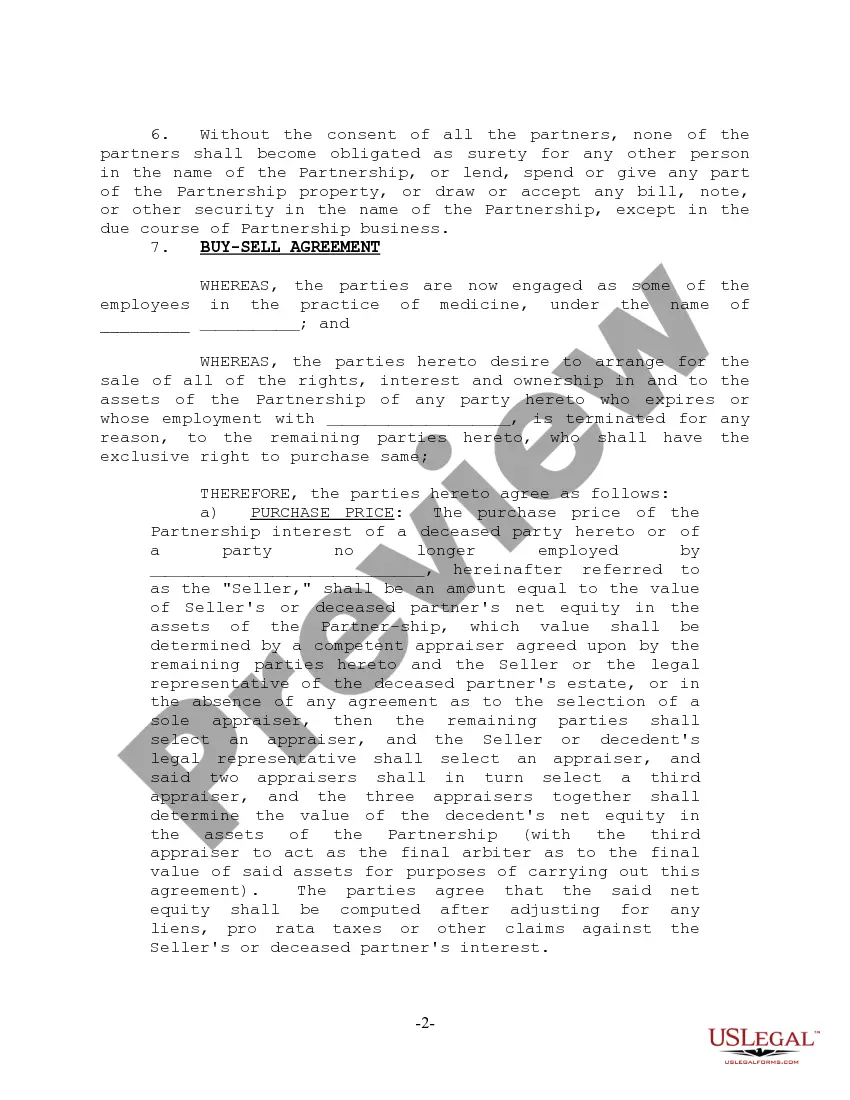

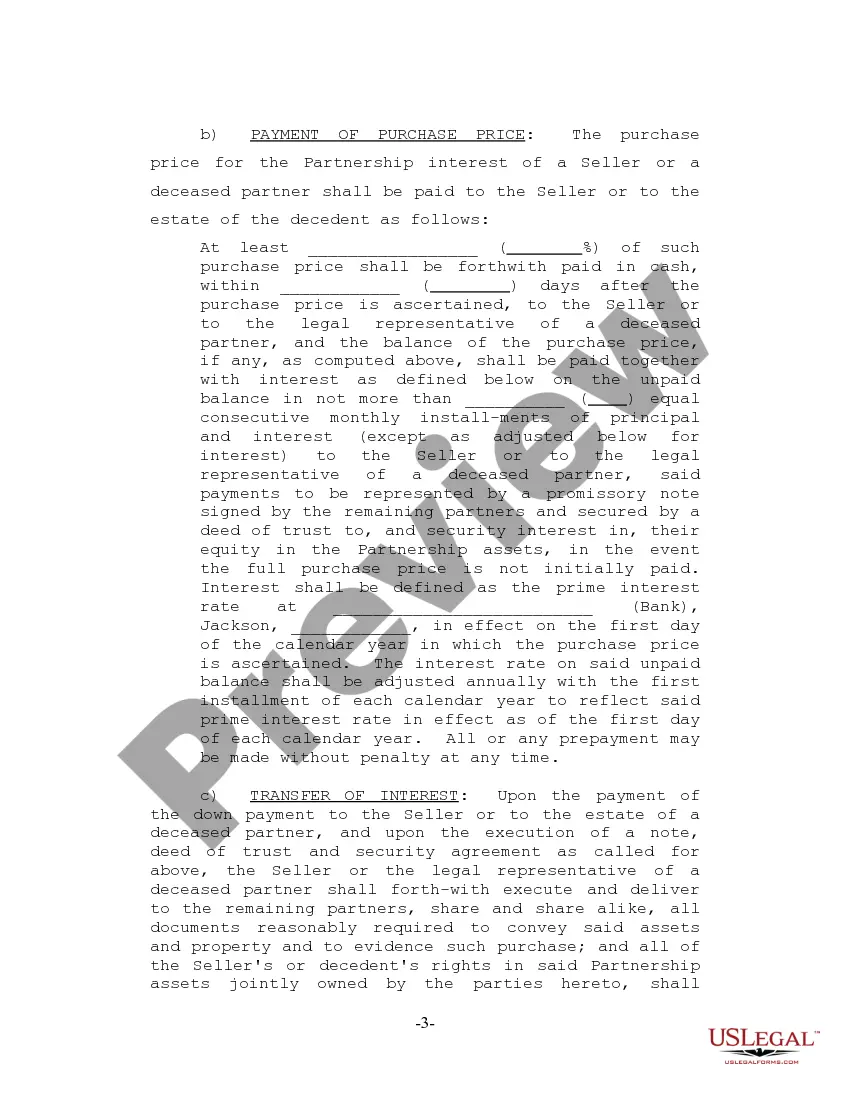

A Dallas Texas Partnership Agreement for Home Purchase is a legally binding document that outlines the terms and conditions between two or more parties entering into a partnership for the purpose of purchasing a home in Dallas, Texas. This agreement helps establish the rights, responsibilities, and obligations of each partner involved in the home buying process, ensuring a smooth and fair transaction. In Dallas, there are several types of Partnership Agreements for Home Purchase, which include: 1. Joint Venture Partnership Agreement: This is a commonly used agreement where two or more parties come together to jointly purchase a home in Dallas, Texas. Each partner contributes a predetermined amount of money towards the purchase and expenses related to the property. The agreement typically details the percentage of ownership, profit sharing, and decision-making process for the property. 2. Limited Partnership Agreement: In this type of agreement, there are two types of partners involved: general partners and limited partners. General partners actively participate in the home purchase process and have decision-making authority, while limited partners contribute financially but have limited control over the property. This arrangement is often suitable if one partner has more knowledge or expertise in real estate investments. 3. Tenancy in Common Agreement: With a tenancy in common agreement, each partner owns a specific percentage of the property, which can be equal or unequal. Unlike joint tenancy or community property, partners do not have the automatic right of survivorship. This means that when a partner passes away, their share will be transferred to their estate rather than automatically transferred to the other partner(s). 4. Limited Liability Partnership Agreement: This type of partnership agreement offers liability protection to partners involved in the home purchase. It allows partners to limit their personal liability for any debts or obligations related to the property. Each partner's liability is generally limited to the amount of their investment in the partnership. When drafting a Dallas Texas Partnership Agreement for Home Purchase, it is important to include key provisions such as the property's address, purchase price, allocated shares of ownership, contributions of each partner, profit and loss sharing ratios, decision-making procedures, dispute resolution methods, and exit strategies. Overall, a comprehensive Dallas Texas Partnership Agreement for Home Purchase provides a solid framework for partners to work together harmoniously and protect their rights and investments during the home buying process in Dallas, Texas.

Dallas Texas Partnership Agreement for Home Purchase

Description

How to fill out Dallas Texas Partnership Agreement For Home Purchase?

How much time does it typically take you to draft a legal document? Considering that every state has its laws and regulations for every life situation, finding a Dallas Partnership Agreement for Home Purchase suiting all regional requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. Apart from the Dallas Partnership Agreement for Home Purchase, here you can find any specific form to run your business or individual affairs, complying with your regional requirements. Specialists check all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Dallas Partnership Agreement for Home Purchase:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Dallas Partnership Agreement for Home Purchase.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!