Cuyahoga Ohio LLC Operating Agreement for Shared Vacation Home

Description

How to fill out LLC Operating Agreement For Shared Vacation Home?

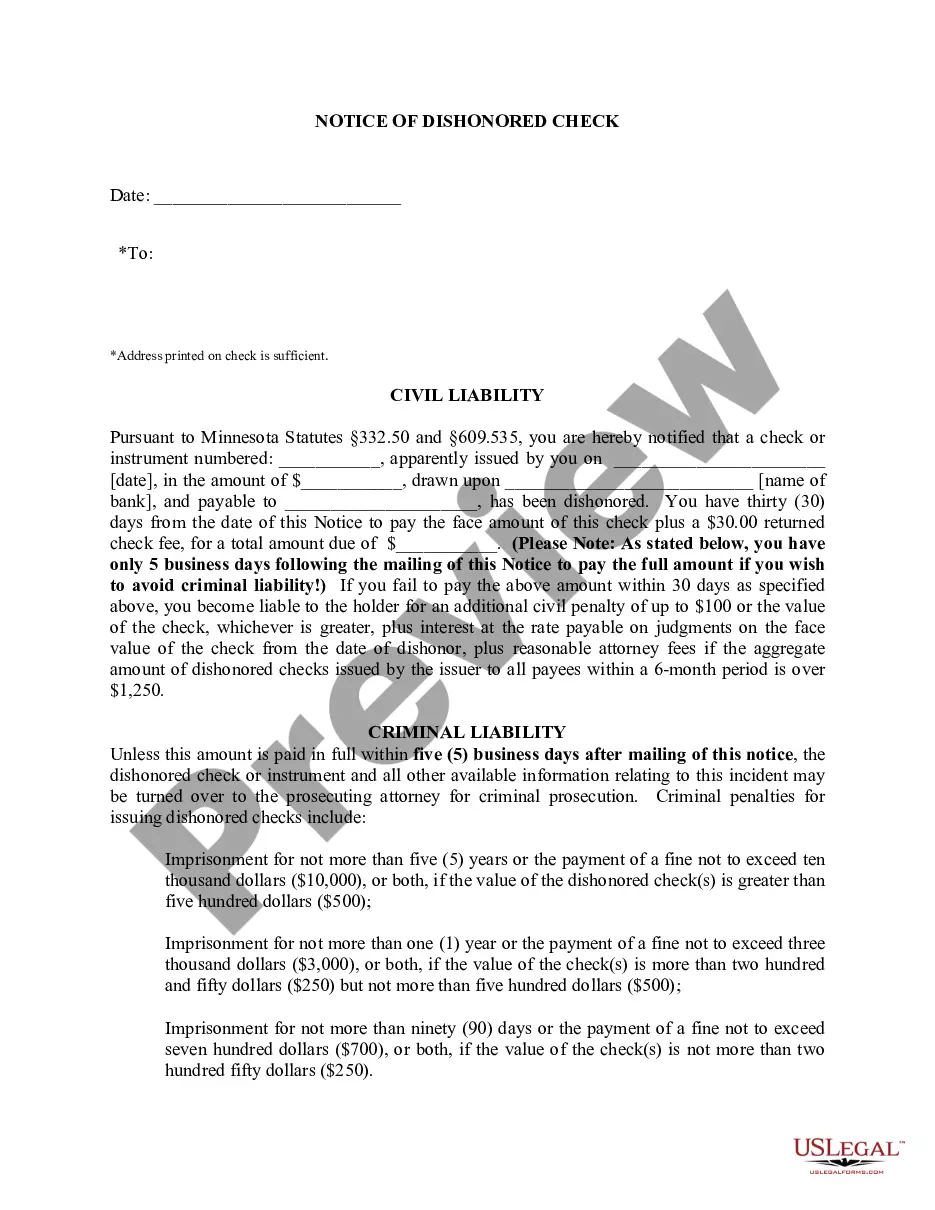

Drafting legal paperwork can be off-putting. Moreover, if you opt to hire a lawyer to create a commercial contract, documents for asset transfer, prenuptial agreement, divorce documents, or the Cuyahoga LLC Operating Agreement for Shared Vacation Home, it might be quite expensive.

So, what is the most effective method to conserve both time and finances while preparing valid documents that fully adhere to your state and local laws? US Legal Forms offers a fantastic solution, whether you’re looking for templates for personal or business purposes.

Don’t be concerned if the form does not meet your needs - search for the appropriate one in the header.

- US Legal Forms is the largest online collection of state-specific legal papers, delivering users with the latest and professionally vetted forms for any situation all consolidated in a single location.

- As a result, if you require the latest edition of the Cuyahoga LLC Operating Agreement for Shared Vacation Home, you can conveniently find it on our platform.

- Acquiring the documents only takes a fraction of the time.

- Users with an existing account should confirm that their subscription remains active, Log In, and choose the template by clicking on the Download button.

- If you have not yet subscribed, here’s how you can obtain the Cuyahoga LLC Operating Agreement for Shared Vacation Home.

- Browse through the page and confirm that a sample for your region is available.

- Review the form description and utilize the Preview option, if available, to ensure it’s the sample you require.

