Collin Texas Partnership Agreement for Lawyers is a legal contract that outlines the terms and conditions of a partnership between lawyers or law firms operating in Collin County, Texas. This agreement serves as a set of guidelines and rules governing the relationship, responsibilities, rights, and obligations of the partners involved. In Collin County, lawyers may enter into different types of partnership agreements, depending on their specific needs and goals. Some common forms of partnership agreements for lawyers in Collin Texas include: 1. General Partnership Agreement: This is the most basic type of partnership agreement where two or more lawyers form a partnership and share responsibilities, profits, and liabilities equally or as defined in the agreement. 2. Limited Partnership Agreement: In this type of agreement, there are two categories of partners — general partners and limited partners. General partners have unlimited liabilities and actively participate in managing the partnership, while limited partners have limited liability and generally contribute capital but don't participate in day-to-day operations. 3. Limited Liability Partnership (LLP) Agreement: An LLP agreement is a popular choice for lawyers in Collin Texas as it offers partners limited personal liability for the partnership's debts and actions. It allows each partner to have flexibility in managing their own legal practices while sharing business expenses and profits. 4. Professional Corporation (PC) Partnership Agreement: Lawyers in Collin Texas may choose to form a partnership through a professional corporation where each attorney maintains a separate legal practice but shares resources, facilities, and profits within the corporation. The PC partnership agreement specifies the terms and conditions of this shared arrangement. In Collin Texas Partnership Agreement for Lawyers, essential provisions typically included are: 1. Name of the partnership 2. Purpose and scope of the partnership 3. Contributions and ownership interests of each partner 4. Distribution of profits and losses 5. Decision-making processes and voting rights 6. Management responsibilities and authority 7. Withdrawal or retirement terms for partners 8. Dispute resolution mechanisms 9. Terms for admission of new partners 10. Dissolution procedures and liquidation of assets. By entering into a Collin Texas Partnership Agreement for Lawyers, legal professionals can ensure transparency, fairness, and accountability in their collaborative endeavors while protecting their individual interests. It is always advisable to consult with a legal professional familiar with Texas partnership laws when drafting or reviewing such agreements to ensure compliance with applicable regulations and to address specific partnership needs.

