Chicago Illinois Partnership Agreement for LLC is a legally binding document that outlines the terms and conditions agreed upon by the partners of a limited liability company (LLC) based in Chicago, Illinois. The agreement serves as a crucial foundation for the operation, management, and decision-making processes of the LLC. It is essential for partners to understand and agree upon these terms to ensure a smooth and harmonious functioning of the business. The Chicago Illinois Partnership Agreement for LLC covers a wide range of aspects such as the rights, responsibilities, and obligations of each partner, the distribution of profits and losses, the decision-making process, dispute resolution mechanisms, and the procedures for admission or withdrawal of partners. By outlining these key components, the agreement aims to provide clarity and establish a fair and equitable relationship among the partners. In Chicago, Illinois, there are two main types of Partnership Agreements for LCS: 1. General Partnership Agreement: This type of agreement is suited for partnerships where all partners have equal rights and responsibilities. In a general partnership, each partner is fully liable for the debts and obligations of the business, and all partners have an equal say in the decision-making process. 2. Limited Partnership Agreement: Unlike a general partnership, a limited partnership agreement allows for a differentiation of roles between general partners and limited partners. General partners have unlimited liability and are actively involved in the management of the business. On the other hand, limited partners have limited liability and are typically passive investors who do not participate in the day-to-day operations of the LLC. To create a Chicago Illinois Partnership Agreement for LLC, partners need to consult an attorney who specializes in business law to ensure compliance with state laws and regulations. The agreement should be carefully crafted and tailored to meet the specific needs and objectives of the partners involved. It is crucial to include detailed provisions regarding profit sharing, decision-making processes, dispute resolution methods, exit strategies, and other relevant terms to protect the interests of all parties involved. In conclusion, the Chicago Illinois Partnership Agreement for LLC is a comprehensive legal document that establishes the framework for a successful and mutually beneficial partnership. It provides clarity, sets expectations, and safeguards the rights and responsibilities of the partners in a limited liability company.

