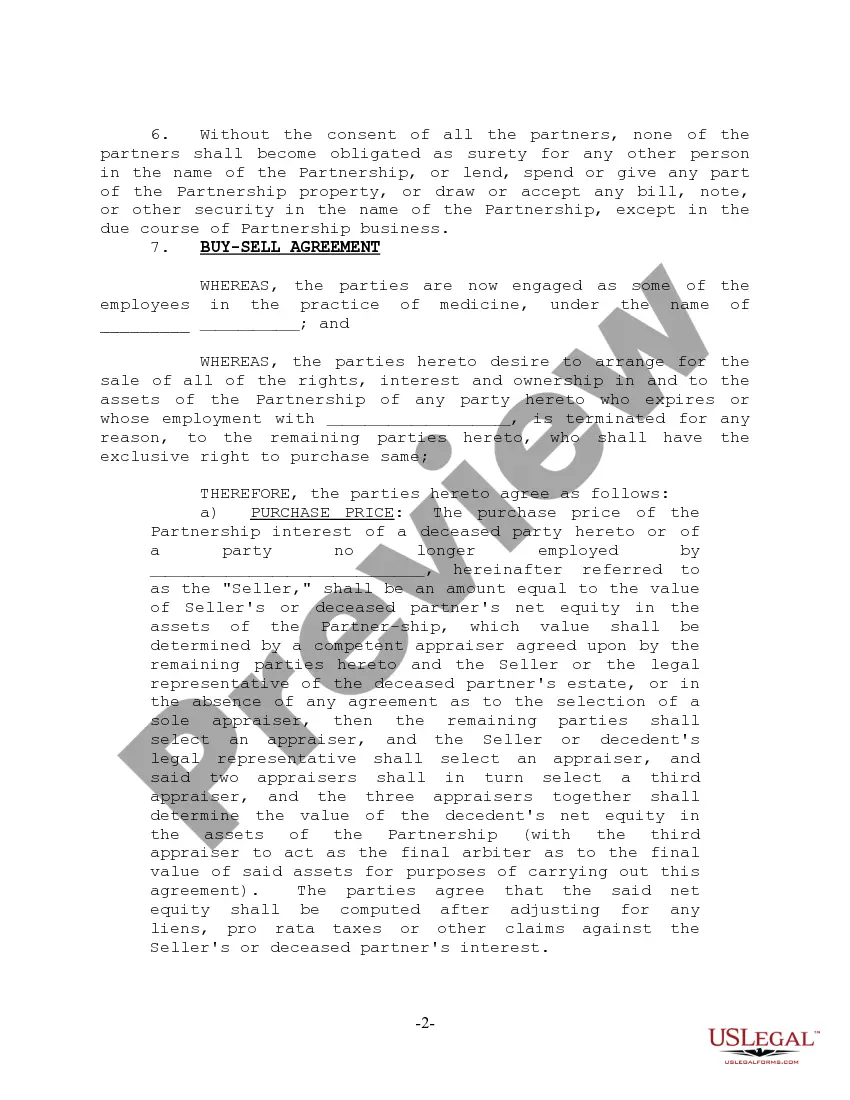

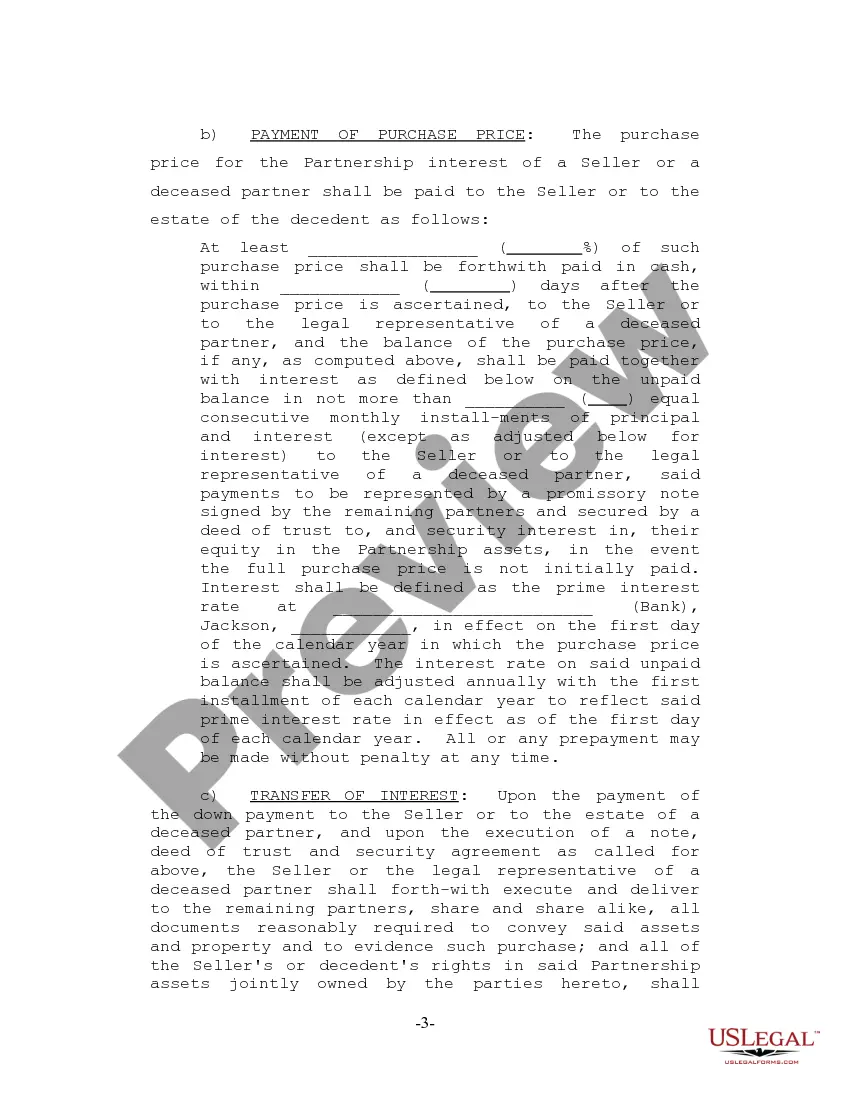

The Tarrant Texas Partnership Agreement for Law Firm is a legally binding document that outlines the terms and conditions of a partnership between two or more law firms operating in Tarrant County, Texas. This agreement serves as a foundation for efficient collaboration, shared responsibilities, decision-making processes, and the distribution of profits and losses among the partners. There are several types of partnership agreements that law firms in Tarrant Texas can enter into, each with its own unique characteristics and implications. These include: 1. General Partnership Agreement: This is the most common form of partnership agreement where all partners share equal responsibility and liability for the firm's operations. Each partner contributes capital, expertise, or both, and they have equal decision-making powers. 2. Limited Partnership Agreement: In this type of agreement, there are general partners who have unlimited liability and management control, while limited partners have limited liability and minimal involvement in the firm's operations. Limited partners provide capital but do not actively participate in managing the firm. 3. Limited Liability Partnership (LLP) Agreement: An LLP agreement provides partners with limited personal liability for the firm's debts and obligations. Additionally, each partner is insulated from the negligence or misconduct of other partners. This type of agreement is often favored by professional service firms, including law firms. 4. Professional Corporation (PC) Partnership Agreement: In this arrangement, partners organize their law firms as professional corporations to enjoy certain tax benefits and limited personal liability. Professional corporations have specific requirements and regulations that must be adhered to. Regardless of the type of partnership agreement chosen, it is crucial for law firms in Tarrant Texas to clearly define the roles, responsibilities, and expectations of each partner. The agreement should cover topics such as profit and loss distribution, decision-making procedures, admission and withdrawal of partners, dispute resolution mechanisms, restrictions on competition, and the dissolution process. By having a well-drafted Tarrant Texas Partnership Agreement for Law Firm, law firms can establish a solid foundation for their operations, ensure efficient collaboration, reduce potential conflicts, and protect the interests of all partners involved. It is always advisable to consult with legal professionals familiar with Texas partnership laws to draft a comprehensive and customized agreement that suits the specific needs of the law firm.

Tarrant Texas Partnership Agreement for Law Firm

Description

How to fill out Tarrant Texas Partnership Agreement For Law Firm?

Do you need to quickly create a legally-binding Tarrant Partnership Agreement for Law Firm or probably any other document to take control of your personal or business affairs? You can go with two options: hire a professional to write a valid document for you or create it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get neatly written legal documents without paying unreasonable prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-specific document templates, including Tarrant Partnership Agreement for Law Firm and form packages. We offer documents for an array of life circumstances: from divorce papers to real estate document templates. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra hassles.

