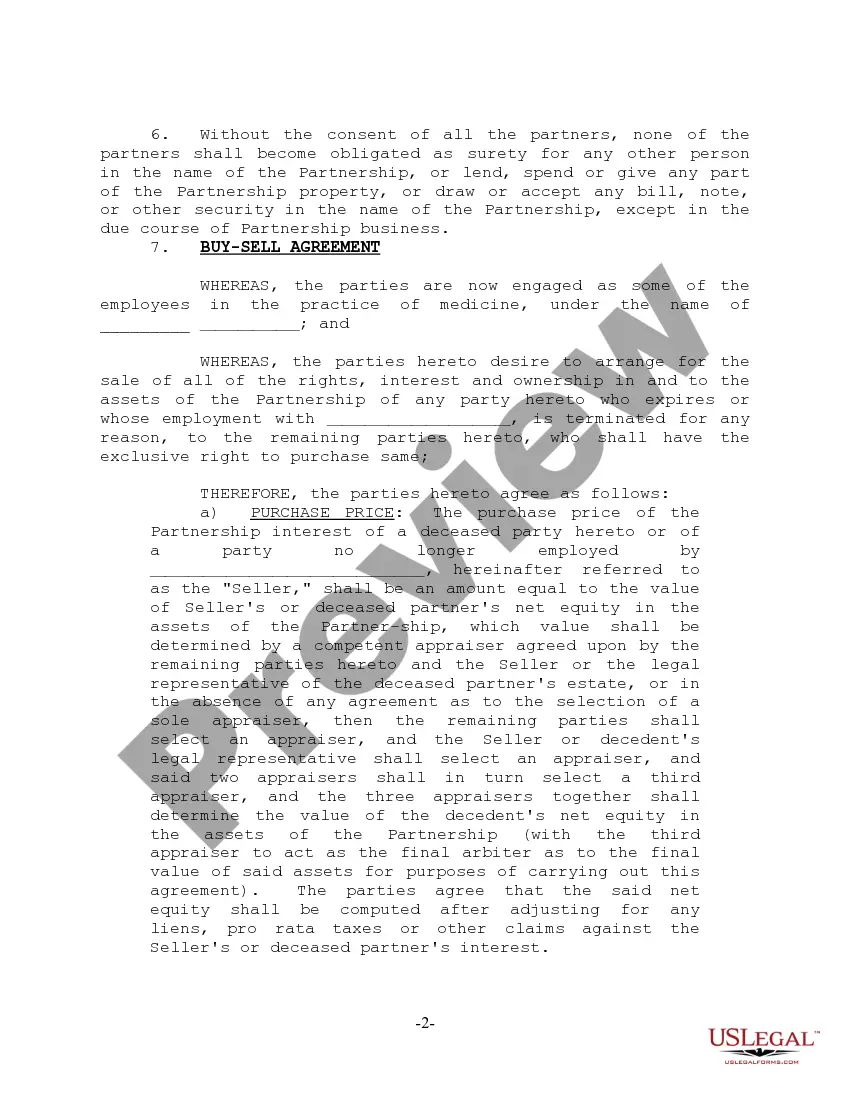

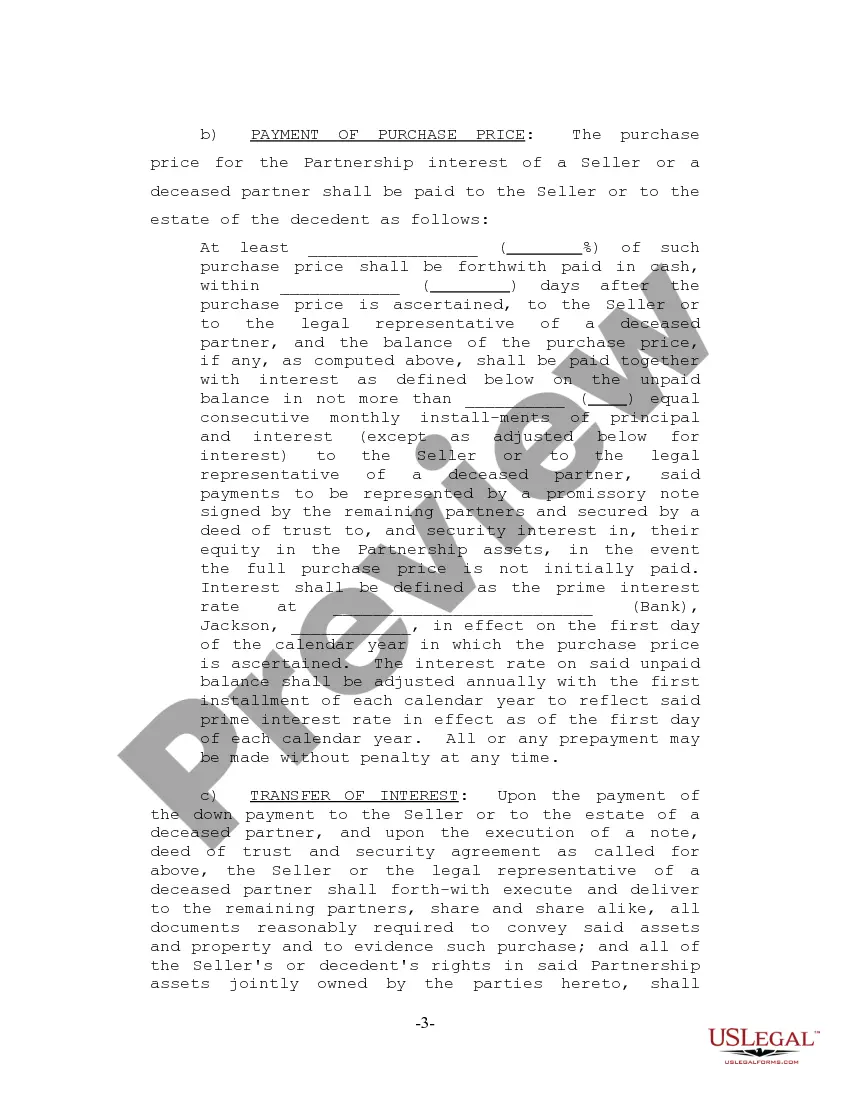

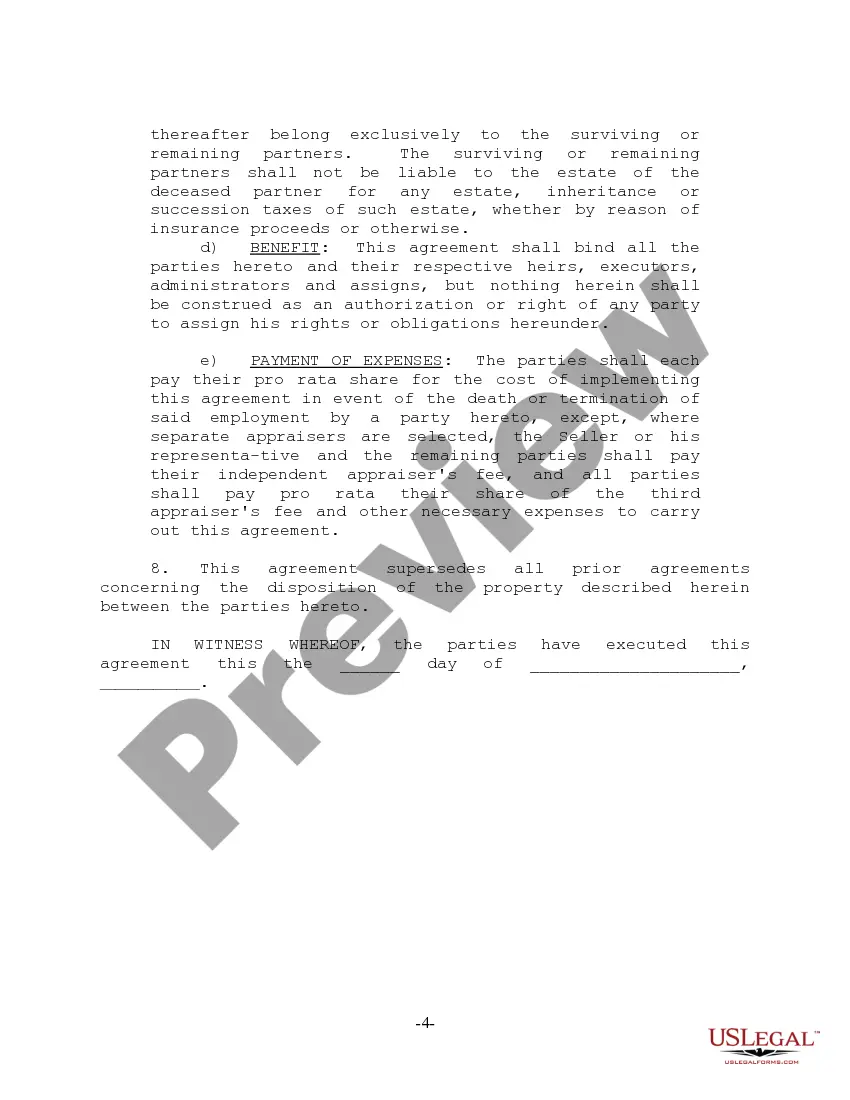

Broward Florida Partnership Agreement for Profit Sharing is a legal document that outlines the terms and conditions for profit distribution amongst business partners in Broward County, Florida. This agreement is applicable to businesses operating in different industries, ranging from real estate and finance to hospitality and technology. The partnership agreement provides a comprehensive framework for how profits will be allocated amongst the partners involved. It defines the rights, responsibilities, and obligations of each partner, ensuring a fair and equitable distribution of earnings based on their contributions and agreed-upon terms. Key terms and provisions commonly found in a Broward Florida Partnership Agreement for Profit Sharing include: 1. Partners' Contributions: This section outlines the capital, assets, skills, or expertise that each partner brings into the business. It details how these contributions affect the profit sharing ratio. 2. Profit Allocation: The agreement indicates the method for determining profit distribution amongst the partners. This can be based on a pre-determined ratio, such as equal sharing or proportionate to their capital contribution. 