Houston Texas LLC Operating Agreement for S Corp: A Comprehensive Guide An LLC operating agreement serves as a crucial document for any Limited Liability Company (LLC), including those structured as an S Corporation (S Corp), operating within the state of Texas, specifically in Houston. This guide aims to provide a detailed description of what the Houston Texas LLC Operating Agreement for S Corp entails, outlining its significance, essential components, and potential variations. Overview: The Operating Agreement, a legally binding document, outlines the operational and ownership structure of an LLC. While Texas does not legally require an LLC to have an operating agreement, it is highly recommended for LCS in Houston due to its numerous benefits, such as clarity of ownership, allocation of profits and losses, and protection of limited liability. The Houston Texas LLC Operating Agreement for an S Corp details the specific agreements between business partners, members, or shareholders. This document sets forth the rules and procedures governing the company's internal operations, management, and decision-making processes. Key Components of Houston Texas LLC Operating Agreement for S Corp: 1. Company Information: This section includes basic details about the LLC, such as its legal name, purpose, principal place of business, duration, and registered agent information. 2. Ownership Structure: Describes how ownership interests or shares are structured and allocated among members or shareholders. It includes the initial capital contributions made by each participant and outlines the procedure for future contributions. 3. Management and Decision-making: Defines the management structure, whether it is member-managed, where all members jointly manage the LLC, or manager-managed, where specific individuals or entities are assigned managerial powers. This section specifies the decision-making process, voting rights, and quorum requirements for major business decisions. 4. Distributions and Allocations: Outlines how profits and losses are distributed among members or shareholders. For LCS structured as S Corps, distributions must adhere to specific Internal Revenue Service (IRS) guidelines to maintain the S Corp status and take advantage of tax benefits. 5. Meeting Protocol: Specifies the frequency and conduct of meetings, including annual meetings and special meetings. It defines notice requirements, record-keeping responsibilities, and the ability to hold meetings through electronic means. 6. Transfer of Ownership: Addresses procedures for transferring ownership interests and outlines any restrictions or rights of first refusal that may be applicable. This section ensures an orderly transfer process while protecting the LLC's stability. 7. Dissolution and Liquidation: Details the process of dissolving the LLC, including voluntary or involuntary dissolution, and outlines the steps to be taken for winding up the LLC's affairs, liquidating assets, and distributing remaining funds among members or shareholders. Types of Houston Texas LLC Operating Agreement for S Corp: While the basic structure and components mentioned above are generally applicable to all LCS operating as S Corps in Houston, variations in operating agreements may occur based on individual business needs and preferences. Some specific types of Houston Texas LLC Operating Agreements for S Corps include: 1. Single-Member Operating Agreement for S Corp: Designed for LCS with a single owner or member who also elects S Corp taxation. This agreement outlines the single-member LLC's internal operations and adherence to S Corp tax guidelines. 2. Multi-Member Operating Agreement for S Corp: Suitable for LCS with multiple owners or members who choose S Corp taxation. This agreement facilitates decision-making, profit distribution, and other internal operations in a multi-owner environment. 3. Customized Operating Agreement for S Corp: In some cases, LCS may require specific provisions tailored to their unique circumstances. These provisions could include additional requirements regarding capital contributions, member qualifications, or dispute resolution mechanisms. In conclusion, the Houston Texas LLC Operating Agreement for S Corp is a vital document that governs the internal operations, decision-making processes, and ownership structure of an LLC operating as an S Corporation in Houston. By carefully drafting and adhering to this agreement, LLC members or shareholders can establish clear guidelines and protect their interests while maintaining compliance with state and federal regulations.

Houston Texas LLC Operating Agreement for S Corp

Description

How to fill out Houston Texas LLC Operating Agreement For S Corp?

