Palm Beach Florida Partnership Agreement for Profit Sharing is a legally binding contract that outlines the terms and conditions of sharing profits between two or more parties engaged in business activities in Palm Beach, Florida. This agreement defines the rights, responsibilities, and obligations of each partner regarding the distribution of profits generated by the partnership. Partnership agreements for profit sharing in Palm Beach, Florida can vary based on the specific needs and goals of the partners involved. Some common types include: 1. General Partnership Agreement: This type of agreement is formed when two or more individuals decide to conduct business jointly. Each partner contributes capital, skills, or assets to the partnership and shares in the profits and losses. 2. Limited Partnership Agreement: In this arrangement, there are two types of partners — general partners and limited partners. General partners have management authority and share personal liability for the partnership's obligations. Limited partners, on the other hand, provide capital or assets but have limited involvement in the partnership's day-to-day operations and reduced personal liability. 3. Limited Liability Partnership Agreement: This type of partnership agreement combines elements of both general and limited partnerships. It offers partners limited personal liability for partnership debts and obligations while allowing them to actively participate in managing the business. 4. Joint Venture Agreement: A joint venture agreement is formed when two or more parties collaborate on a specific project or venture for a limited duration. The profits generated from the venture are shared among the partners based on the terms defined in the agreement. The Palm Beach Florida Partnership Agreement for Profit Sharing focuses on crucial aspects such as profit distribution percentages, investment contributions, management responsibilities, dispute resolution mechanisms, and the process of admitting or withdrawing partners. It ensures transparency, fairness, and accountability among partners, fostering a conducive business environment for mutual growth and success. Partners considering entering into a profit-sharing agreement in Palm Beach, Florida must consult with legal professionals specializing in partnership law to draft a comprehensive and tailored agreement that protects their interests and aligns with Florida's specific legal requirements.

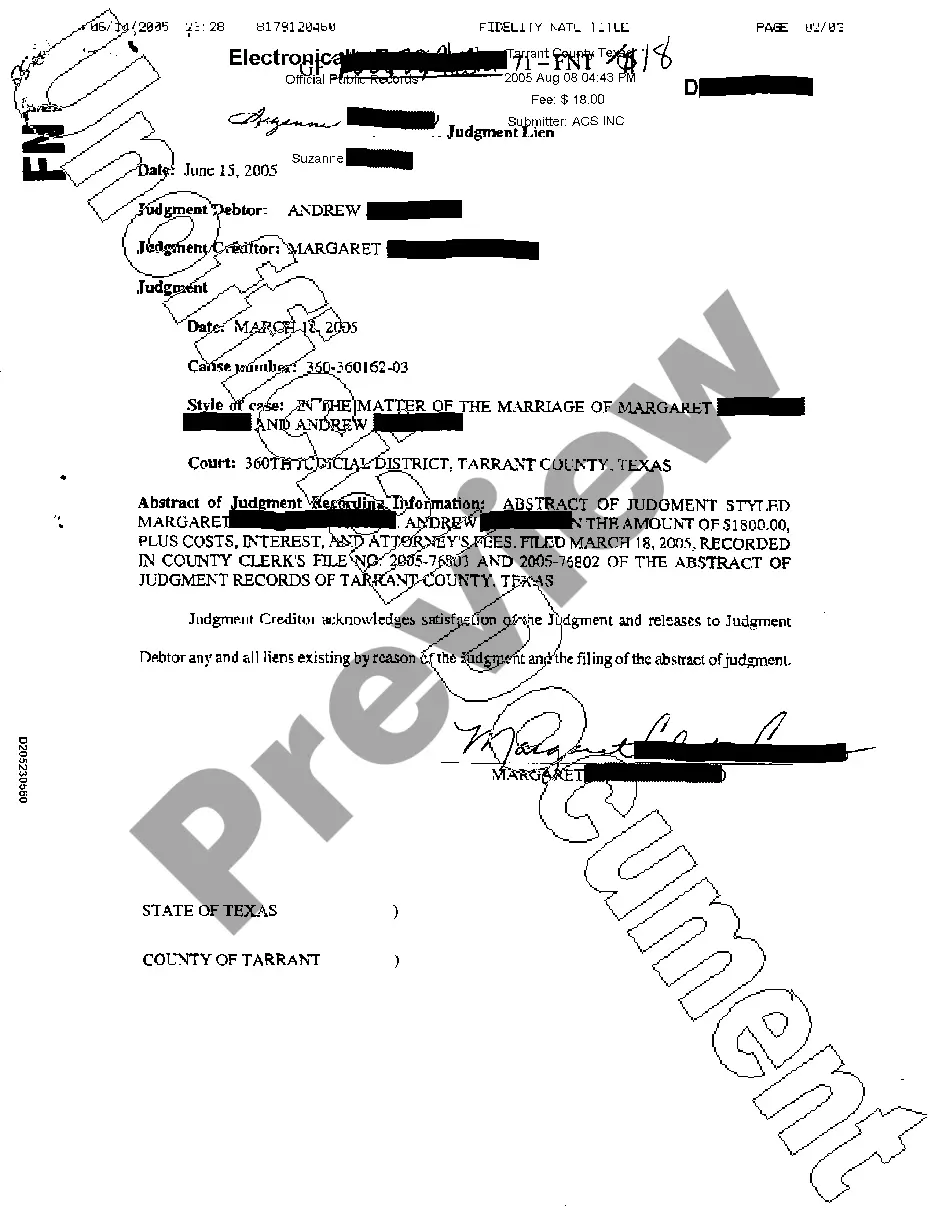

Palm Beach Florida Partnership Agreement for Profit Sharing

Description

How to fill out Palm Beach Florida Partnership Agreement For Profit Sharing?

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life scenario, locating a Palm Beach Partnership Agreement for Profit Sharing meeting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. In addition to the Palm Beach Partnership Agreement for Profit Sharing, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Palm Beach Partnership Agreement for Profit Sharing:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Palm Beach Partnership Agreement for Profit Sharing.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!