The Nassau New York Partnership Agreement for LLC is a legal document that outlines the terms and conditions governing the relationship between multiple individuals or entities who wish to form a Limited Liability Company (LLC) in Nassau County, New York. This agreement is crucial for setting forth the rights, responsibilities, and obligations of the LLC's members. The partnership agreement includes various provisions such as the purpose of the LLC, the contributions made by each member, the distribution of profits and losses, management responsibilities, dispute resolution mechanisms, and the process for adding or removing members. It serves as a blueprint for the LLC's operation, helping to prevent potential conflicts or misunderstandings in the future. There are different types of Nassau New York Partnership Agreements depending on the specific requirements and preferences of the LLC. Some common variations include: 1. General Partnership Agreement: This type of agreement allows all members to have equal management authority and share both profits and liabilities equally. It is suitable for LCS where all members want equal decision-making power and financial responsibilities. 2. Limited Partnership Agreement: In this type of agreement, there are two types of members: general partners and limited partners. General partners have unlimited liability and control over the LLC's management, while limited partners have limited liability and no control over management decisions. This agreement is ideal when a group of individuals wants to invest in an LLC but have limited involvement in its day-to-day operations. 3. Joint Venture Agreement: Although technically not a partnership agreement, a joint venture agreement is relevant in LLC contexts. It establishes a cooperative business arrangement between two or more parties for a specific project or a limited duration. The agreement outlines the parties' roles, responsibilities, and profit-sharing arrangements. Regardless of the type, the Nassau New York Partnership Agreement for LLC should cover essential aspects such as capital contributions, profit distribution, decision-making processes, member withdrawal or dissociation, dispute resolution methods, and any other terms deemed necessary by the LLC members. Crafting a well-drafted Nassau New York Partnership Agreement for LLC is crucial to ensure transparency, avoid conflicts, and protect the interests of all participating members. It is advisable to consult with an attorney who specializes in business law to ensure compliance with relevant New York state laws and regulations.

Nassau New York Partnership Agreement for LLC

Description

How to fill out Nassau New York Partnership Agreement For LLC?

Drafting papers for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Nassau Partnership Agreement for LLC without expert assistance.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Nassau Partnership Agreement for LLC by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Nassau Partnership Agreement for LLC:

