A Dallas Texas Partnership Agreement for Corporation is a legal document that outlines the terms and conditions agreed upon by two or more parties who wish to form a partnership in the city of Dallas, Texas. This agreement helps establish the roles, responsibilities, and rights of each partner involved in the corporation. The Dallas Texas Partnership Agreement for Corporation typically includes various important clauses and provisions that address key aspects related to the partnership, such as capital contributions, profit and loss allocation, management responsibilities, decision-making processes, dispute resolution, liability, and dissolution. There are different types of Dallas Texas Partnership Agreements for Corporation based on the specific needs and goals of the partners involved. These variations include: 1. General Partnership Agreement: This is the most common type of partnership agreement, where all partners share equal responsibility and liability for the partnership's debts and obligations. 2. Limited Partnership Agreement: In this type of agreement, there are two types of partners — general partners and limited partners. General partners have unlimited liability and are actively involved in managing the partnership, whereas limited partners have limited liability and are more passive investors. 3. Limited Liability Partnership Agreement: This agreement offers individual partners protection from personal liability for the partnership's debts and obligations. Each partner's liability is limited to their own acts and omissions, not those of other partners. 4. Joint Venture Agreement: While technically not a partnership, a joint venture agreement serves a similar purpose, where two or more parties collaborate for a specific business venture. Partners in a joint venture retain their separate legal identities and contribute resources to achieve a common goal. 5. Professional Service Partnership Agreement: This type of agreement is specifically tailored for professional service firms such as law firms, accounting firms, or medical practices. It includes provisions addressing professional licensing requirements and regulations. When drafting a Dallas Texas Partnership Agreement for Corporation, it is crucial to ensure that it complies with the laws and regulations of the state of Texas, as well as any specific requirements related to the city of Dallas. Seeking legal advice or assistance from a qualified attorney is strongly recommended ensuring the agreement accurately reflects the intentions and protects the interests of all parties involved.

Dallas Texas Partnership Agreement for Corporation

Description

How to fill out Dallas Texas Partnership Agreement For Corporation?

Whether you intend to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like Dallas Partnership Agreement for Corporation is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to get the Dallas Partnership Agreement for Corporation. Adhere to the guide below:

- Make certain the sample fulfills your personal needs and state law requirements.

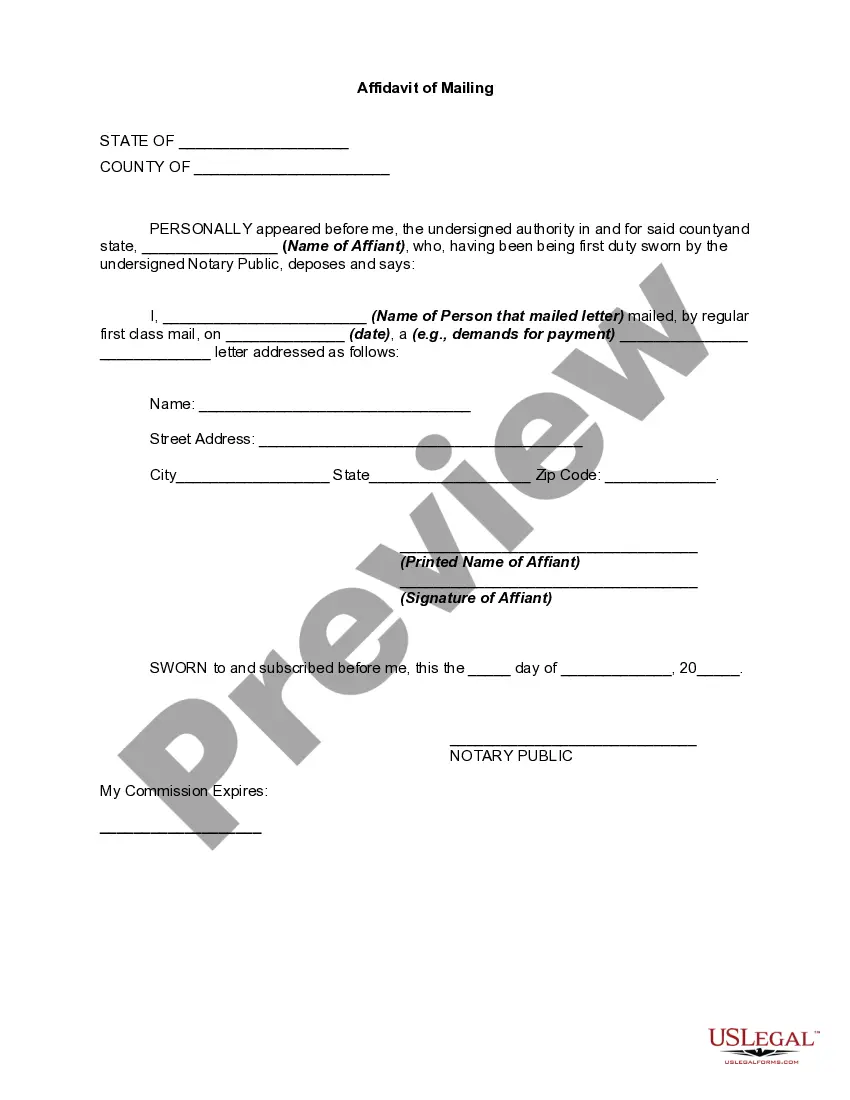

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Partnership Agreement for Corporation in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!