Alameda California Sample Letter for Priority Issue in Bankruptcy

Description

How to fill out Alameda California Sample Letter For Priority Issue In Bankruptcy?

Whether you plan to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Alameda Sample Letter for Priority Issue in Bankruptcy is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to get the Alameda Sample Letter for Priority Issue in Bankruptcy. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

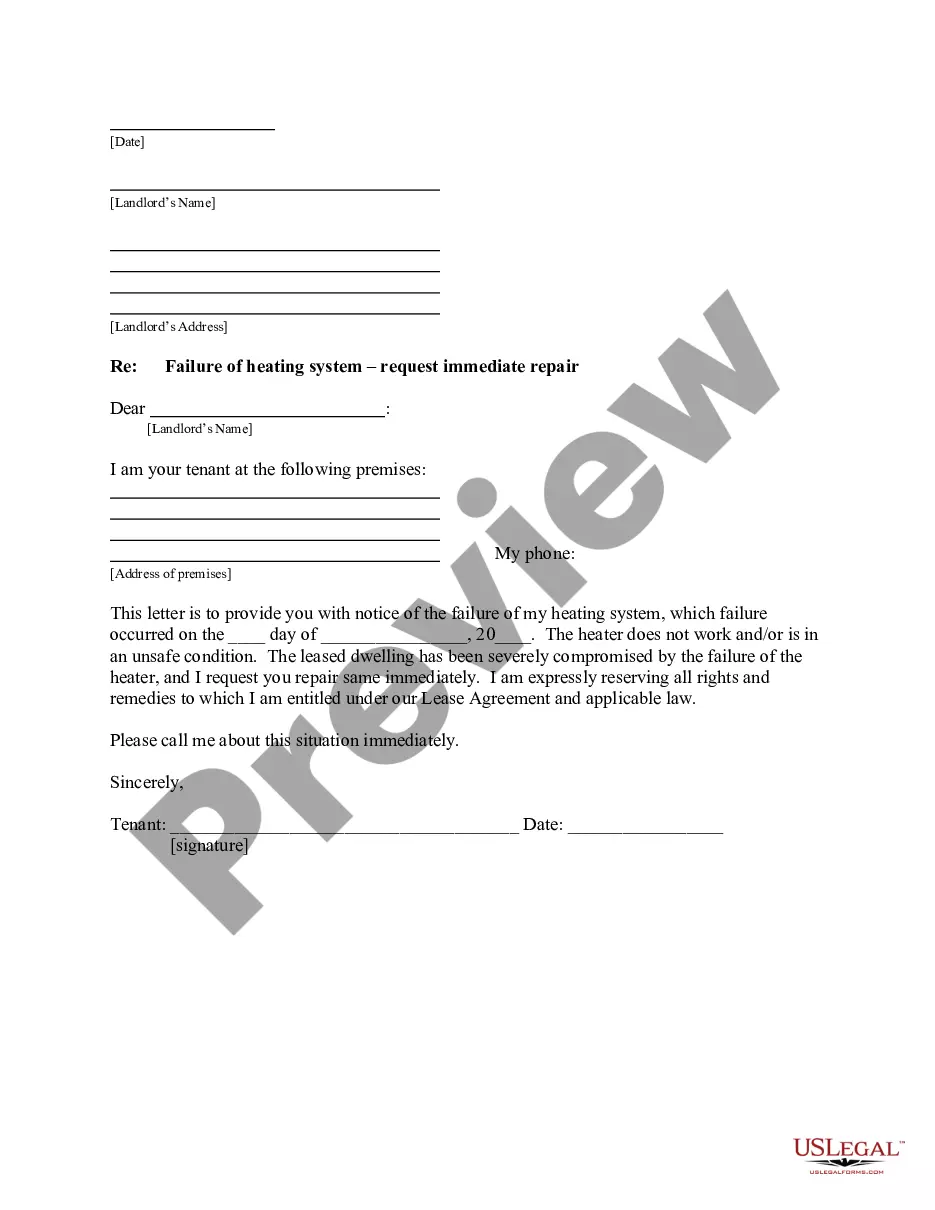

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file once you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Alameda Sample Letter for Priority Issue in Bankruptcy in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

The bankruptcy order should not have been made however, you must apply for permission to appeal the decision within 21 days of the order being made; Within three months all debts owing to creditors are paid in full from your bankrupt estate; or.

After assessing the priority order, each secured claim still receives top priority to receive liquidation proceeds. Though paid before any other creditor, creditors with second or worse claims receive unfavorable treatment compared to first lien claims.

In Chapter 7 bankruptcy, priority debt is significant enough to jump to the head of the bankruptcy repayment line. Priority debt includes domestic support obligations and employee wages, and the Chapter 7 bankruptcy trustee must pay them before other commitments, such as credit card balances and medical bills.

Here are examples of common priority claims: costs to administer the bankruptcy (such as accounting or legal fees) child and spousal support obligations. up to $15,150 in compensation earned 180 days before bankruptcy (wages, commissions, and other compensation)

Priority creditors get paid before other creditors in bankruptcy. The following are some of the most common types of priority claims: alimony. child support. certain tax obligations, and.

Usually, creditor's rights refers to what creditors can do to get back money owed to them and their positioning to other creditors of the debtor. Federal and state laws such as the Fair Debt Collection Practices Act (FDCPA) restrict the ways in which creditors may attempt to collect debts.

Certain unsecured claims which are entitled to be paid in full before general unsecured claims are paid. These include administrative expenses and salaries, unpaid wages, employee benefits, consumer deposits, and prepetition taxes.

Secured credits first in line regarding lien claim take highest priority. Secured Claims (2nd Lien): An asset can theoretically have dozens of lien claims against it. After assessing the priority order, each secured claim still receives top priority to receive liquidation proceeds.

When you file for Chapter 7 bankruptcy, you will have to complete a form called the Statement of Intention for Individuals Filing Under Chapter 7. On this form, you tell the court whether you want to keep your secured and leased propertysuch as your car, boat, or homeor let it go back to the creditor.

All creditors have the right to be heard with regard to liquidation of the debtor's nonexempt assets in Chapter 7 and with regard to the debtor's repayment plan under Chapter 13. All creditors are also entitled to challenge the debtor's right to a discharge. Not all creditors are treated equally in a bankruptcy case.