The Franklin Ohio Partnership Agreement for Investment Club is a legal document that outlines the responsibilities, rights, and the relationship between the members of an investment club in Franklin, Ohio. This agreement helps to establish a clear understanding of how the investment club will operate, how decisions will be made, and how profits and losses will be distributed among the members. The purpose of forming an investment club in Franklin Ohio is to pool together resources from individual investors to invest in various financial assets such as stocks, bonds, real estate, or mutual funds. By joining forces and sharing knowledge, members of the investment club can potentially maximize returns and minimize risks. The Franklin Ohio Partnership Agreement for Investment Club typically includes several key components: 1. Club Name and Purpose: The agreement clearly states the name of the investment club and specifies its purpose, such as providing education, collective investment opportunities, or long-term financial growth. 2. Membership Eligibility and Contributions: This section outlines the requirements to become a member, including any minimum contribution or investment amount. It may also specify the maximum number of members the club can have. 3. Management and Decision-making: The agreement defines how decisions will be made within the investment club. It may state whether decisions are made by a majority vote or by a designated managing partner. The agreement also establishes the roles and responsibilities of each member, including any administrative or managerial duties. 4. Capital Contributions and Allocations: This section describes how capital contributions will be made by the members and the proportionate share of profits and losses that each member will receive. It also specifies how membership interest can be transferred or sold. 5. Meeting Frequency and Investments: The agreement may outline the frequency of club meetings and how investment opportunities will be proposed, discussed, and decided upon. It may also establish the process for adding or removing investments from the club's portfolio. 6. Dissolution and Exit Strategy: This part of the agreement details the procedures for dissolving the investment club, should the need arise. It may include provisions for distributing any remaining assets or handling outstanding obligations. Types of Franklin Ohio Partnership Agreements for Investment Club can vary based on the specific needs and goals of the club. Some variations may include: 1. General Partnership Agreement: This agreement establishes a partnership where all members have equal decision-making power and liability. Each member is personally liable for the debts and obligations of the club. 2. Limited Partnership Agreement: In this type of agreement, there are two types of members: general partners and limited partners. General partners have unlimited liability and participate in managing the club, while limited partners have limited liability and typically do not participate in day-to-day management. 3. Limited Liability Partnership Agreement: This agreement offers liability protection to all members. This allows members to have limited personal liability for the club's debt and obligations. Members have the flexibility to participate actively in managing the club or have a purely financial interest. In conclusion, the Franklin Ohio Partnership Agreement for Investment Club serves as a crucial document in establishing the terms and conditions for operating an investment club in Franklin, Ohio. It ensures clarity, fairness, and the smooth functioning of the club while providing a legal framework for members to collaborate, invest collectively, and potentially achieve their financial goals.

Franklin Ohio Partnership Agreement for Investment Club

Description

How to fill out Franklin Ohio Partnership Agreement For Investment Club?

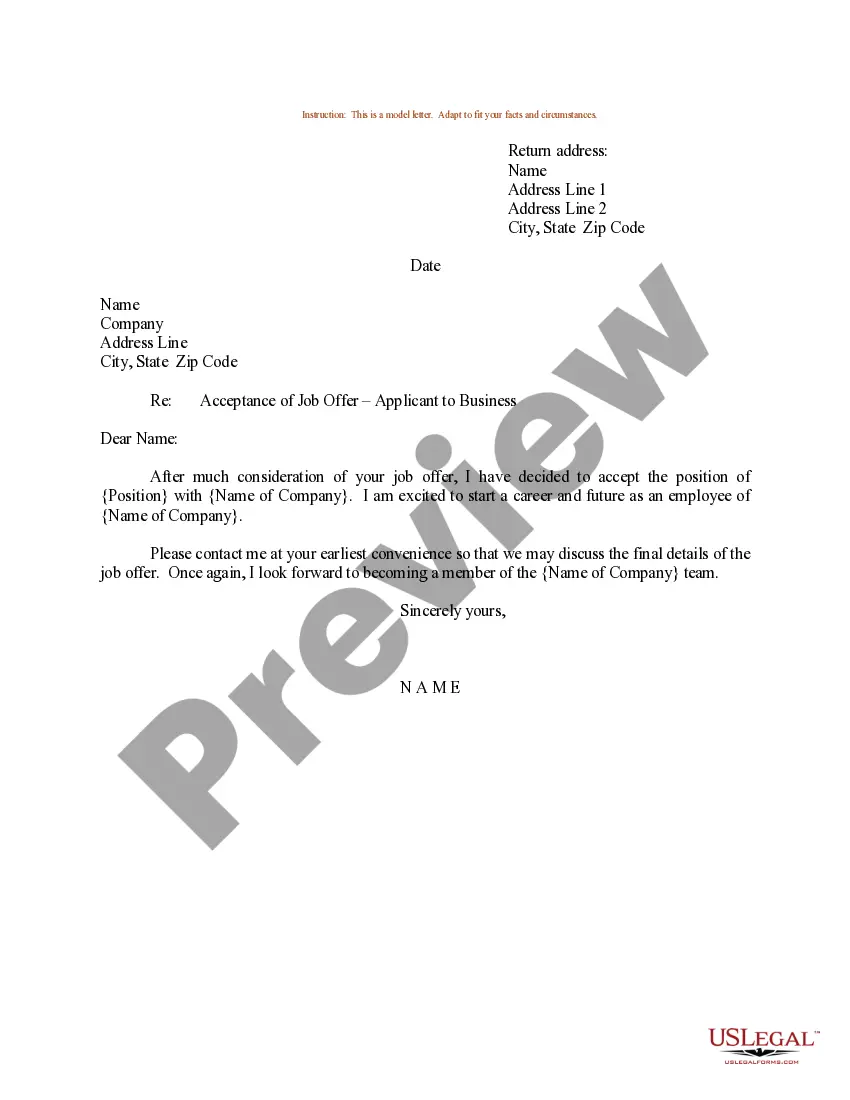

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Franklin Partnership Agreement for Investment Club, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Consequently, if you need the latest version of the Franklin Partnership Agreement for Investment Club, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Franklin Partnership Agreement for Investment Club:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Franklin Partnership Agreement for Investment Club and download it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!