- First and foremost, double-check if the Tarrant Partnership Agreement for Law Firm is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to check what it's intended for.

- Start the search again if the document isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Tarrant Partnership Agreement for Law Firm template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Additionally, the paperwork we offer are reviewed by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Written partnership agreements protect the company and each partner's investment in it. If there is no written partnership agreement, partners are not allowed to draw a salary. Instead, they share the profits and losses in the business equally.

A domestic partnership agreement is a legal agreement but it is not a marriage, a common-law marriage, or a civil union. Texas does not currently recognize any of these unions.

Here are five clauses every partnership agreement should include: Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.

How to Write a Business Partnership Agreement name of the partnership. goals of the partnership. duration of the partnership. contribution amounts of each partner (cash, property, services, future contributions) ownership interests of each partner (assets) management roles and terms of authority of each partner.

How do I create a Partnership Agreement? Specify the type of business you're running.State your place of business.Provide partnership details.State the partnership's duration.Provide each partner's details.State each partner's capital contributions.Outline the admission of new partners.

What to Include in Your Partnership Agreement Name of the partnership. One of the first things you must do is agree on a name for your partnership.Contributions to the partnership.Allocation of profits, losses, and draws.Partners' authority.Partnership decision making.

A partnership (also known as a general partnership) is an informal business structure consisting of two or more people. You don't have to file paperwork to establish a partnership -- you create a partnership simply by agreeing to go into business with another person.

If you are a business owner, looking to draft your own partnership agreement, you can do so using free templates available online. It is advisable to contact a business lawyer or a partnership agreement lawyer to ensure that the agreement follows the federal, state and local laws.

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell how out disputes are to be adjudicated and what happens if one of the partners dies prematurely.

A partnership agreement is one of the most important documents when forming a partnership. A partnership agreement indicates the rules and regulations for operating the business.

Interesting Questions

More info

You Have the Right to Appeal an Enforcing Agency Order. We are committed to assisting all our clients, however, we are only able to provide service in Denton, Collin, and Tarrant counties, Texas. We are unable to provide service to all counties in the state of Texas. Contact us for details on how to file for an appeal in a different county. A complaint filed with our office is public.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.