A San Diego California Partnership Agreement for Home Purchase is a legally binding contract between two or more individuals who decide to join forces and purchase a property together in San Diego. This agreement outlines the rights, responsibilities, and obligations of each partner involved in the real estate transaction. Using clear and concise language, it specifies the terms and conditions that will govern the partnership, including how costs, profits, and losses will be divided among the partners. There are different types of San Diego California Partnership Agreements for Home Purchase, depending on the nature of the partnership and the relationship between the individuals involved. Some common variations are: 1. Joint Tenancy Agreement: In this type of agreement, partners hold equal ownership of the property, and in the event of a partner's death, their share automatically passes to the surviving partners. Joint tenancy agreements typically come with a "right of survivorship," which ensures that the property does not pass through probate. 2. Tenancy in Common Agreement: This agreement allows partners to hold different ownership shares of the property. Each partner's interest in the property can be freely transferred or sold without the consent of the other partners. In tenancy in common agreements, there is no right of survivorship, and upon a partner's death, their share becomes part of their estate. 3. Limited Partnership Agreement: This type of agreement involves a general partner who manages the property and assumes personal liability, while limited partners contribute financially but have limited liability. Limited partnership agreements are often used in real estate investments, allowing individuals to passively invest in properties without assuming full liability. 4. LLC Operating Agreement: In this agreement, partners form a limited liability company (LLC) to purchase and manage the property. This structure provides limited liability protection to all partners. An LLC operating agreement determines the roles and responsibilities of each partner, as well as the distribution of profits and losses. 5. Buyout Agreement: This agreement outlines the process and terms for buying out a partner's share in the property. It includes provisions for valuing the property, determining the buyout price, and the mechanism for executing the buyout. San Diego California Partnership Agreements for Home Purchase ensure that all parties involved in the property purchase have a clear understanding of their rights, responsibilities, and expectations. By addressing key legal and financial aspects, these agreements protect the interests of the partners and help mitigate potential conflicts or misunderstandings in the future.

