Salt Lake Utah Partnership Agreement for Profit Sharing is a legally binding agreement entered into by businesses or individuals in Salt Lake City, Utah, to mutually distribute profits among partners based on predetermined terms and conditions. This partnership agreement establishes the framework for profit sharing and outlines the rights, responsibilities, and obligations of each partner involved. The primary objective is to create an equitable distribution of profits generated by the partnership, promoting collaboration, and fostering a harmonious business relationship. There are several types of Salt Lake Utah Partnership Agreements for Profit Sharing, which may vary based on specific preferences, business goals, and legal requirements. Some common variations include: 1. General Partnership Agreement for Profit Sharing: This agreement involves two or more parties who contribute capital, labor, or expertise to jointly operate and share profits in a partnership. The partners have equal rights and responsibilities in decision-making and liability for debts. 2. Limited Partnership Agreement for Profit Sharing: In this type of partnership, there are two types of partners — general partners and limited partners. General partners are actively involved in managing the business and share the profits and losses. Limited partners, on the other hand, contribute capital but have limited involvement in decision-making and enjoy limited liability for the partnership's obligations. 3. Joint Venture Partnership Agreement for Profit Sharing: Joint ventures are formed when two or more entities collaborate to carry out a specific project or business endeavor. This agreement outlines the terms and conditions for profit sharing, resource allocation, and the responsibilities of each partner. 4. Silent Partnership Agreement for Profit Sharing: Also known as a sleeping partnership, this agreement allows one partner to contribute capital without actively participating in the day-to-day operations. Profit-sharing is determined based on the terms outlined in the agreement. 5. Limited Liability Partnership (LLP) Agreement for Profit Sharing: Laps are popular among professional service providers, such as attorneys or accountants. This type of partnership provides limited liability protection to partners while allowing them to share profits based on the agreed-upon terms. 6. Non-Profit Partnership Agreement for Profit Sharing: Non-profit organizations in Salt Lake Utah can also have partnerships aimed at achieving mutual goals without a profit motive. These agreements govern the sharing of funds, resources, and responsibilities among the partner organizations. A Salt Lake Utah Partnership Agreement for Profit Sharing may include essential details such as the duration of the partnership, the amount of capital contributed by each partner, the percentage of profit-sharing, the decision-making process, guidelines for dispute resolution, provisions for admission or withdrawal of partners, and methods for valuing assets in case of dissolution. In summary, a Salt Lake Utah Partnership Agreement for Profit Sharing is a comprehensive and legally binding document that outlines the terms and conditions for distributing profits among partners in various types of partnerships. These agreements promote transparency, fairness, and accountability within the partnership while ensuring all partners benefit from the success of the business.

Salt Lake Utah Partnership Agreement for Profit Sharing

Description

How to fill out Salt Lake Utah Partnership Agreement For Profit Sharing?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Salt Lake Partnership Agreement for Profit Sharing, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in various types varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find information materials and tutorials on the website to make any tasks related to document completion straightforward.

Here's how you can find and download Salt Lake Partnership Agreement for Profit Sharing.

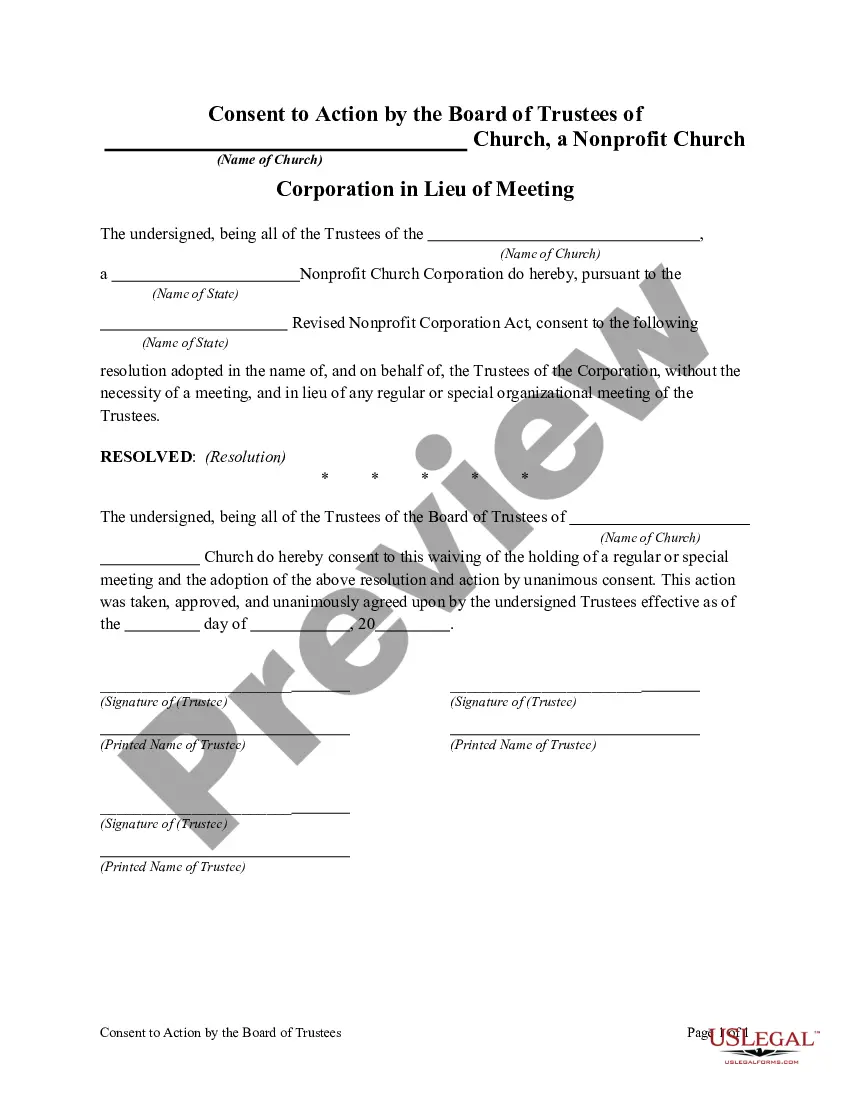

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choice is specific to your state/county/area since state laws can affect the validity of some documents.

- Check the related forms or start the search over to locate the appropriate document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and purchase Salt Lake Partnership Agreement for Profit Sharing.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Salt Lake Partnership Agreement for Profit Sharing, log in to your account, and download it. Needless to say, our platform can’t replace an attorney entirely. If you have to cope with an exceptionally difficult case, we recommend using the services of an attorney to check your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-compliant documents effortlessly!