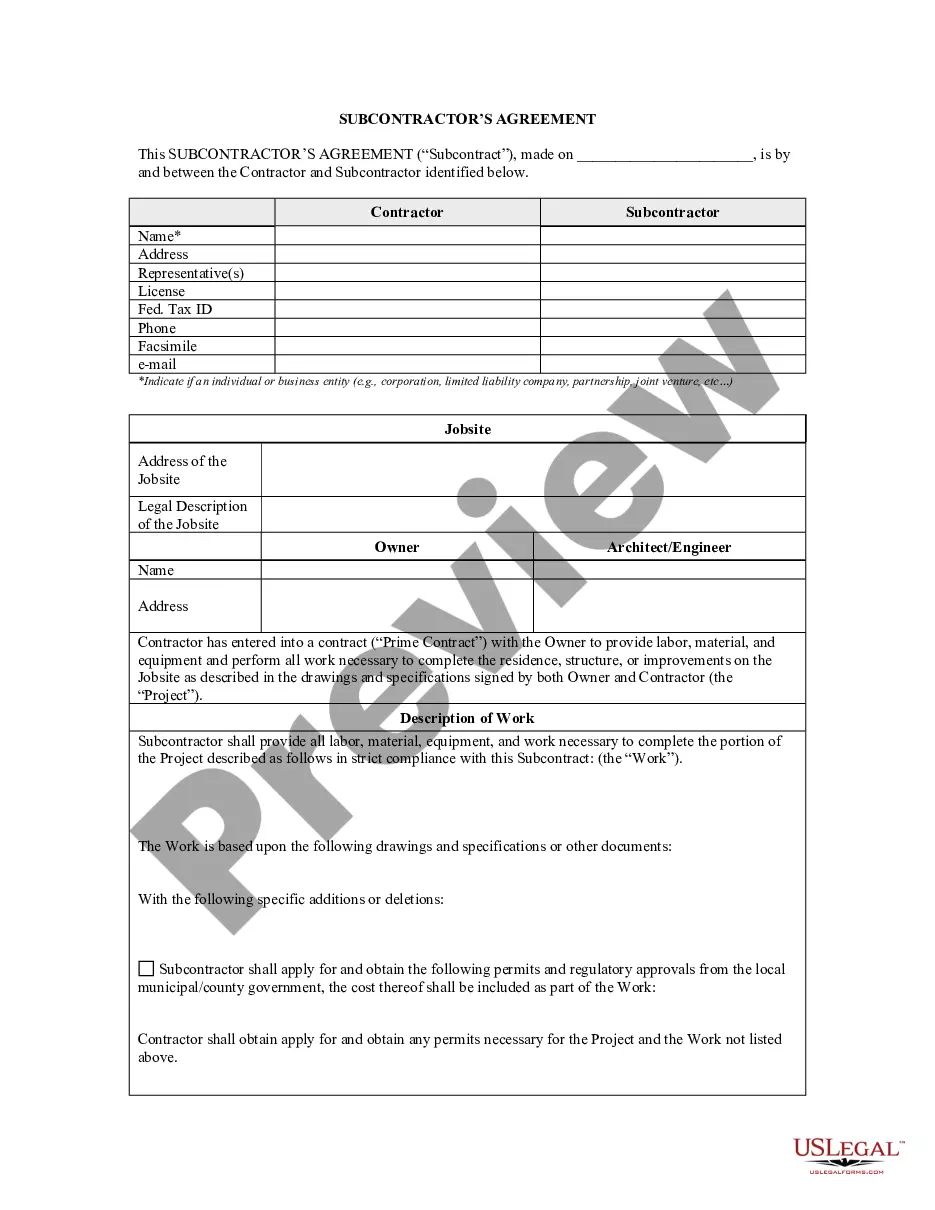

The Harris Texas Partnership Agreement for Investment Club is a legal document that outlines the terms and conditions of a partnership formed between individuals to pool their funds and collectively invest in various financial instruments. This partnership agreement is specifically designed for investment clubs based in Harris County, Texas. The purpose of the Harris Texas Partnership Agreement for Investment Club is to establish a formal structure and define the rights and responsibilities of each partner involved in the investment club. The agreement typically covers crucial aspects such as capital contributions, profit-sharing ratios, decision-making processes, and dispute resolution methods. There are several types of Harris Texas Partnership Agreements for Investment Clubs, depending on the specific needs and goals of the club: 1. General Partnership Agreement: This is the most common type of partnership agreement, where each partner assumes unlimited liability for the club's obligations and can actively participate in the decision-making process. 2. Limited Partnership Agreement: In this type of partnership agreement, there are two categories of partners — general partners and limited partners. General partners have unlimited personal liability, while limited partners have limited liability and are mainly passive investors. 3. Limited Liability Partnership (LLP) Agreement: An LLP agreement enables partners to limit their personal liability and safeguard their assets. This type of partnership is suitable for investment clubs that want to protect individual partners' personal assets from the club's liabilities. 4. Limited Liability Company (LLC) Agreement: Though not technically a partnership agreement, an LLC agreement provides similar benefits as an LLP by combining the liability protection of a corporation with the flexibility and tax advantages of a partnership. 5. Joint Venture Agreement: This type of partnership agreement is suitable for investment clubs that come together for a specific project or investment opportunity. Partners share resources and expertise while determining the terms of their collaboration. It is essential to consult legal professionals or investment advisors to determine the most appropriate type of partnership agreement for an investment club based in Harris County, Texas. Customizing the agreement to meet the club's specific needs ensures that all partners have a clear understanding of their rights and obligations, fostering a successful and harmonious investment environment.

Harris Texas Partnership Agreement for Investment Club

Description

How to fill out Harris Texas Partnership Agreement For Investment Club?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Harris Partnership Agreement for Investment Club, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various types ranging from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find detailed materials and tutorials on the website to make any activities associated with document completion straightforward.

Here's how to purchase and download Harris Partnership Agreement for Investment Club.

- Go over the document's preview and description (if provided) to get a general information on what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can affect the validity of some documents.

- Examine the similar forms or start the search over to find the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and buy Harris Partnership Agreement for Investment Club.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Harris Partnership Agreement for Investment Club, log in to your account, and download it. Of course, our platform can’t take the place of an attorney entirely. If you have to deal with an extremely difficult case, we advise using the services of a lawyer to check your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork with ease!