The Suffolk New York Partnership Agreement for Restaurant Business is a legal document that outlines the terms and conditions of a partnership between two or more individuals who wish to establish and operate a restaurant business in Suffolk County, New York. This agreement serves as a foundation for the partnership and governs its operations, responsibilities, and liabilities. The partnership agreement covers various aspects such as the names and addresses of the partners, the purpose and objectives of the partnership, the duration of the agreement, and the capital contributions made by each partner. It also specifies the profit-sharing and loss allocation among the partners, as well as the decision-making process for important business matters. In Suffolk County, there are several types of partnership agreements available for restaurant businesses, depending on the nature of the partnership and the desired level of liability protection. Here are some common types: 1. General Partnership Agreement: This is the most basic form of partnership, where two or more partners share equal rights and responsibilities in managing the restaurant business. All partners have unlimited personal liability for the partnership's debts and obligations. 2. Limited Partnership Agreement: In this type of partnership, there are two types of partners — general partners and limited partners. General partners have unlimited liability and are responsible for managing the business, while limited partners have limited liability and are primarily investors. 3. Limited Liability Partnership (LLP) Agreement: An LLP Agreement provides a higher level of personal liability protection for the partners. Each partner has limited liability for the partnership's debts and obligations, and they enjoy greater flexibility in the management of the restaurant business. 4. Limited Liability Company (LLC) Partnership Agreement: This agreement combines elements of a partnership and a corporation. The partners, known as members, have limited liability for the company's debts and obligations, and they have flexibility in deciding how the business is managed. The Suffolk New York Partnership Agreement for Restaurant Business is an essential legal document that ensures clarity, fairness, and accountability among partners in the restaurant industry. It is advisable to consult with an attorney or legal professional experienced in business law to draft and review the partnership agreement to ensure compliance with local regulations and the specific needs of the restaurant business.

Suffolk New York Partnership Agreement for Restaurant Business

Description

How to fill out Suffolk New York Partnership Agreement For Restaurant Business?