San Diego California Partnership Agreement for Home Purchase

Description

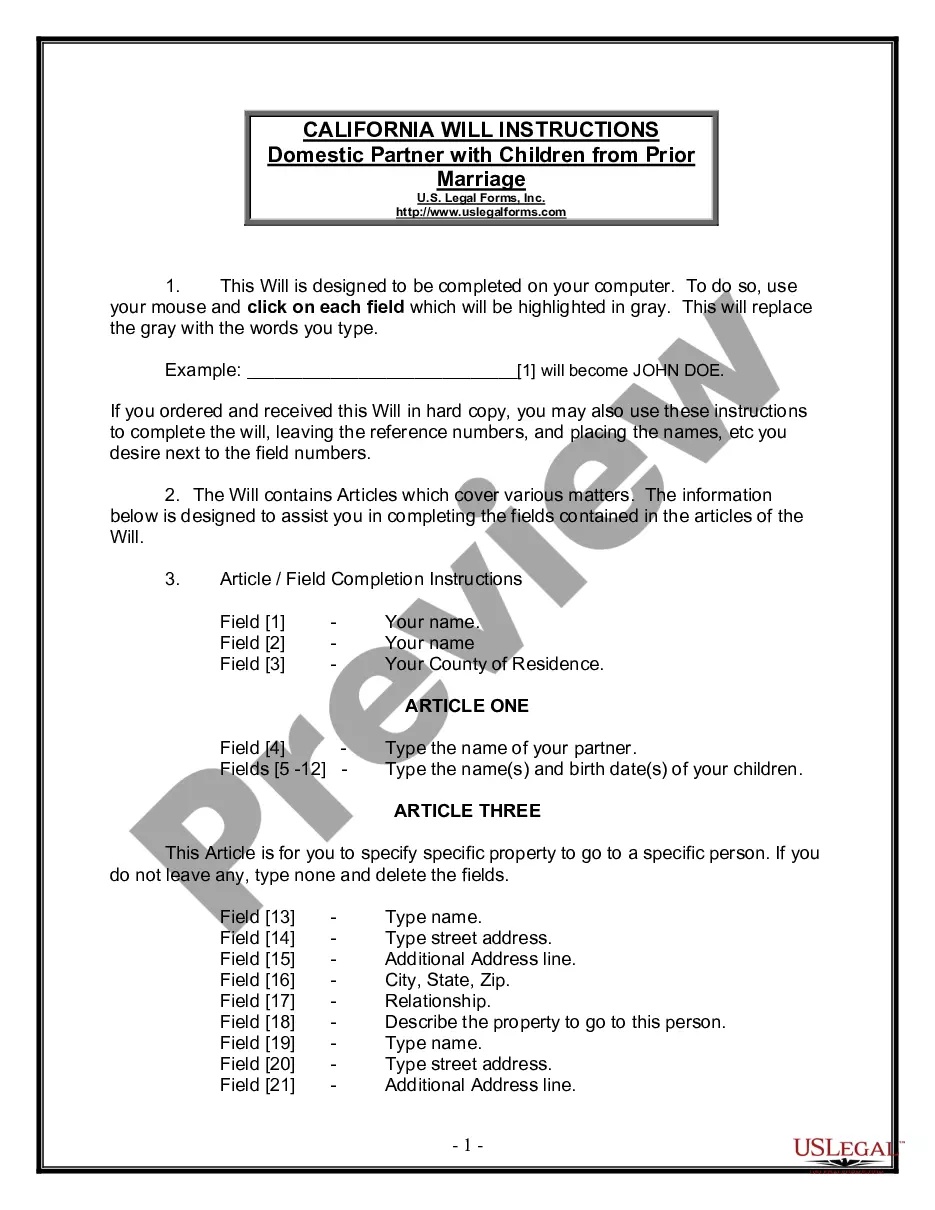

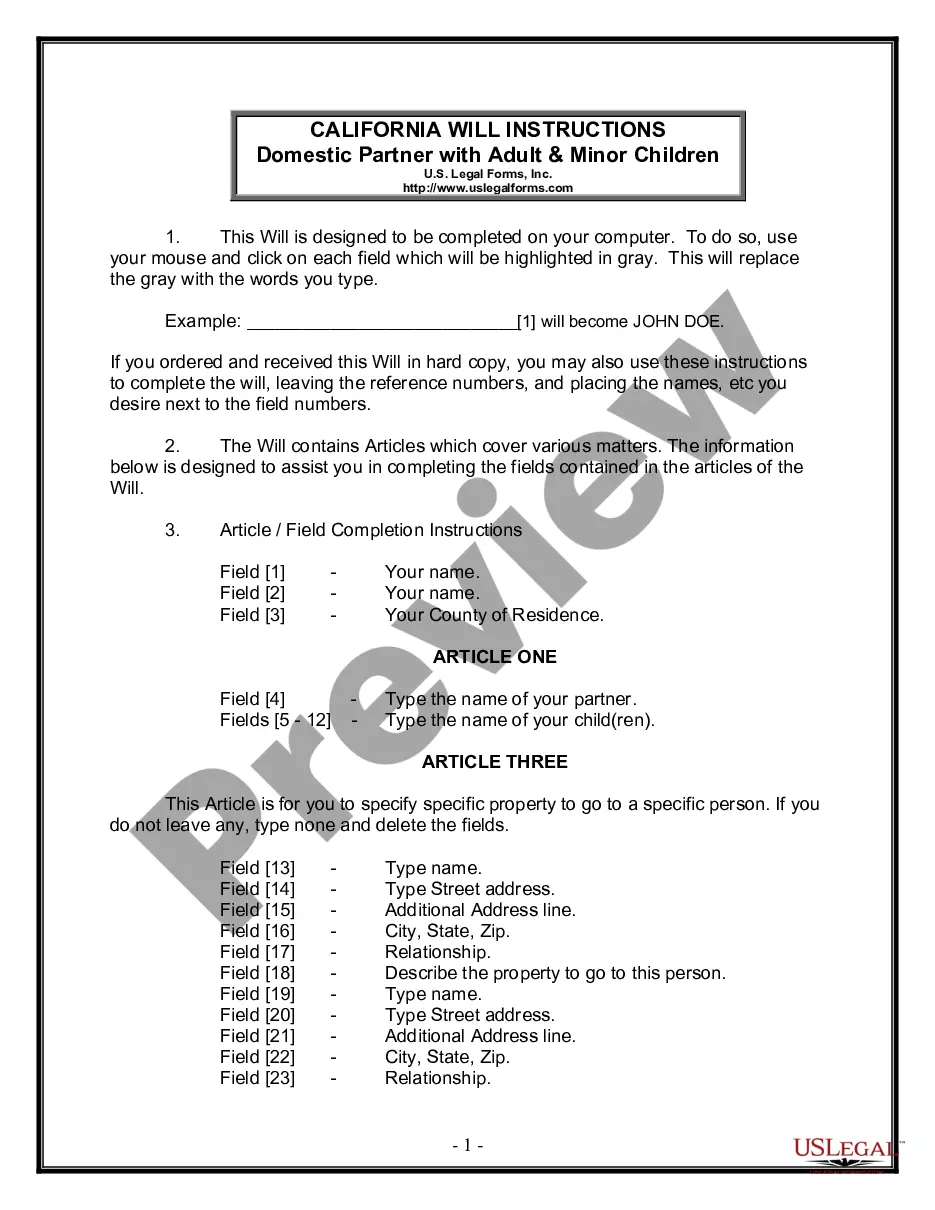

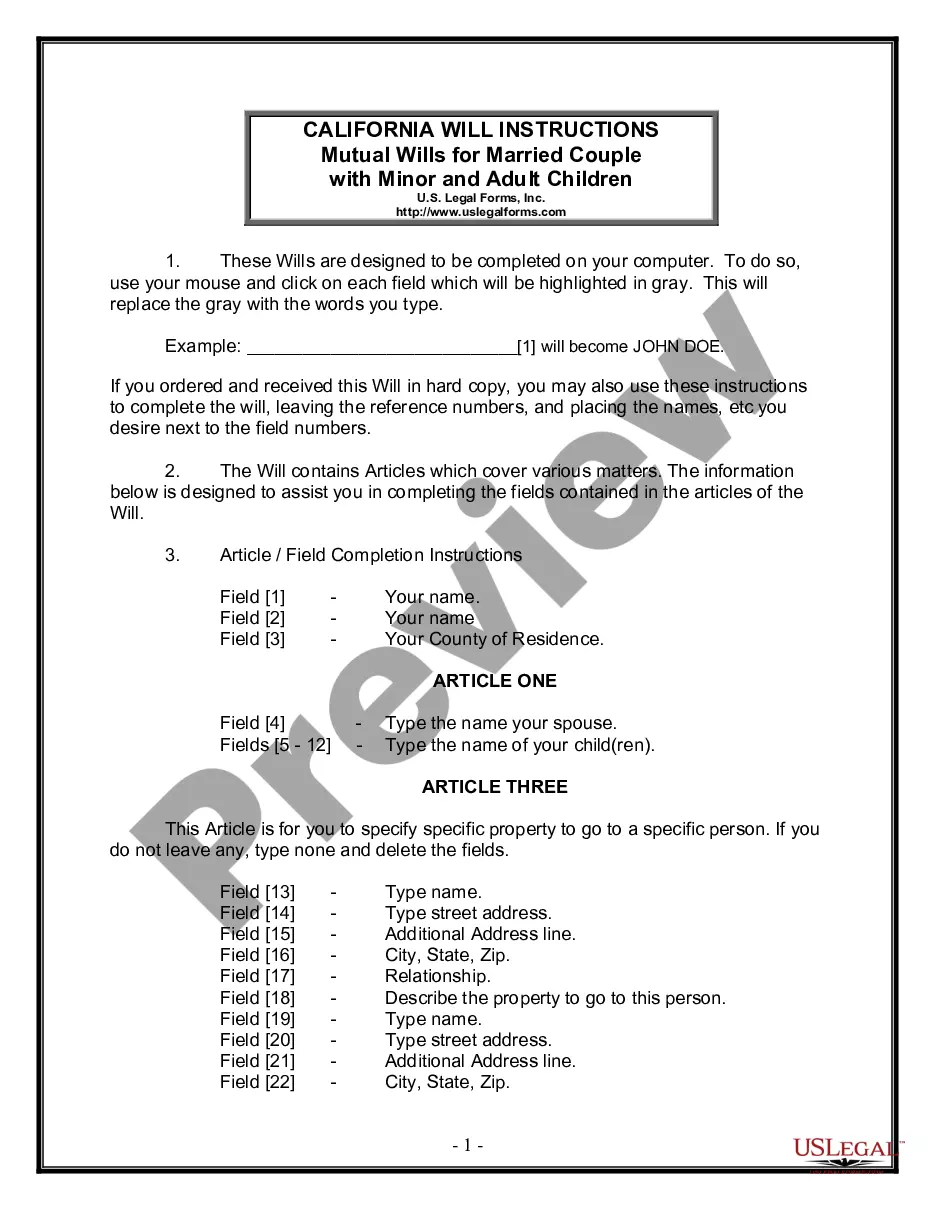

How to fill out San Diego California Partnership Agreement For Home Purchase?

Draftwing documents, like San Diego Partnership Agreement for Home Purchase, to take care of your legal matters is a difficult and time-consumming process. Many situations require an attorney’s involvement, which also makes this task not really affordable. However, you can acquire your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms crafted for various cases and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the San Diego Partnership Agreement for Home Purchase template. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before getting San Diego Partnership Agreement for Home Purchase:

- Ensure that your form is compliant with your state/county since the rules for creating legal papers may vary from one state another.

- Discover more information about the form by previewing it or going through a quick intro. If the San Diego Partnership Agreement for Home Purchase isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to begin using our service and get the document.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment information.

- Your template is good to go. You can try and download it.

It’s easy to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!