Form popularity

FAQ

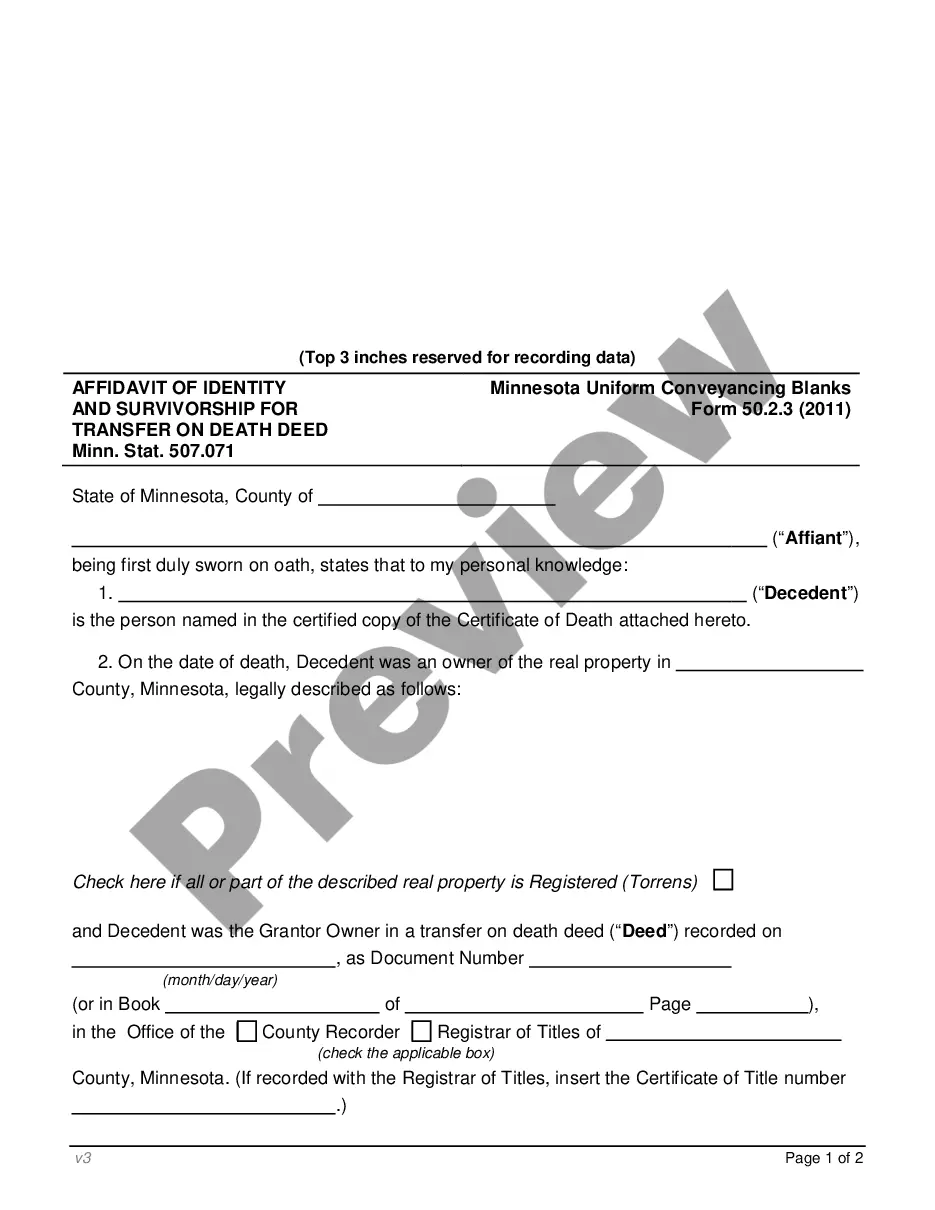

You might put property into an LLC for two main reasons: To capitalize your business. A new business needs assets to get off the ground, and owners typically make capital contributions that might consist of cash, personal property, or real estate.For liability protection when you own investment real estate.

5 Things to Know When Sharing a Vacation Home With Other Families CHOOSE YOUR PARTNERS CAREFULLY. You may think sharing a vacation home is something you do with close friends.MAKE CLEAR RULES. Solid rules are the foundation of a happy partnership.PLAN AN EXIT STRATEGY.DIVVY UP THE TIME.BUDGET FOR COMMON EXPENSES.

For many vacation rental owners, minimizing risk is top of mind, and an LLC is a way to gain added protection in addition to vacation rental insurance. The ability to have extra safeguards for personal risks exposure is without a doubt a major highlight of becoming one.

LLCs for Airbnb: The Bottom Line Yes, absolutely. Starting an LLC can protect your personal assets in the long run, but it will cost a bit of investment in the short-term.

If the property is a rental, by default rental income or loss is considered passive. Generally, passive losses can only be used to offset other passive income in any given year.

The goal of a family beach house is to be a fun place to hang out. But there have to be a few rules for maintaining order and comfort as a sandy crowd moves in and out.... Create a beach command center.Provide a laundry bin for each bedroom.Build in a dedicated charging station.Make it easy for everyone to pitch in.

Consider LLC fees & annual registration fees for multiple LLCs. Again, for the best asset protection it's best to put every single property in its own LLC, without those LLCs being engaged in any other businesses.

To the Internal Revenue Service, a vacation home is just another property as long as it's used for business lodging purposes. As such, your business has the opportunity to write off many of the expenses that it incurs in using and owning the property.

While owning a second home is a luxury that few can afford, 10% of a vacation home might be more in your price range. Through fractional ownership, you can share a home with a larger group of people without actually sharing the space when you go on vacation. Instead, each owner uses the home for a portion of the year.