Salt Lake Utah Partnership Agreement for Investment Club is a legally binding contract that outlines the rights, responsibilities, and obligations of the partners involved in an investment club based in Salt Lake City, Utah. This agreement aims to establish a clear framework for operating the club and managing its investment activities effectively. Keywords: Salt Lake Utah, Partnership Agreement, Investment Club, legally binding, rights, responsibilities, obligations, framework, operating, managing, investment activities, effective. There may be different types of Salt Lake Utah Partnership Agreement for Investment Club that can serve specific purposes based on the club's objectives and preferences. Some of these types could include: 1. General Partnership Agreement: This type of agreement is commonly used in investment clubs where all partners have equal rights and responsibilities in decision-making and liability. Each partner contributes funds and shares profits or losses based on their ownership percentage. 2. Limited Partnership Agreement: In this type of agreement, there are general partners who actively manage the investment club's operations and limited partners who contribute capital but have limited involvement in decision-making. Limited partners usually have limited liability, and their liability is restricted to the amount of their investment. 3. Limited Liability Partnership Agreement: This agreement offers liability protection to all partners, meaning their personal assets are safeguarded against the investment club's debts and obligations. This type of partnership agreement is often suitable for investment clubs with a larger number of partners. 4. Joint Venture Agreement: A joint venture agreement can be considered when multiple investment clubs or organizations collaborate to pursue a specific investment opportunity or project collectively. This agreement defines the terms, roles, and share of profits or losses for each entity involved. It's crucial for an investment club based in Salt Lake Utah to choose the most appropriate partnership agreement type based on their objectives, desired level of involvement, and risk tolerance. Consulting with legal professionals or experienced investment advisors is advisable to ensure the agreement suits the specific needs and complies with relevant laws and regulations in the state.

Salt Lake Utah Partnership Agreement for Investment Club

Description

How to fill out Salt Lake Utah Partnership Agreement For Investment Club?

Preparing legal documentation can be difficult. In addition, if you decide to ask a legal professional to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Salt Lake Partnership Agreement for Investment Club, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the latest version of the Salt Lake Partnership Agreement for Investment Club, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Salt Lake Partnership Agreement for Investment Club:

- Glance through the page and verify there is a sample for your region.

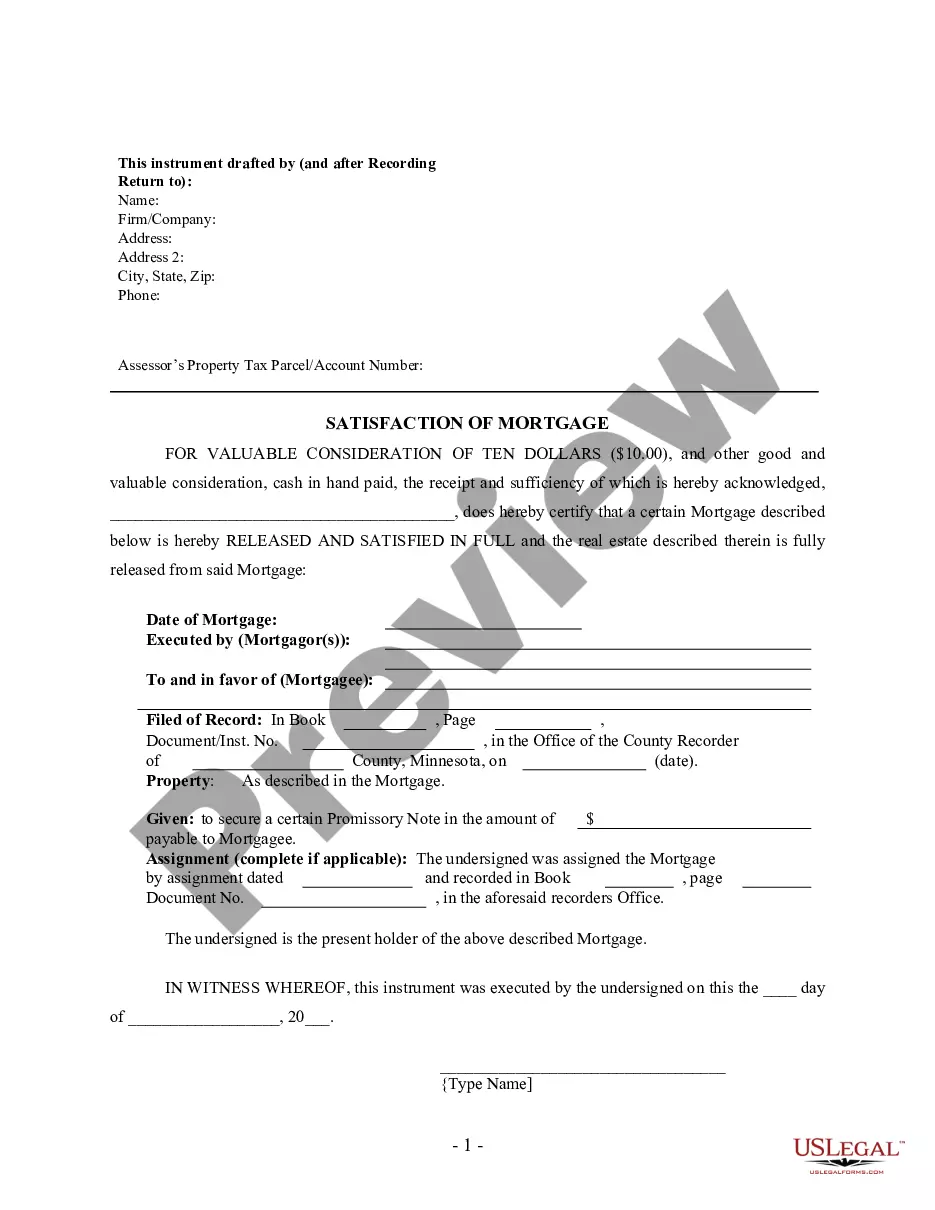

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Salt Lake Partnership Agreement for Investment Club and save it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!