Chicago Illinois Partnership Agreement for LLC

Description

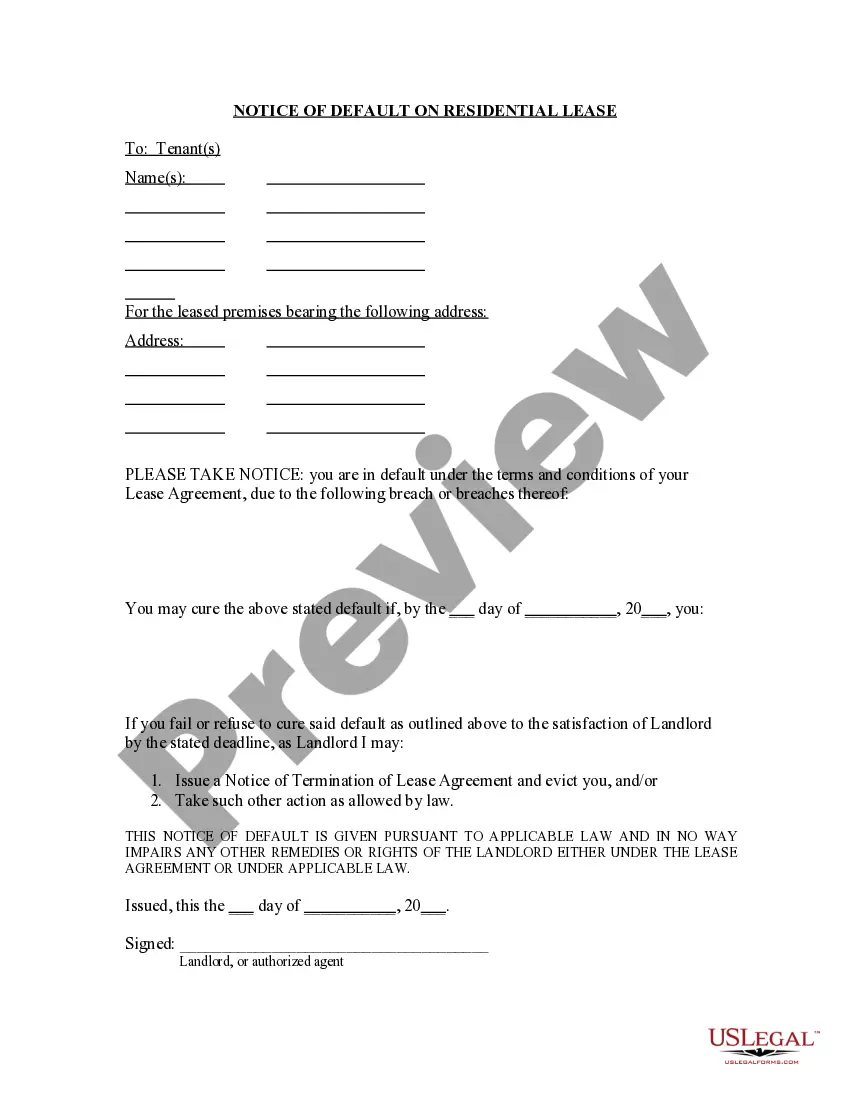

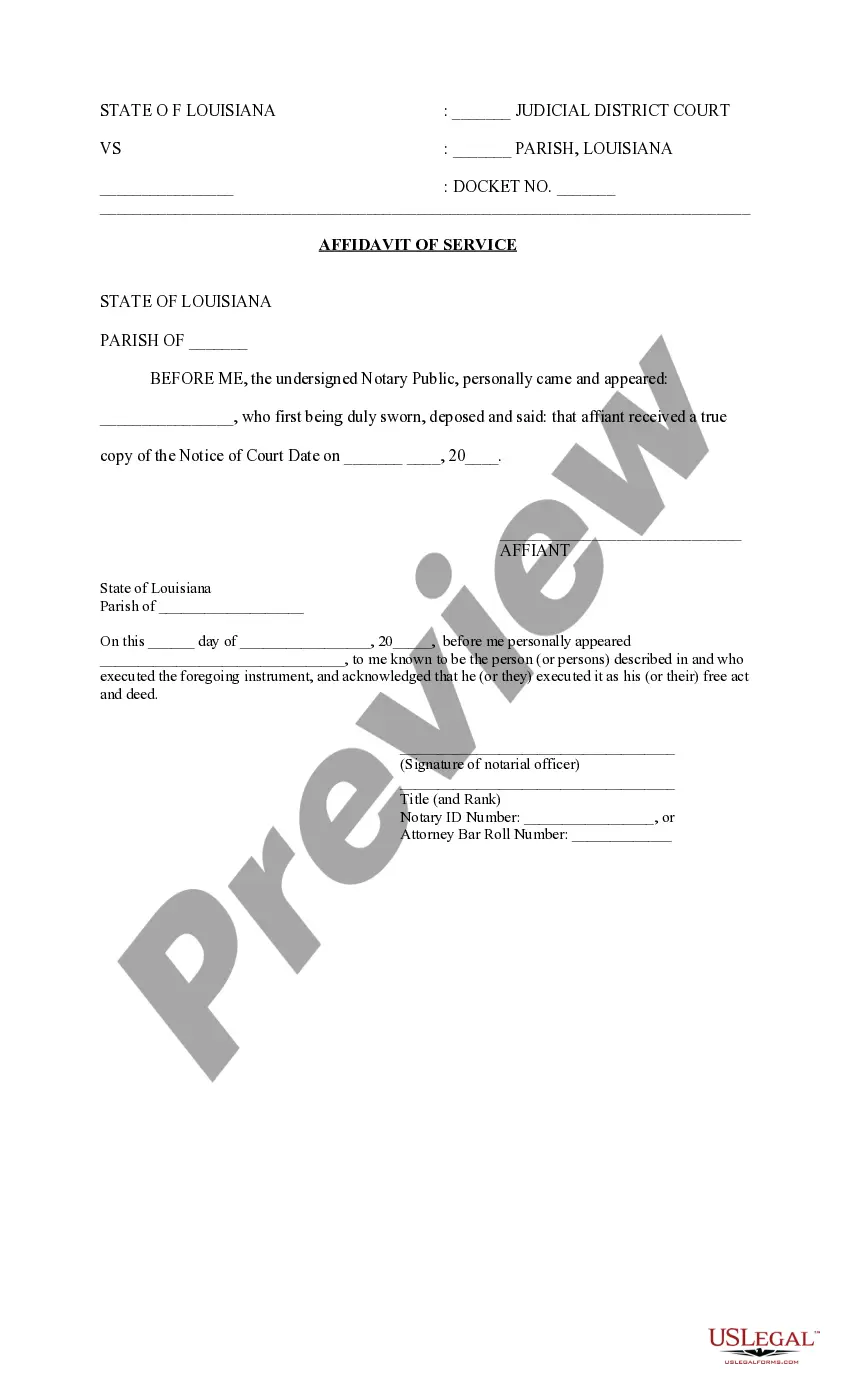

How to fill out Chicago Illinois Partnership Agreement For LLC?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life situation, finding a Chicago Partnership Agreement for LLC suiting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. In addition to the Chicago Partnership Agreement for LLC, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Professionals check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can retain the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Chicago Partnership Agreement for LLC:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Chicago Partnership Agreement for LLC.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

If you are a business owner, looking to draft your own partnership agreement, you can do so using free templates available online. It is advisable to contact a business lawyer or a partnership agreement lawyer to ensure that the agreement follows the federal, state and local laws.

Company name, status, and duration. Liability of the partners. Number of owners/control of the business. Capital. Management, decision-making and binding the partnership. Dissolution. Death and disability. Transfer of partnership interests.

How do I create a Partnership Agreement? Specify the type of business you're running.State your place of business.Provide partnership details.State the partnership's duration.Provide each partner's details.State each partner's capital contributions.Outline the admission of new partners.

Do partnership agreements need to be in writing? Partnerships are unique business relationships that don't require a written agreement. However, it's always a good idea to have such a document.

A legally binding partnership, however, requires that each partner is assigned specific roles and responsibilities, financial expectations, and future planning expectations for the business. The partnership should also have an agreement as to handling the exit of one of the business partners.

How do I create a Partnership Agreement? Specify the type of business you're running.State your place of business.Provide partnership details.State the partnership's duration.Provide each partner's details.State each partner's capital contributions.Outline the admission of new partners.

There are several different types of partnerships, each with different characteristics, benefits, and possible disadvantages. A general partnership is the simplest form of a partnership. Generally, if a business is referred to simply as a ?partnership,? it is a general partnership.

To form a partnership in Illinois, you should take the following steps: Choose a business name. File an Assumed Business Name Certificate. Draft and sign a partnership agreement. Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number.

Here are five clauses every partnership agreement should include: Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.

Here are the basic steps to forming a partnership: Choose a business name. Register a fictitious business name. Draft and sign a partnership agreement.