Subject: Requesting Refinancing of Loan — Santa Clara, California Dear [Lender's Name], I hope this letter finds you in good health and high spirits. I am writing to express my interest in refinancing my current loan with your esteemed financial institution. I currently reside in the vibrant city of Santa Clara, California, and I believe that refinancing my loan with your institution will bring significant financial advantages and potentially improve my overall financial position. Santa Clara, located in the heart of Silicon Valley, is a city known for its thriving economy, robust job market, and innovative technological advancements. With its appealing mix of residential areas, bustling commercial districts, and renowned educational institutions, Santa Clara has emerged as a highly sought-after location for professionals, entrepreneurs, and families alike. As a resident of Santa Clara, I have experienced firsthand the growth and development the city has undergone over the years. With this evolution, the cost of living has also increased, leading to the need for smarter financial choices. Thus, I am taking this opportunity to explore refinancing options to better meet my financial goals and aspirations. I have researched various loan refinancing options and carefully considered your institution for its reputable track record and exceptional customer service. By refinancing my loan with you, I believe I will gain access to the best terms and rates available in the market, and ultimately, make sound financial decisions that align with my needs. The specific type of Santa Clara, California Sample Letter for Refinancing of Loan can vary depending on the purpose and nature of the loan. Some common types include: 1. Home Loan Refinancing: If Santa Clara homeowners wish to avail of better interest rates, lower monthly payments, or shorten the loan term, they may opt for refinancing their home loans. This enables them to save on overall interest costs and potentially build equity faster. 2. Auto Loan Refinancing: Residents of Santa Clara who have previously financed their vehicles may want to consider refinancing their auto loans to take advantage of better interest rates or modify the loan terms to suit their current financial situation. 3. Student Loan Refinancing: Students or graduates residing in Santa Clara may also seek to refinance their existing student loans, aiming to secure better interest rates, reduced monthly payments, or streamline multiple loans into a single, easily manageable loan. I would be greatly appreciative if you could provide me with more detailed information regarding the refinancing options available to me as a Santa Clara resident. Additionally, if possible, kindly guide me through the application process and provide any necessary documentation required for loan refinancing. Your prompt attention to this matter will be highly valued. I am confident that by refinancing my loan, I can achieve greater financial stability and peace of mind. Thank you for considering my request, and I eagerly await your response. Best Regards, [Your Name] [Your Contact Information]

Santa Clara California Sample Letter for Refinancing of Loan

Description

How to fill out Santa Clara California Sample Letter For Refinancing Of Loan?