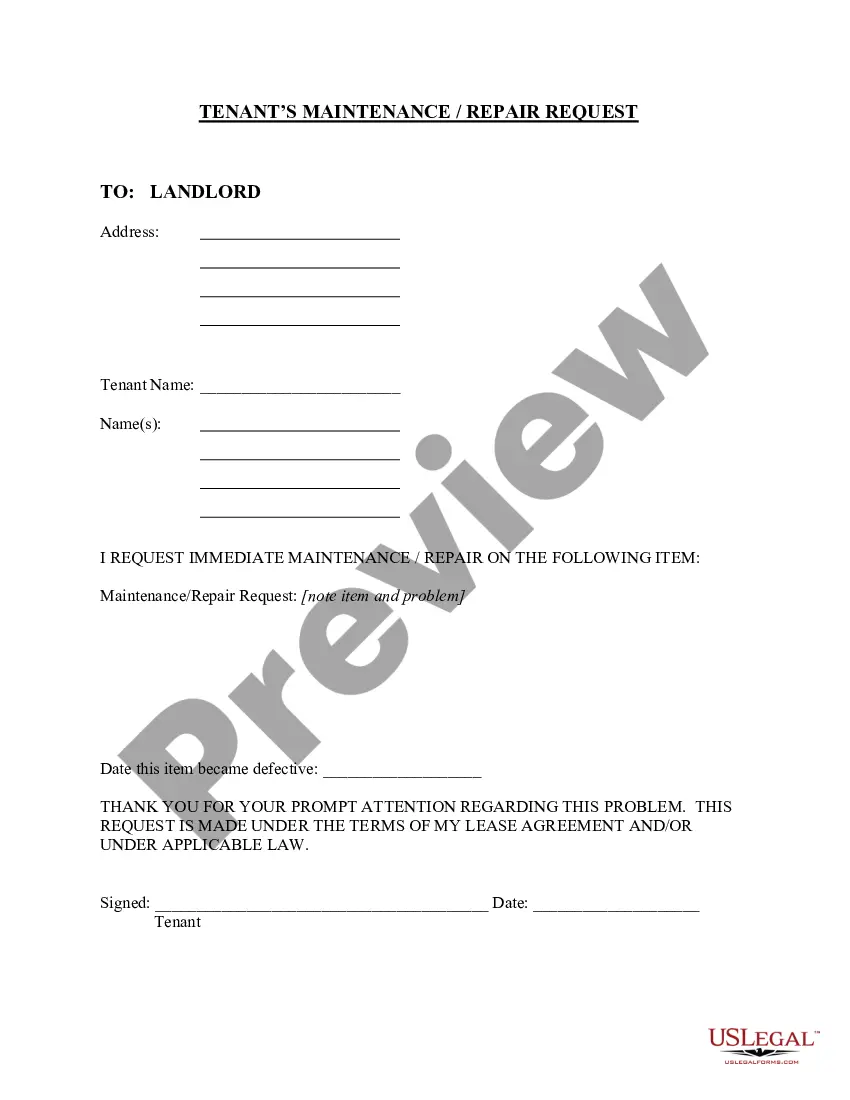

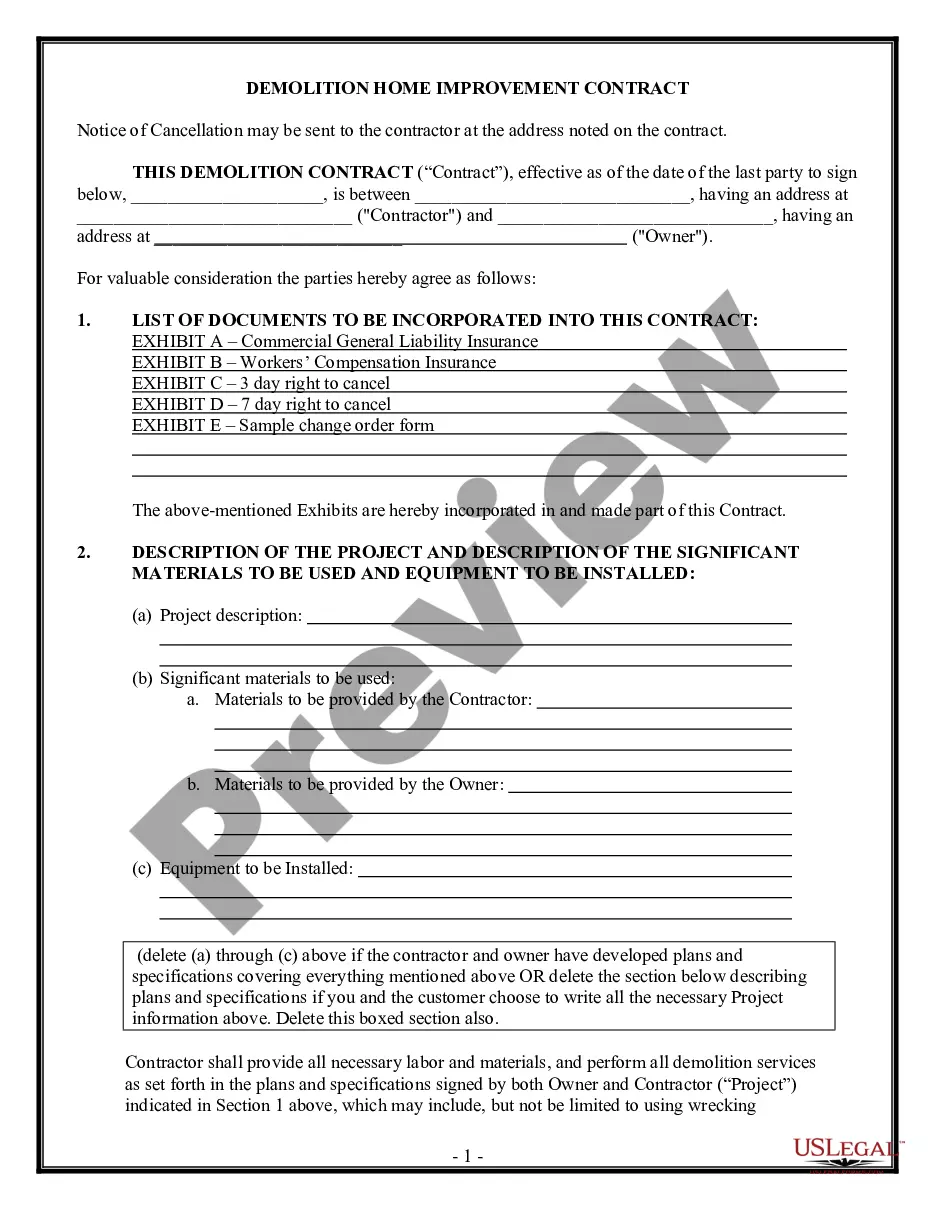

- Examine the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that suits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a couple of clicks!