A Chicago Illinois LLC Operating Agreement for S Corp is a legal document that outlines the specific terms and conditions of operation for a limited liability company (LLC) that has elected to be treated as an S Corporation for tax purposes. This agreement serves as a blueprint for how the LLC will be managed, the rights and responsibilities of the members, and how business decisions will be made. The Chicago Illinois LLC Operating Agreement for S Corp is essential for any LLC that wishes to benefit from the advantages of S Corporation taxation, which includes pass-through taxation where profits and losses flow through to the individual tax returns of the members. By choosing this structure, the LLC can avoid double taxation on its income. This operating agreement is customized to comply with the specific laws and regulations in the state of Illinois, with a focus on the unique aspects of operating within the city of Chicago. It takes into account the local requirements and ordinances that may affect the LLC's operations and ensures that the business remains in compliance with the law. There may be variations or different types of Chicago Illinois LLC Operating Agreement for S Corp depending on the specific needs and preferences of the LLC members. Some examples of these variations include: 1. Single-Member LLC Operating Agreement for S Corp: This agreement is designed for LCS with only one member, who wishes to take advantage of the S Corporation tax status. It outlines the member's rights and responsibilities, as well as the procedures for decision-making and profit allocation. 2. Multi-Member LLC Operating Agreement for S Corp: This type of agreement is tailored for LCS with multiple members, where all members have elected to be taxed as an S Corporation. It addresses various aspects, such as voting rights, capital contributions, profit and loss sharing, and management responsibilities. 3. Professional Services LLC Operating Agreement for S Corp: This agreement is specific to LCS that are engaged in professional services, such as law firms, accounting practices, or medical groups. It may include provisions related to licensing requirements, professional liability, and restrictions on non-professional members. 4. Real Estate LLC Operating Agreement for S Corp: This operating agreement is suitable for LCS that primarily focus on real estate investments or property management activities. It may cover topics such as property acquisition, leasing, property maintenance, and distribution of rental income. The Chicago Illinois LLC Operating Agreement for S Corp is a crucial legal document that provides clarity and protection for the members of the LLC. It establishes the rules governing the LLC's operations, helps prevent disputes, and ensures compliance with local laws and regulations. Seeking professional advice from an attorney experienced in business and taxation laws is highly recommended when drafting or amending this agreement to ensure its effectiveness and suitability for the specific needs of the LLC.

Chicago Illinois LLC Operating Agreement for S Corp

Description

How to fill out Chicago Illinois LLC Operating Agreement For S Corp?

Preparing legal documentation can be difficult. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Chicago LLC Operating Agreement for S Corp, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Consequently, if you need the current version of the Chicago LLC Operating Agreement for S Corp, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Chicago LLC Operating Agreement for S Corp:

- Glance through the page and verify there is a sample for your region.

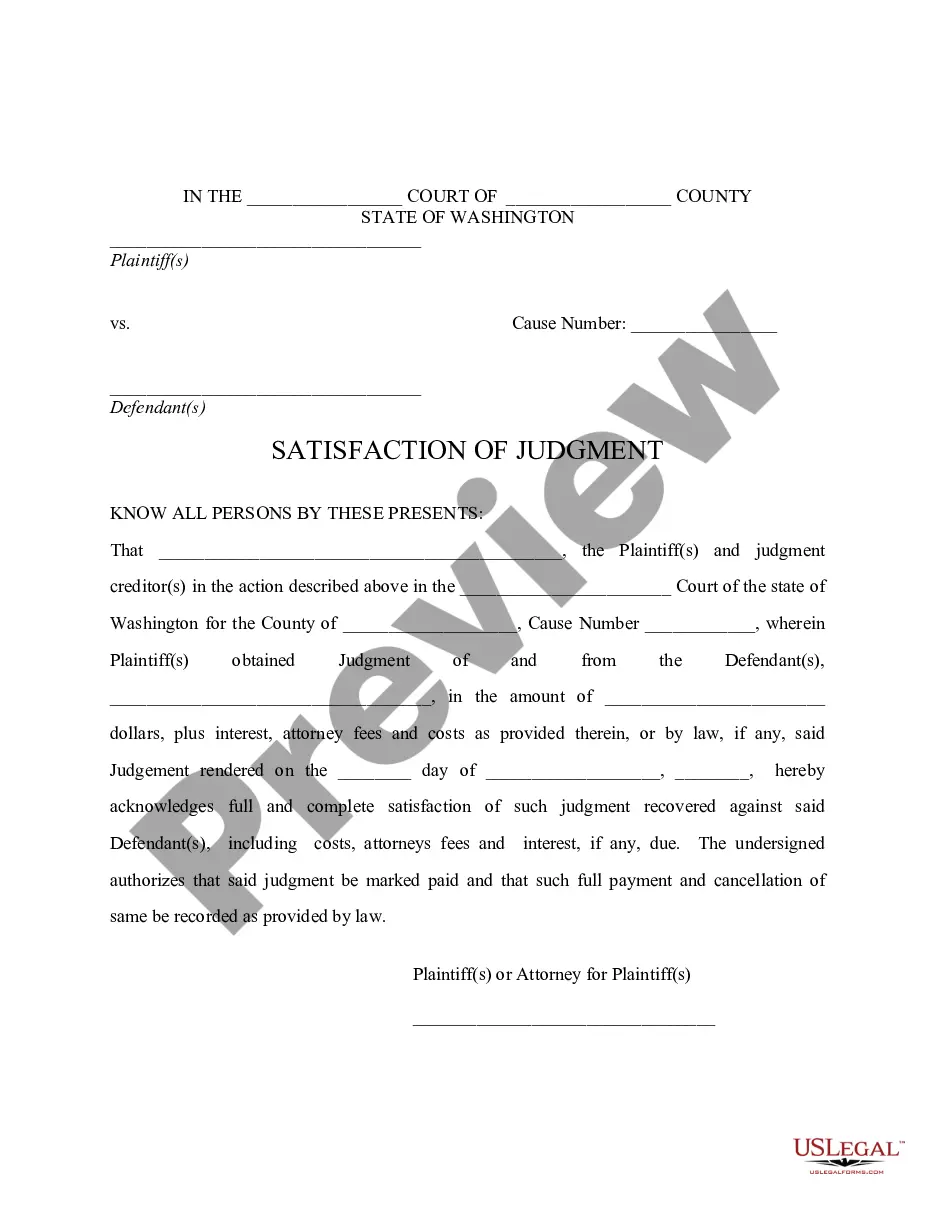

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Chicago LLC Operating Agreement for S Corp and save it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!