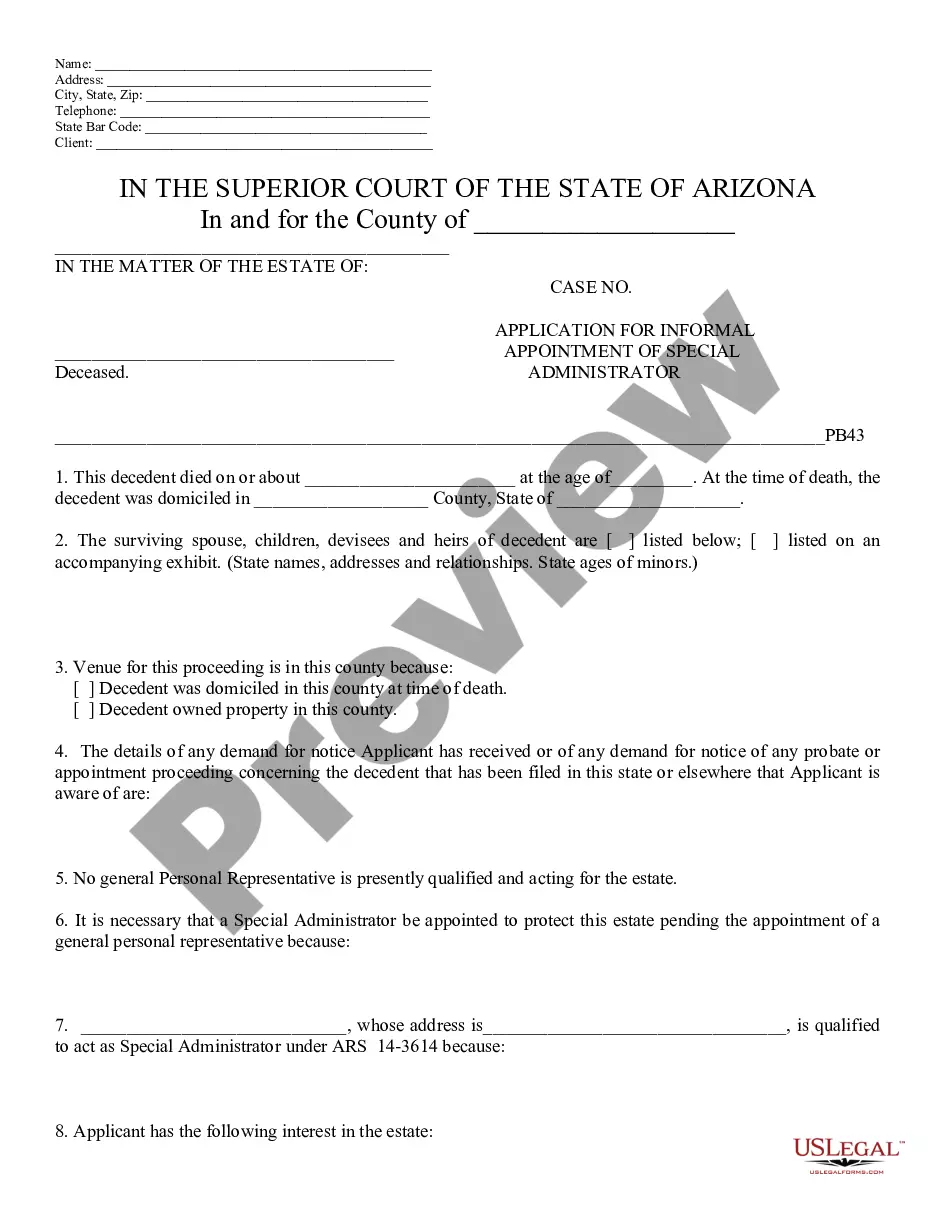

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life sphere, locating a Santa Clara Sample Letter for Refinancing of Loan suiting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. In addition to the Santa Clara Sample Letter for Refinancing of Loan, here you can get any specific document to run your business or personal affairs, complying with your regional requirements. Specialists check all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Santa Clara Sample Letter for Refinancing of Loan:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Santa Clara Sample Letter for Refinancing of Loan.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

4 Reasons to Refinance Your Mortgage Lower your monthly mortgage payment. Even the slightest difference in your mortgage rate can impact your monthly payment.Pay off your loan sooner.Save on total interest.Switch mortgage types.

It explains to the lender why you want to take some cash out while you're refinancing. There are many other types of letters of explanation that lenders might request. For example, they might ask that you explain a blemish on your credit report or why there's a gap in your employment history.

6 Steps to Refinancing Your Home Mortgage Check Your Credit. Determine Your Target Rate. Shop Around and Choose a Qualified Lender. Watch Out for High Lending Fees. Be Patient About Signing a Mortgage. Don't Open Any Credit During the Refinancing Process. Make the Best Decision Based on the Numbers.

out refinance lets you cash in on the equity you've accumulated in your home. You can spend the lump sum of money you gain from the refi on pretty much anything you want. out refinance might be a good way to pay for a home improvement project, debt consolidation or unexpected car repairs, for instance.

Include a reference to the mortgage agreement you have signed with the letter recipient, certify your intent to seek cash-out refinance, explain why do you choose to obtain money this way instead of taking out an additional loan, and indicate your contact information.

How to write a letter of explanation The lender's name and address. Your name and your application number. The date you're submitting the letter and expected closing date (if you know it) A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.

What Documents Are Needed to Refinance a Mortgage? Pay Stubs.W-2s or 1099s.Tax Returns.Statement of Assets.Statement of Debts.Insurance.Additional Documents.

A letter of explanation for a cash-out refinance does what its name implies. It explains to the lender why you want to take some cash out while you're refinancing. There are many other types of letters of explanation that lenders might request.

How to Write a Letter Regarding Why You Need a Cash Out Refinance Compose the inside address of the letter to the lender and add the current date.Explain the purpose of the letter in the opening paragraph.Enumerate the reasons for your cash-out refinance.