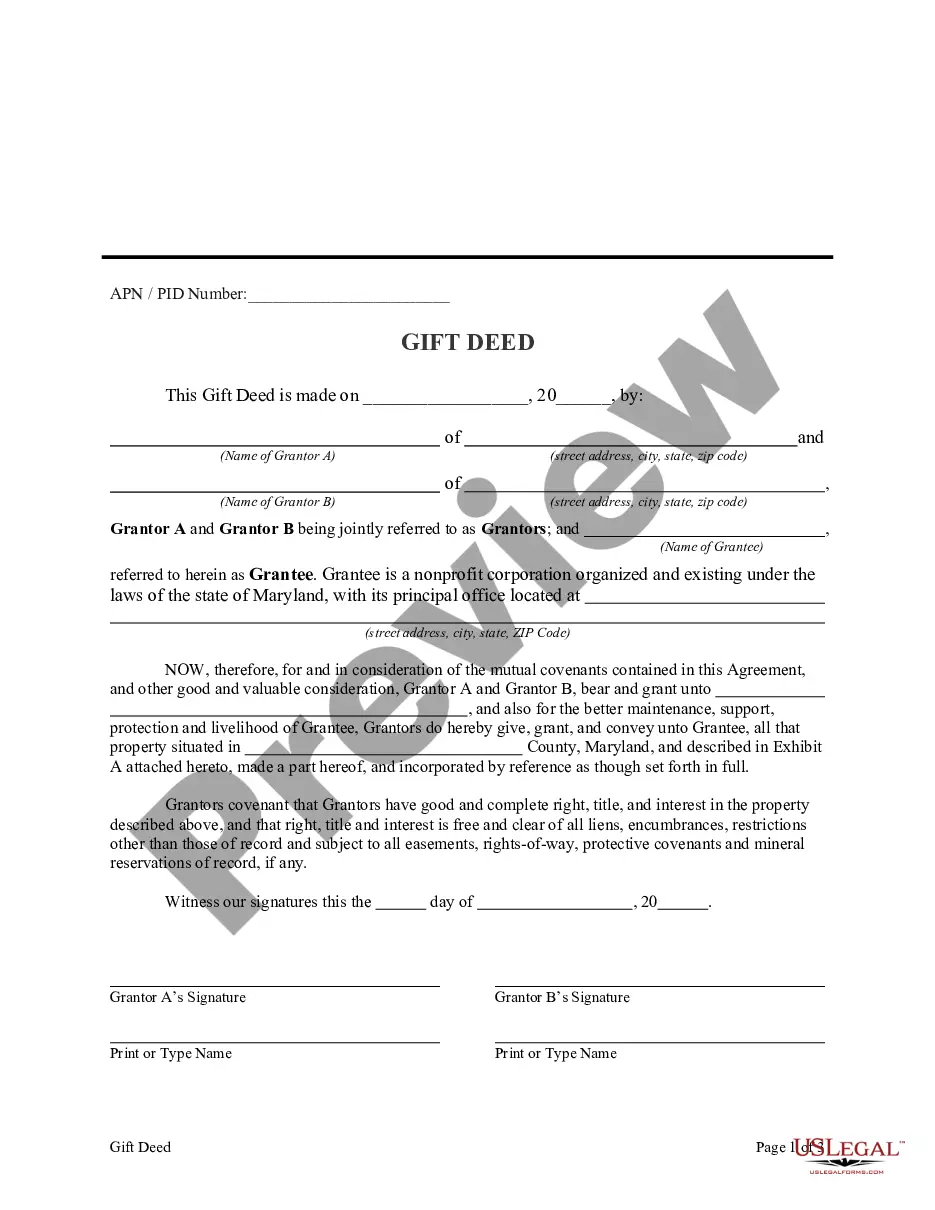

Description

How to fill out Franklin Ohio Sample Letter For Refinancing Of Loan?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare formal documentation that differs throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any personal or business objective utilized in your county, including the Franklin Sample Letter for Refinancing of Loan.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Franklin Sample Letter for Refinancing of Loan will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to obtain the Franklin Sample Letter for Refinancing of Loan:

- Ensure you have opened the correct page with your local form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Franklin Sample Letter for Refinancing of Loan on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!