Dear [Lender's Name], I am writing to inquire about refinancing my existing loan as a resident of Hillsborough, Florida. As a homeowner in this vibrant county, I am seeking to negotiate more favorable terms for my current mortgage and take advantage of the current market conditions. Hillsborough County, located in the heart of the Tampa Bay area, is known for its diverse communities, thriving economy, and picturesque landscape. Home to vibrant cities like Tampa, Brandon, and Plant City, Hillsborough offers a vibrant mix of urban amenities and a close-knit suburban atmosphere. As a homeowner in Hillsborough County, I have realized the potential to improve my financial situation by refinancing my loan. My primary goal is to secure a lower interest rate, reduce my monthly payments, and potentially shorten the loan term. By doing so, I can maximize my financial resources and allocate them towards other important aspects of my life such as saving for the future or investing in home improvement projects. Refinancing has become an attractive option for many homeowners in Hillsborough County due to the historically low interest rates prevailing in the market. By undertaking this refinancing process, I aim to capitalize on the opportunity to save on interest costs over the long run and potentially build equity in my home at an accelerated rate. Moreover, refinancing can help me consolidate any high-interest debts that I may have accumulated over time, providing me with a convenient solution to streamline my financial obligations and potentially reduce my overall debt burden. This approach aligns with my long-term financial goals and allows me to take advantage of the favorable financial climate that currently exists in Hillsborough County. In terms of the types of refinancing options available in Hillsborough, Florida, there are various avenues to consider. Some popular options include rate-and-term refinancing, which allows homeowners to replace their existing mortgage with a new one that offers more favorable terms. Cash-out refinancing is another option, which allows homeowners to tap into their home equity to obtain cash for personal needs such as educational expenses, home renovations, or debt consolidation. I am eager to explore refinancing opportunities with your esteemed institution and would appreciate any guidance or information you can provide on the available options specifically tailored to my situation as a Hillsborough resident. Should we move forward, I look forward to collaborating with your team to gather the necessary documentation, undergo the required appraisal, and meet any additional criteria necessary to complete the refinancing process smoothly. Thank you for your time and consideration. I eagerly anticipate the opportunity to discuss my refinancing goals with you further. Sincerely, [Your Name] [Your Address] [City, State, ZIP] [Phone Number] [Email Address]

Hillsborough Florida Sample Letter for Refinancing of Loan

Description

How to fill out Hillsborough Florida Sample Letter For Refinancing Of Loan?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a lawyer to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Hillsborough Sample Letter for Refinancing of Loan, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Consequently, if you need the recent version of the Hillsborough Sample Letter for Refinancing of Loan, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Hillsborough Sample Letter for Refinancing of Loan:

- Glance through the page and verify there is a sample for your region.

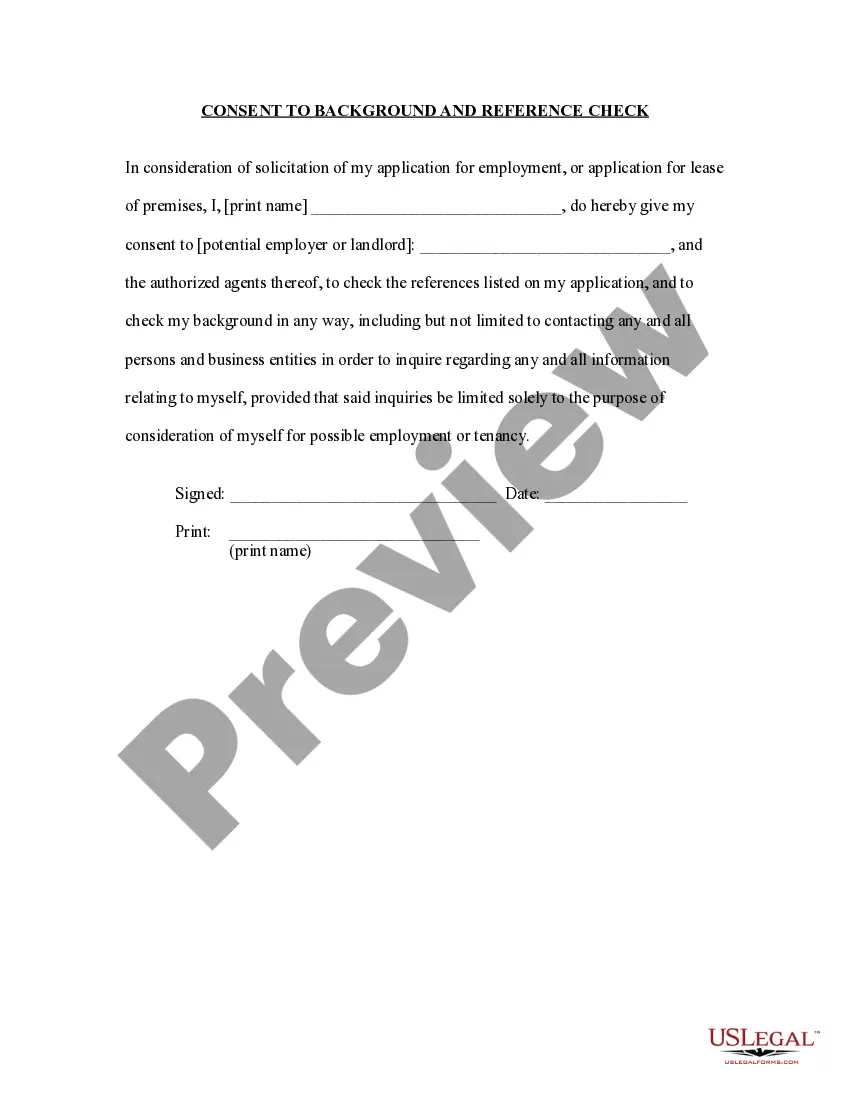

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Hillsborough Sample Letter for Refinancing of Loan and save it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!