Travis Texas Sample Letter for Priority Issue in Bankruptcy

Description

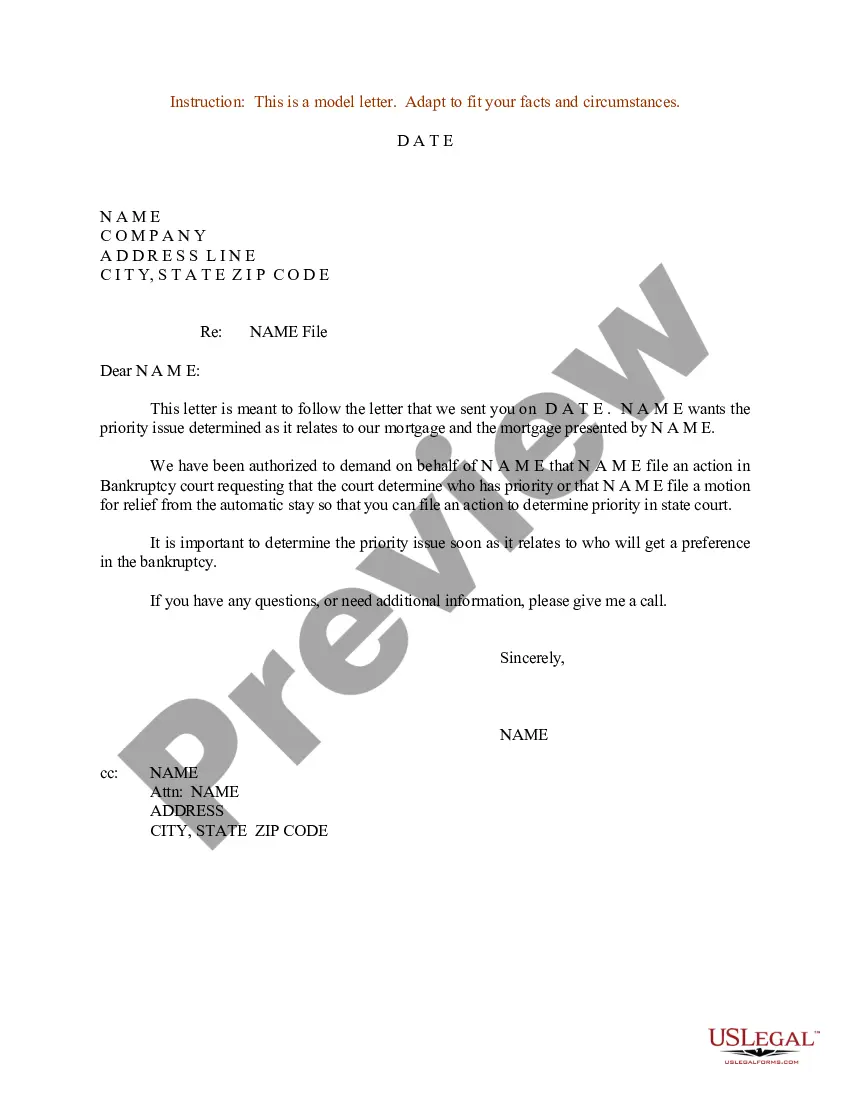

How to fill out Sample Letter For Priority Issue In Bankruptcy?

If you need to find a reliable legal document provider to procure the Travis Sample Letter for Priority Issue in Bankruptcy, consider US Legal Forms. Whether you want to initiate your LLC business or manage your asset distribution, we have you covered. There's no need to be well-versed in law to search for and download the correct form.

Simply opt to search for or navigate through Travis Sample Letter for Priority Issue in Bankruptcy, either via a keyword or by the state/county the document is designed for.

After finding the necessary form, you can Log In and download it or save it in the My documents section.

Don't possess an account? It's simple to get started! Just locate the Travis Sample Letter for Priority Issue in Bankruptcy template and check the form's preview and brief introductory details (if available). If you're confident in the template’s language, proceed to click Buy now. Create an account and select a subscription plan. The template will be ready for download immediately after the payment is processed. You can now fill out the form.

Managing your legal matters doesn’t need to be costly or tedious. US Legal Forms is here to demonstrate that. Our extensive compilation of legal forms makes this journey more affordable and accessible. Establish your first company, arrange your advance care planning, draft a real estate agreement, or complete the Travis Sample Letter for Priority Issue in Bankruptcy – all from the comfort of your home. Join US Legal Forms today!

- You can browse through more than 85,000 forms organized by state/county and case.

- The intuitive interface, diverse educational materials, and committed support simplify the process of discovering and filling out various documents.

- US Legal Forms has been a dependable service supplying legal forms to millions of clients since 1997.

Form popularity

FAQ

Usually, creditor's rights refers to what creditors can do to get back money owed to them and their positioning to other creditors of the debtor. Federal and state laws such as the Fair Debt Collection Practices Act (FDCPA) restrict the ways in which creditors may attempt to collect debts.

In Chapter 7 bankruptcy, priority debt is significant enough to jump to the head of the bankruptcy repayment line. Priority debt includes domestic support obligations and employee wages, and the Chapter 7 bankruptcy trustee must pay them before other commitments, such as credit card balances and medical bills.

Priority debt is always unsecured (secured debt has it's own special payment privileges in bankruptcy). An unsecured debt is one that does not have some property or asset serving as collateral -- or security -- for the debt. Secured debt, on the other hand, has property securing the debt.

Priority creditors get paid before other creditors in bankruptcy. The following are some of the most common types of priority claims: alimony. child support. certain tax obligations, and.

A creditor with an unsecured claim doesn't have a lien. There are two types of unsecured claims: Priority unsecured claims. These debts aren't dischargeable in bankruptcy and, if money is available, the claim will get paid before nonpriority unsecured claims.

Priority unsecured claims are claims that are not secured by collateral but that have priority over other debts under federal law. These debts have priority typically for public policy reasons -- that is, the well-being of the public depends upon these debts being paid.

All creditors have the right to be heard with regard to liquidation of the debtor's nonexempt assets in Chapter 7 and with regard to the debtor's repayment plan under Chapter 13. All creditors are also entitled to challenge the debtor's right to a discharge. Not all creditors are treated equally in a bankruptcy case.

The priority for payment of these claims is generally as follows: first, costs of administration (including professional fees and expenses and post- petition expenses of operating the debtor's business), followed by a host of unsecured claims that Congress has determined deserve a special high priority (again, see §507

Priority refers to the order in which unsecured claims in a bankruptcy case are paid from the money available in the bankruptcy estate. Claims in the higher priority are paid in full before claims in a lower priority receive anything.

Secured credits first in line regarding lien claim take highest priority. Secured Claims (2nd Lien): An asset can theoretically have dozens of lien claims against it. After assessing the priority order, each secured claim still receives top priority to receive liquidation proceeds.