The Nassau New York Partnership Agreement for Corporation is a legal document that outlines the terms and conditions governing the partnership between two or more corporations in Nassau County, New York. This agreement is crafted to establish a solid foundation and define the roles, responsibilities, and obligations of each corporation involved. The Nassau New York Partnership Agreement for Corporation is designed to protect the interests of all parties involved and ensure a smooth operation and partnership. It typically includes provisions relating to the purpose and goals of the partnership, the duration of the partnership, capital contributions from each corporation, profit and loss sharing, decision-making authority, management structure, dispute resolution mechanisms, and the process for adding or removing partners. There may be different types of Nassau New York Partnership Agreements for Corporation, tailored to specific business needs and circumstances. Some common variations include: 1. General Partnership Agreement: This agreement outlines a partnership between two or more corporations where all partners are equally responsible for the debts, liabilities, and obligations of the partnership. 2. Limited Partnership Agreement: In this type of agreement, there are two types of partners: general partners and limited partners. General partners have unlimited liability and are actively involved in the day-to-day operations, while limited partners have limited liability and are typically passive investors. 3. Limited Liability Partnership Agreement: This agreement provides a structure where each corporation has limited liability for the actions, debts, and obligations of the partnership. It allows corporations to operate as independent entities while enjoying the benefits of partnership. 4. Joint Venture Agreement: A joint venture agreement is a specific type of partnership agreement where corporations come together for a specific project or business venture. This agreement outlines the terms of cooperation, profit sharing, decision-making, and other relevant aspects of the joint venture. The Nassau New York Partnership Agreement for Corporation is an essential legal document that ensures clarity and defines the rights and obligations of each corporation involved in the partnership. It is highly recommended for corporations entering into a partnership in Nassau County, New York, to consult with an experienced attorney who specializes in business law to draft a comprehensive and tailored agreement that suits their specific needs.

Nassau New York Partnership Agreement for Corporation

Description

How to fill out Nassau New York Partnership Agreement For Corporation?

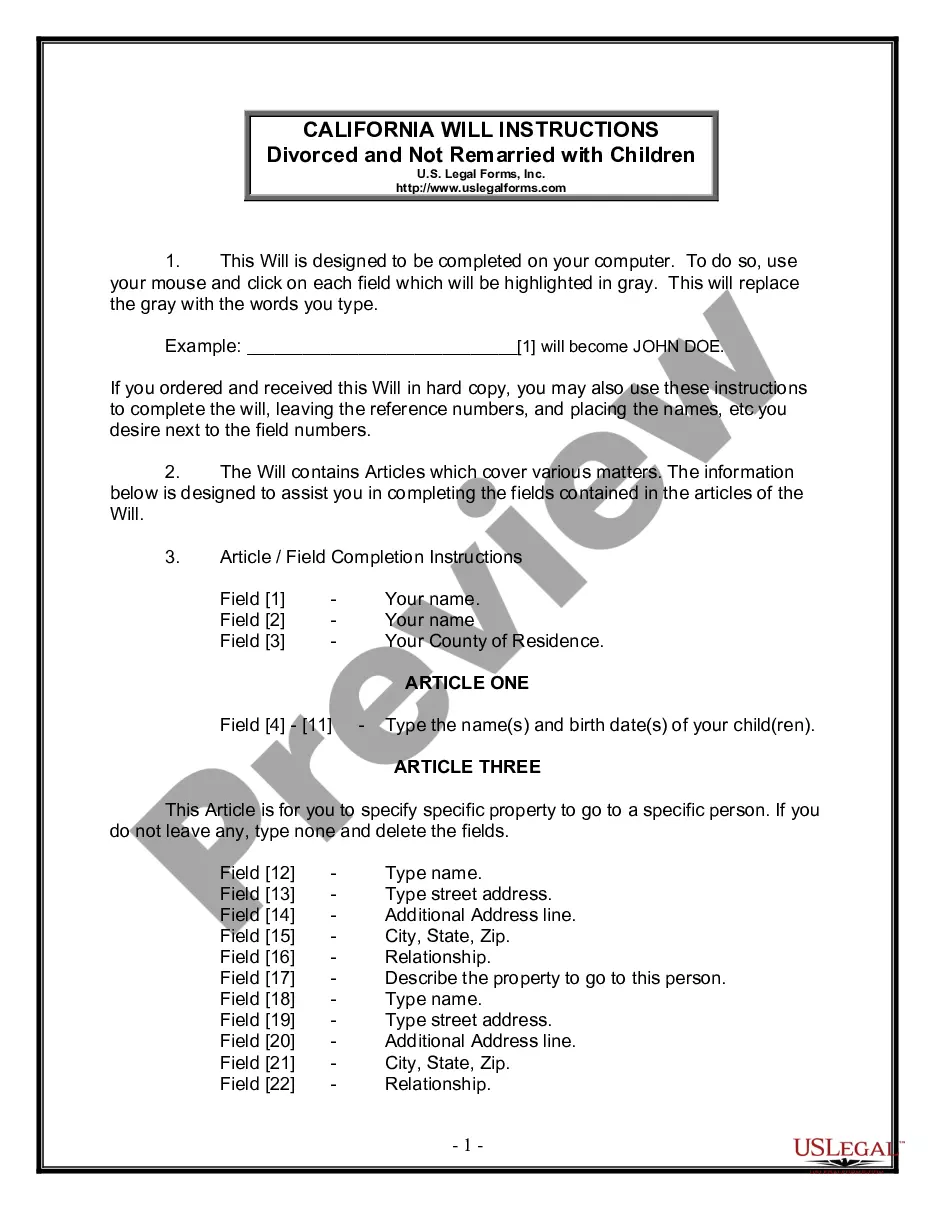

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Nassau Partnership Agreement for Corporation, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Consequently, if you need the recent version of the Nassau Partnership Agreement for Corporation, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Nassau Partnership Agreement for Corporation:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Nassau Partnership Agreement for Corporation and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!