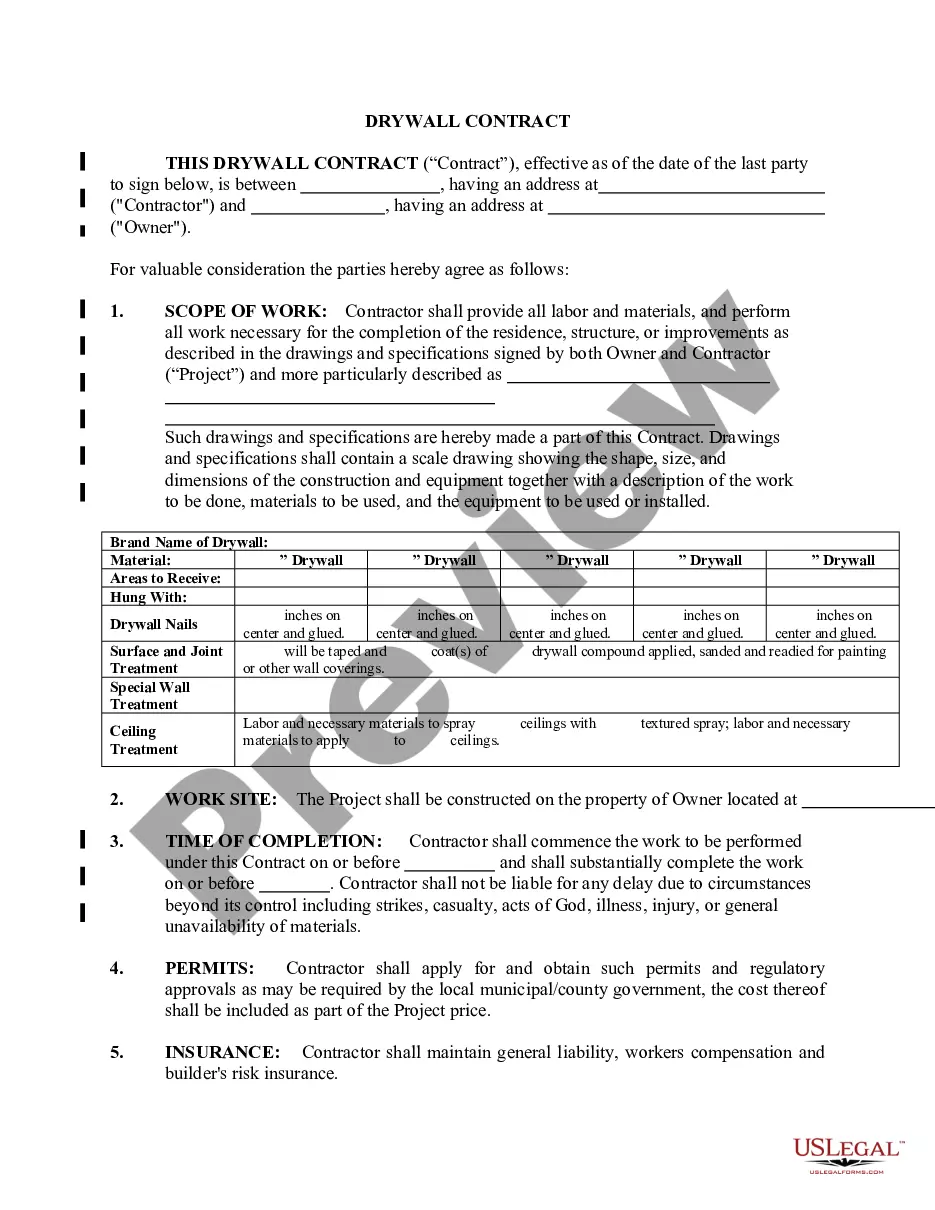

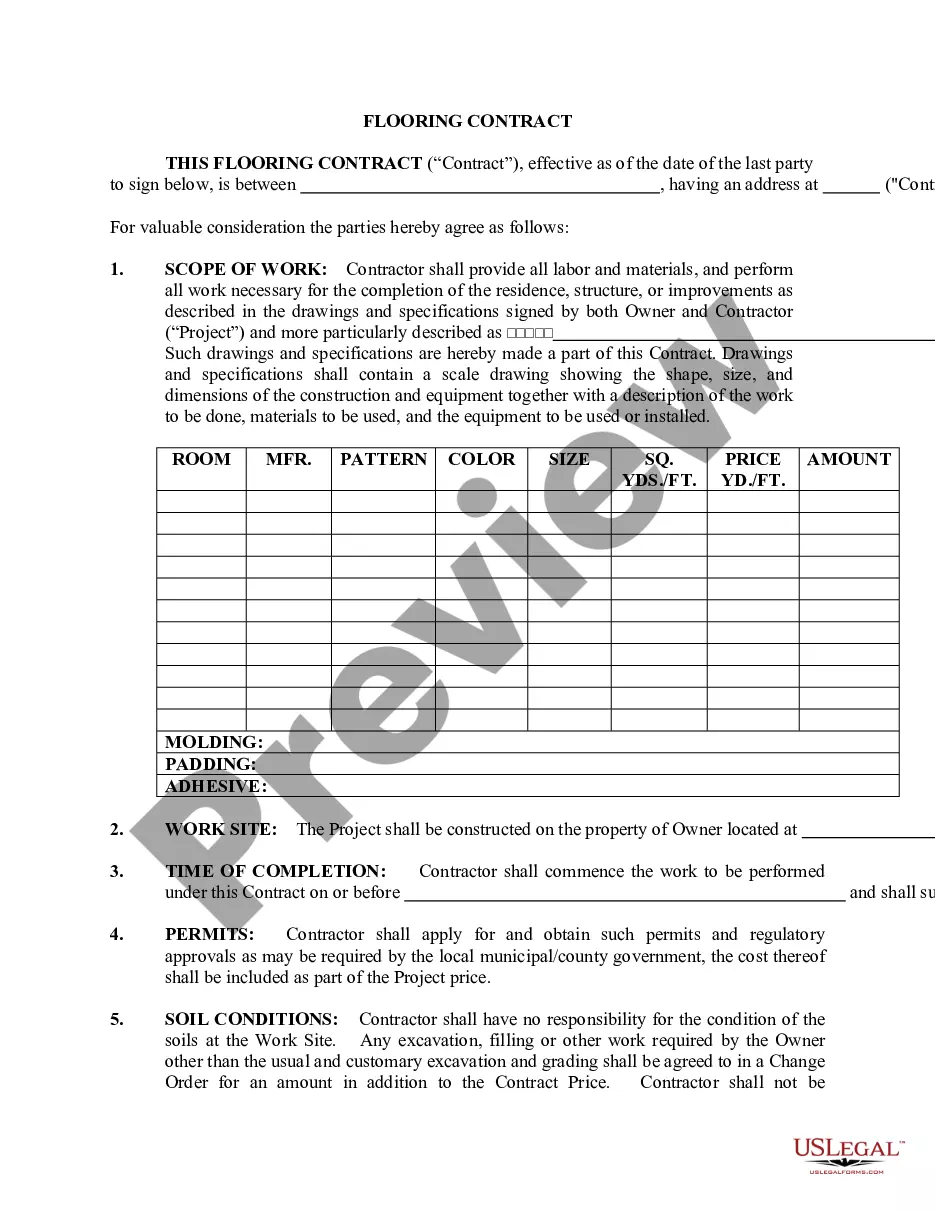

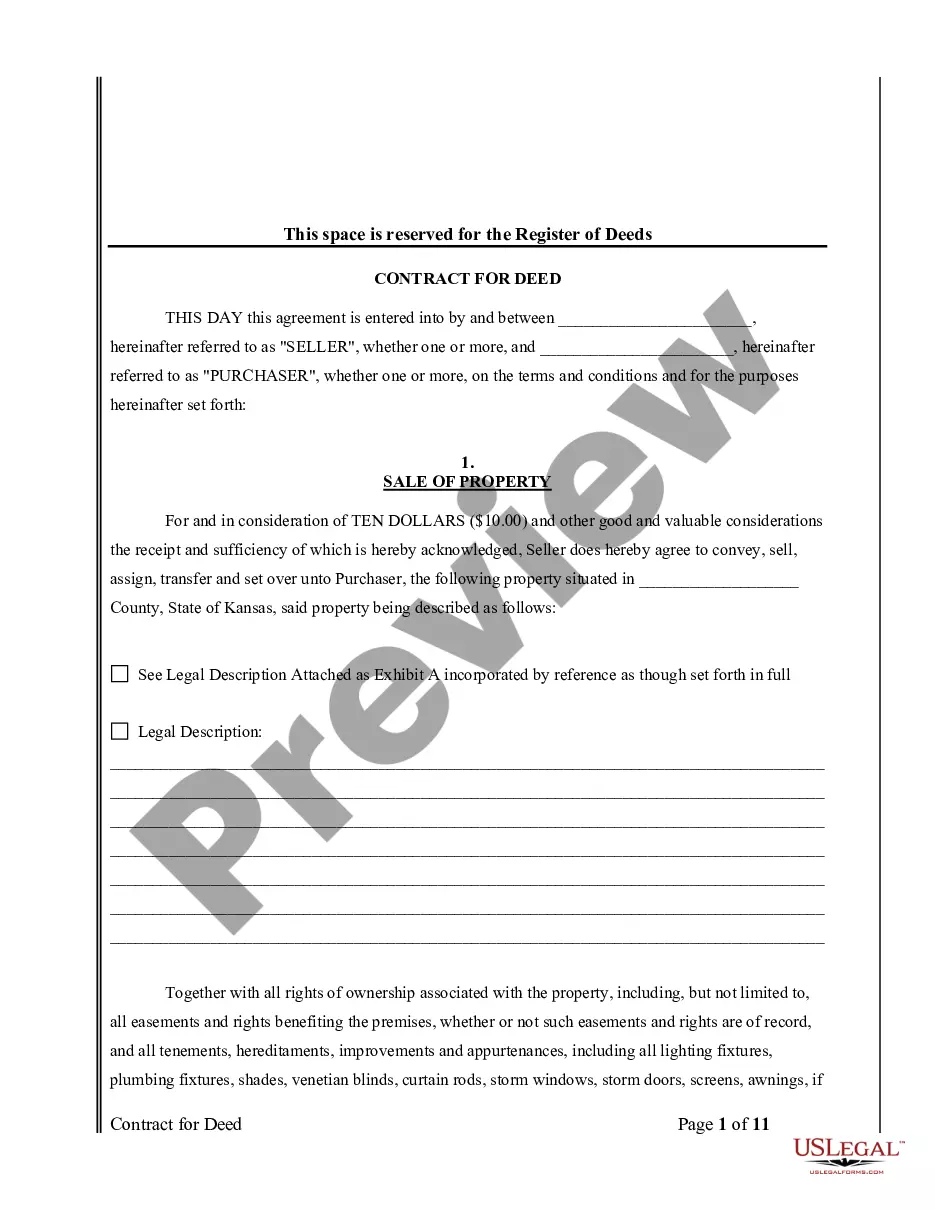

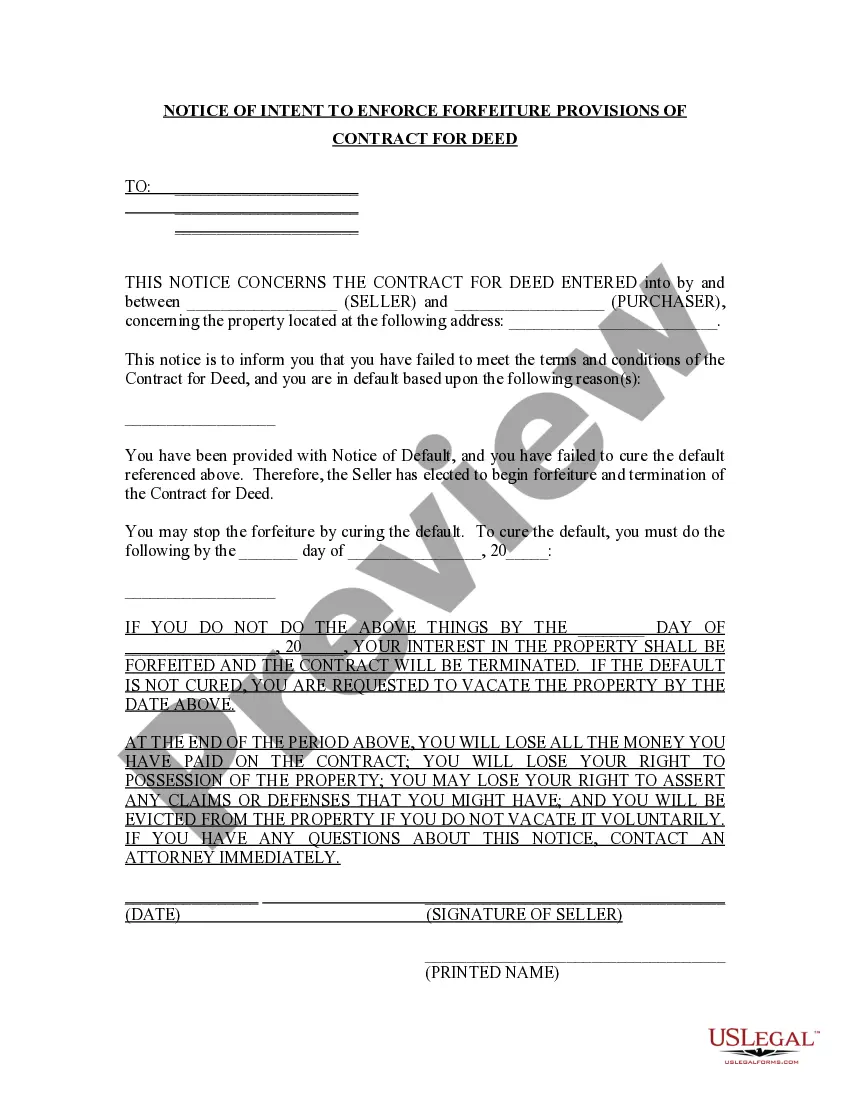

Dallas Texas Partnership Agreement for Profit Sharing is a legally binding contract that outlines the terms and conditions for distributing profits among partners in Dallas, Texas. This agreement is customary for businesses in Dallas that operate as partnerships, where two or more individuals or entities collaborate to run a business for shared financial gains. The Dallas Texas Partnership Agreement for Profit Sharing establishes the profit distribution ratio, which determines how the profits generated by the