3. Expenses and Deductions: The agreement addresses how expenses and deductions, such as operating costs, taxes, and liabilities, will be taken into account before determining the net profits available for distribution. 4. Reserved Accounts: In some cases, the agreement may specify the creation of reserved accounts, such as a capital reserve or contingency fund, to address future business needs or unexpected expenses. 5. Profit Distribution Schedule: It outlines the timing and frequency of profit distribution, ensuring clarity on when partners can expect to receive their share of the profits. 6. Dispute Resolution: This section outlines the dispute resolution mechanisms, such as mediation or arbitration, to be followed in case of conflicts or disagreements regarding profit sharing or any other matter related to the partnership. Different types of Broward Florida Partnership Agreements for Profit Sharing can vary depending on the specific nature of the partnership and the preferences of the partners involved. Some variations may include: 1. General Partnership Agreement: This agreement is suitable for partnerships where all partners share equal rights and responsibilities, including profit sharing, regardless of their capital contributions. 2. Limited Partnership Agreement: In a limited partnership, there are general partners and limited partners. General partners have more management control and liability, while limited partners have less involvement in decision-making but enjoy a limited liability. Profit sharing is determined based on the partnership agreement. 3. Joint Venture Agreement: This type of agreement is commonly used for a specific project or business venture. Profit sharing is defined based on the terms and conditions agreed upon by the partnering entities. 4. LLP Agreement: A Limited Liability Partnership agreement is commonly used in professional service-based businesses. Profit sharing terms are defined based on the partnership agreement, which may consider factors such as billable hours, client acquisition, or individual performance. In conclusion, a Broward Florida Partnership Agreement for Profit Sharing is a vital legal document that outlines the terms and conditions for profit distribution amongst business partners operating in Broward County. The agreement varies depending on the type of partnership, ensuring a fair and equitable distribution of profits for all involved.

Broward Florida Partnership Agreement for Profit Sharing

Description

How to fill out Broward Florida Partnership Agreement For Profit Sharing?