Collin Texas Partnership Agreement for Lawyers

Description

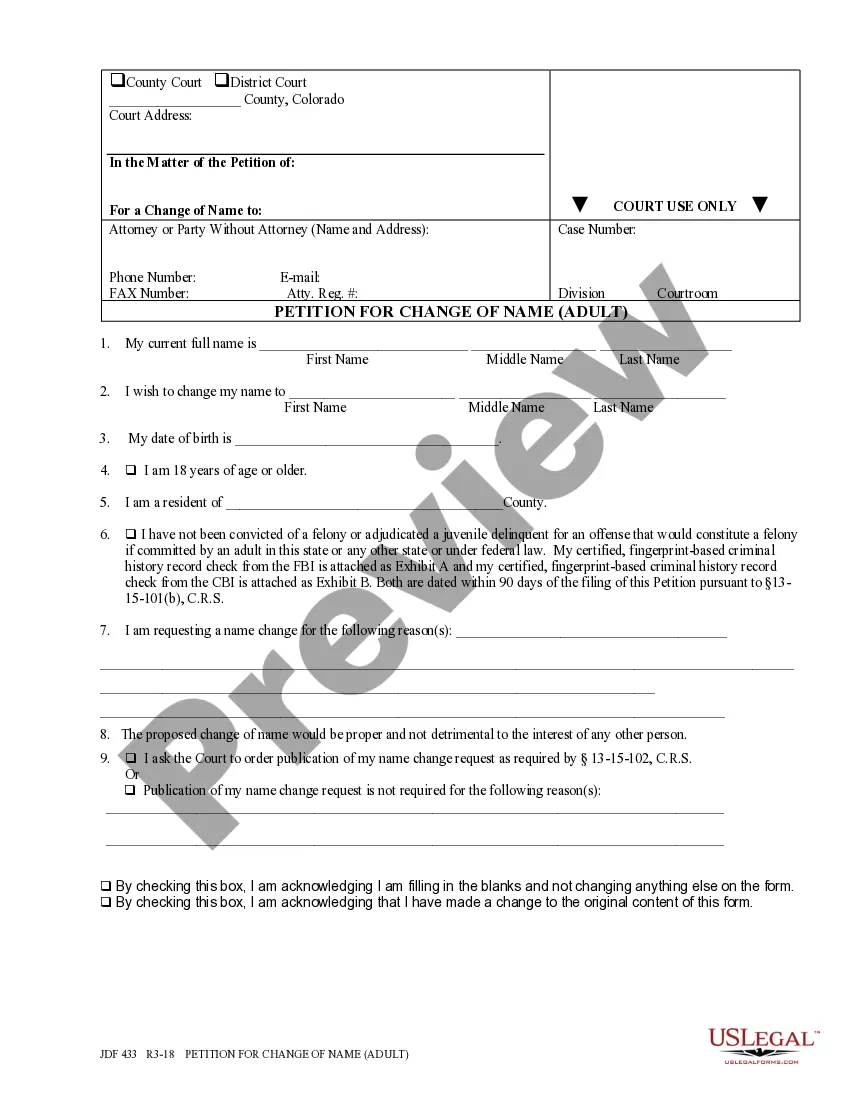

How to fill out Collin Texas Partnership Agreement For Lawyers?

Do you need to quickly create a legally-binding Collin Partnership Agreement for Lawyers or maybe any other document to manage your personal or business matters? You can select one of the two options: contact a professional to write a legal document for you or create it entirely on your own. The good news is, there's another option - US Legal Forms. It will help you receive neatly written legal documents without paying unreasonable prices for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-specific document templates, including Collin Partnership Agreement for Lawyers and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- To start with, double-check if the Collin Partnership Agreement for Lawyers is adapted to your state's or county's regulations.

- If the form comes with a desciption, make sure to verify what it's suitable for.

- Start the search over if the form isn’t what you were hoping to find by using the search bar in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Collin Partnership Agreement for Lawyers template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the documents we provide are reviewed by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell how out disputes are to be adjudicated and what happens if one of the partners dies prematurely.

How do I create a Partnership Agreement? Specify the type of business you're running.State your place of business.Provide partnership details.State the partnership's duration.Provide each partner's details.State each partner's capital contributions.Outline the admission of new partners.

Here are five clauses every partnership agreement should include: Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.

How to Write a Business Partnership Agreement name of the partnership. goals of the partnership. duration of the partnership. contribution amounts of each partner (cash, property, services, future contributions) ownership interests of each partner (assets) management roles and terms of authority of each partner.

How to Dissolve a Partnership Review and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Just keep in mind these five key steps when dissolving a partnership: Review your partnership agreement.Discuss with other partners.File dissolution papers.Notify others.Settle and close out all accounts.

Therefore, you should consider consulting with a local business attorney before ending your partnership. Review Your Partnership Agreement.Take a Vote or Action to Dissolve.Pay Debts and Distribute Assets (Wind Up)No State Filing Required.Notify Creditors, Customers, Clients, and Suppliers.Final Tax Issues.

What to Include in Your Partnership Agreement Name of the partnership. One of the first things you must do is agree on a name for your partnership.Contributions to the partnership.Allocation of profits, losses, and draws.Partners' authority.Partnership decision making.

A partnership agreement is one of the most important documents when forming a partnership. A partnership agreement indicates the rules and regulations for operating the business.

The importance of having a partnership agreement. A partnership agreement is a foundational document for a business partnership and is legally binding on all partners. It sets up the partnership for success by clearly outlining the business's day-to-day operations and the rights and responsibilities of each partner.