Hennepin Minnesota Partnership Agreement for Business is a legally binding document that outlines the terms and conditions agreed upon by two or more parties who wish to form a partnership in Hennepin County, Minnesota. This agreement governs the relationship between the partners and provides clarity on various aspects of the partnership, including ownership, profit sharing, decision-making, and dissolution. Keywords: Hennepin Minnesota, Partnership Agreement, business, legally binding, terms and conditions, parties, partnership, Hennepin County, ownership, profit sharing, decision-making, dissolution. There are different types of Hennepin Minnesota Partnership Agreements for Business, which include: 1. General Partnership Agreement: This type of agreement is formed when two or more individuals decide to join forces and contribute skills, resources, and capital to start a business. In a general partnership, all partners share equal responsibility and liability for the business's debts and obligations. 2. Limited Partnership Agreement: A limited partnership agreement involves at least one general partner and one or more limited partners. General partners have unlimited liability and are actively involved in the day-to-day operations of the business, while limited partners have limited liability and are passive investors. Limited partners typically contribute capital but have no say in the management of the business. 3. Limited Liability Partnership Agreement (LLP): Under an LLP agreement, partners are shielded from personal liability for the partnership's debts and obligations. This type of partnership is commonly chosen by professionals such as lawyers, accountants, or architects who want to collaborate while maintaining personal asset protection. 4. Limited Liability Limited Partnership Agreement (LL LP): An LL LP agreement combines features of both a limited partnership and a limited liability partnership. It provides limited liability protection to all partners (both general and limited) while allowing for flexibility in terms of management and investment contributions. Each type of partnership agreement in Hennepin Minnesota has its own set of advantages and considerations, and it is essential for prospective partners to carefully evaluate their needs and objectives before choosing the appropriate agreement that best suits their business goals. Remember, it is always recommended seeking legal advice from a qualified attorney when drafting or entering into a partnership agreement to ensure compliance with relevant laws and regulations specific to Hennepin County and Minnesota.

Hennepin Minnesota Partnership Agreement for Business

Description

How to fill out Hennepin Minnesota Partnership Agreement For Business?

Whether you plan to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Hennepin Partnership Agreement for Business is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Hennepin Partnership Agreement for Business. Follow the instructions below:

- Make sure the sample fulfills your individual needs and state law regulations.

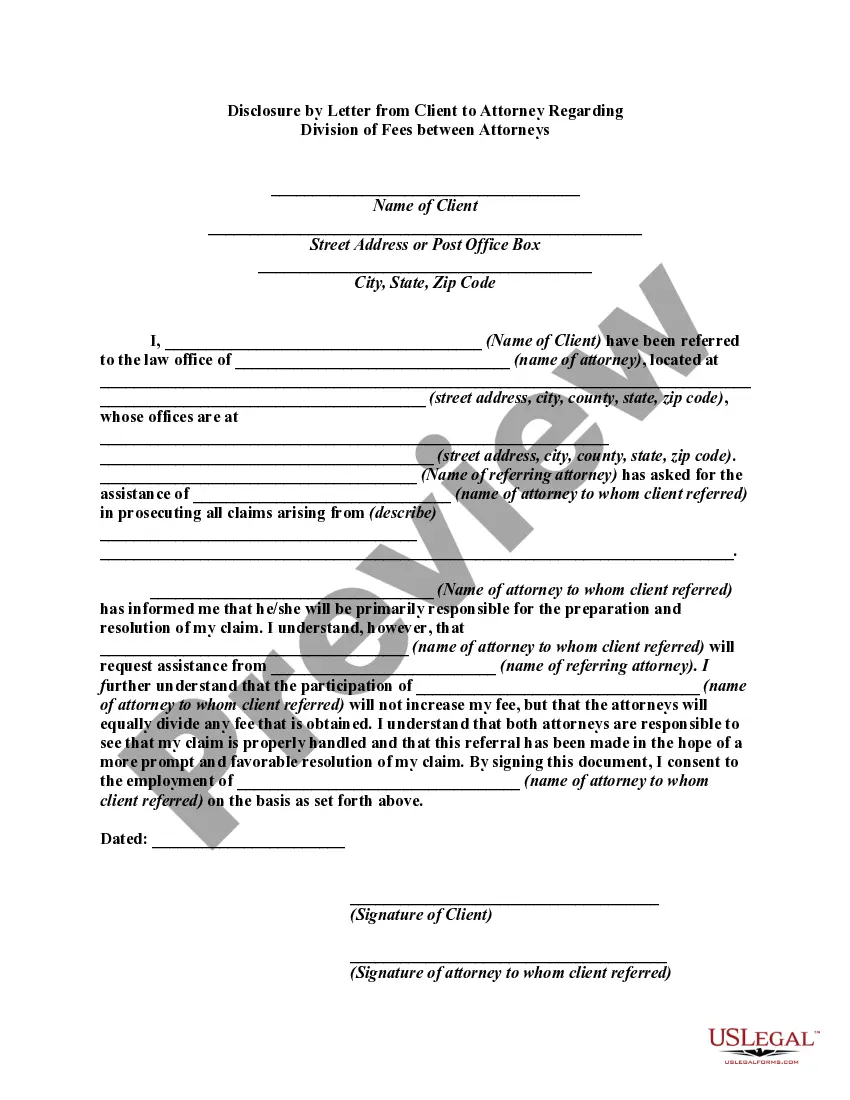

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the file once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Hennepin Partnership Agreement for Business in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!