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life scenario, locating a Broward Partnership Agreement for Profit Sharing meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. In addition to the Broward Partnership Agreement for Profit Sharing, here you can get any specific form to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can pick the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Broward Partnership Agreement for Profit Sharing:

- Examine the content of the page you’re on.

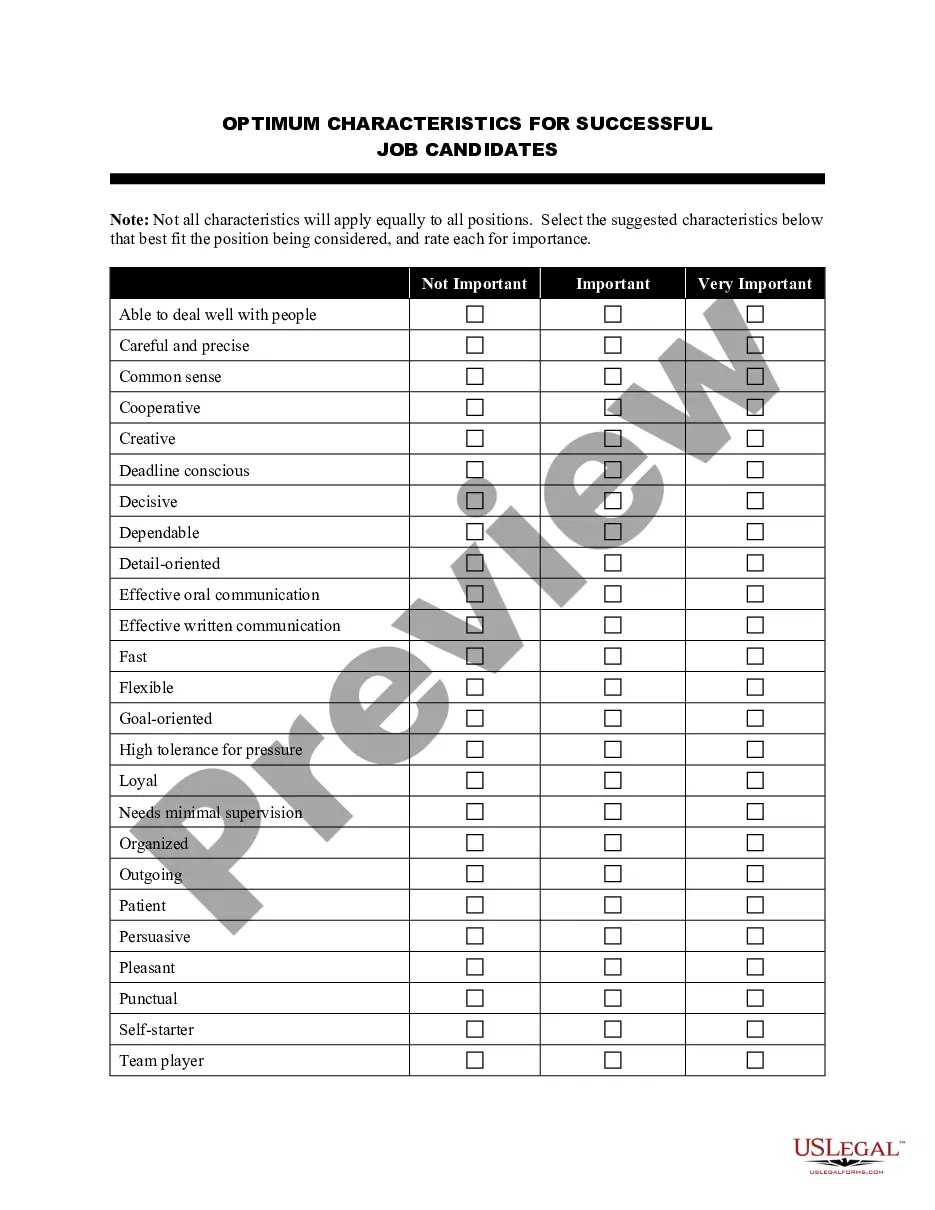

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Broward Partnership Agreement for Profit Sharing.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!