partnership will be allocated among the partners. It also specifies the rules and procedures for distributing profits, ensuring transparency and fairness within the partnership. There are several types of Partnership Agreements for Profit Sharing in Dallas, Texas, each tailored to meet the specific needs and requirements of the partners involved. Here are some of the commonly used agreements: 1. Equal Profit Sharing Agreement: In this type of agreement, all partners are entitled to an equal share of the profits. This approach is often preferred when partners contribute equally to the partnership financially, or when the partners have similar levels of expertise and involvement in the business. 2. Ratio-based Profit Sharing Agreement: This agreement allocates profits based on a predetermined ratio agreed upon by the partners. The ratio can be determined by various factors such as the amount of initial capital contributed, the degree of involvement in the business, or any other mutually agreed-upon criteria. 3. Capital-based Profit Sharing Agreement: In this agreement, the distribution of profits is directly proportional to each partner's capital contribution to the partnership. Partners who invest more capital are entitled to a higher share of the profits, reflecting the difference in their financial stake in the business. 4. Performance-based Profit Sharing Agreement: This type of agreement bases profit distribution on the individual performance of each partner. Partners who contribute significantly to the success of the business or achieve specific business targets may be rewarded with a larger share of the profits. Regardless of the type of Partnership Agreement for Profit Sharing chosen in Dallas, Texas, it is crucial for partners to carefully draft the agreement and seek legal advice to ensure that all aspects of profit distribution are clearly defined and agreed upon. This helps minimize disputes and promotes a harmonious partnership environment where all partners feel fairly compensated for their contributions.