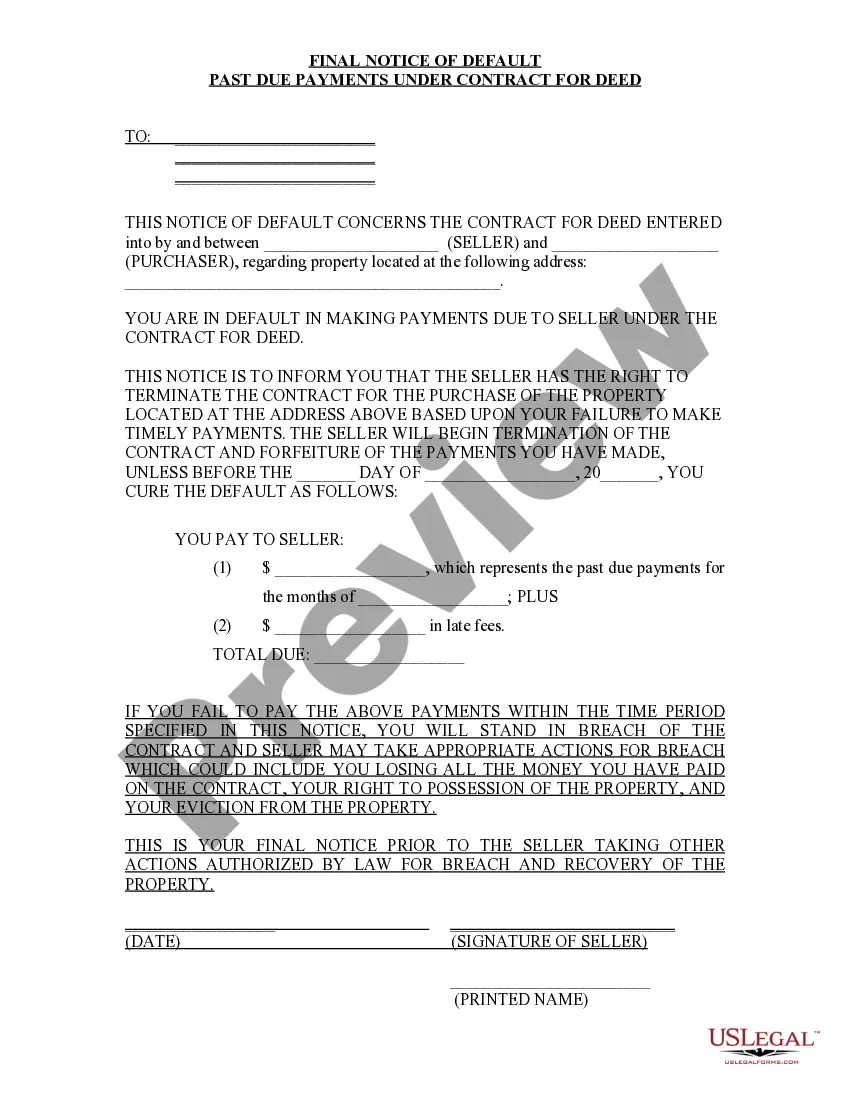

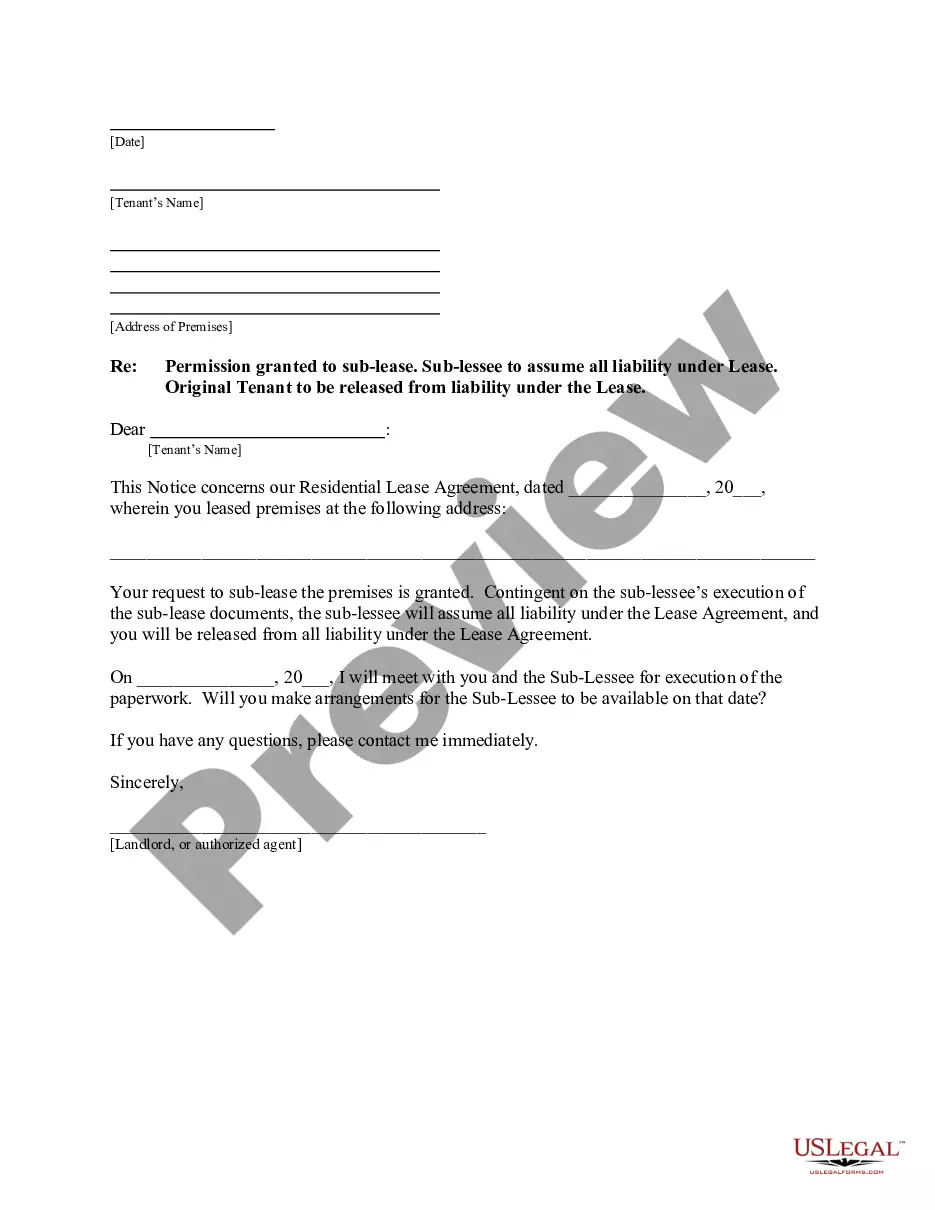

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life situation, finding a Suffolk Partnership Agreement for Restaurant Business meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. Apart from the Suffolk Partnership Agreement for Restaurant Business, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Suffolk Partnership Agreement for Restaurant Business:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Suffolk Partnership Agreement for Restaurant Business.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!