Dallas Texas Partnership Agreement for Profit Sharing

Description

How to fill out Dallas Texas Partnership Agreement For Profit Sharing?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business purpose utilized in your region, including the Dallas Partnership Agreement for Profit Sharing.

Locating samples on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Dallas Partnership Agreement for Profit Sharing will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the Dallas Partnership Agreement for Profit Sharing:

- Ensure you have opened the proper page with your local form.

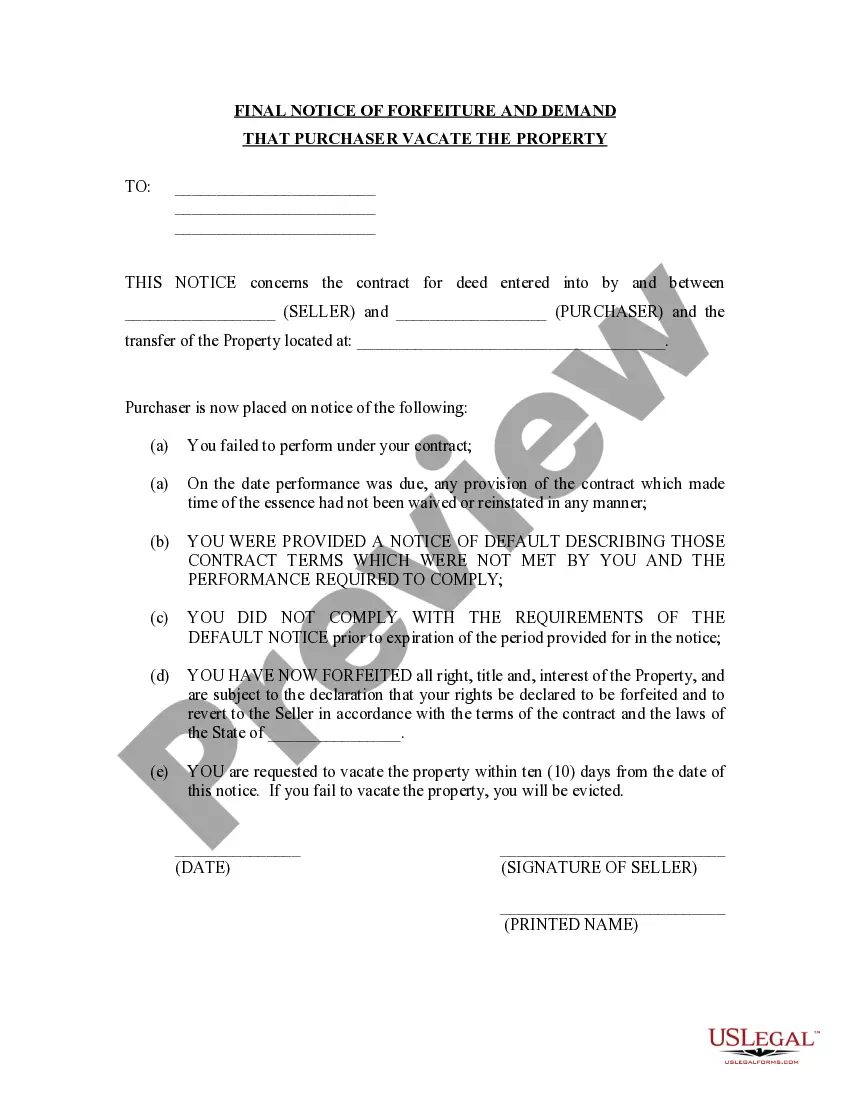

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Dallas Partnership Agreement for Profit Sharing on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!