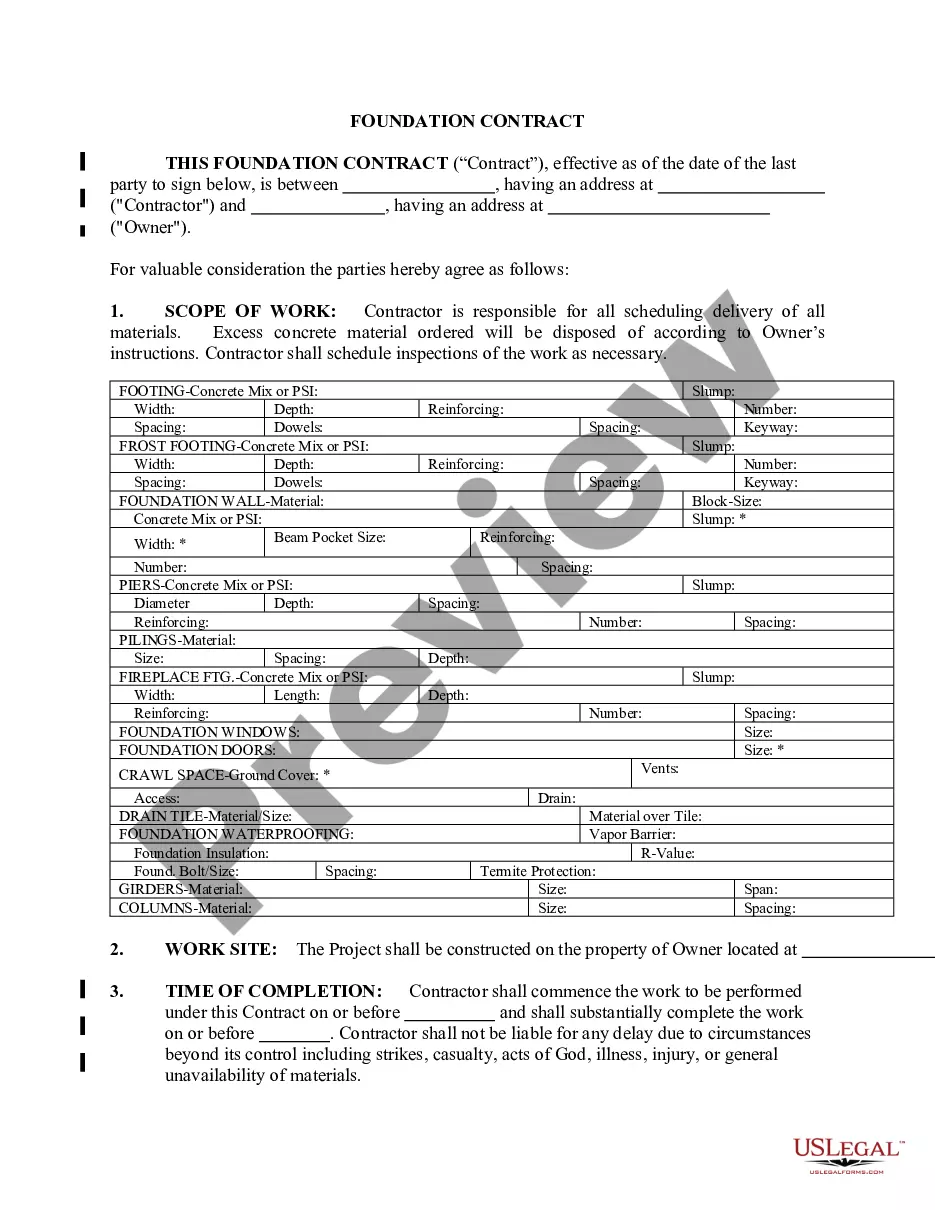

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Houston LLC Operating Agreement for S Corp, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed resources and guides on the website to make any activities related to paperwork completion straightforward.

Here's how to purchase and download Houston LLC Operating Agreement for S Corp.

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can impact the validity of some documents.

- Examine the similar document templates or start the search over to locate the appropriate file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Houston LLC Operating Agreement for S Corp.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Houston LLC Operating Agreement for S Corp, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional entirely. If you need to cope with an exceptionally challenging case, we advise getting an attorney to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Become one of them today and purchase your state-specific documents effortlessly!

Form popularity

FAQ

What's the difference in bylaws vs operating agreement? Bylaws are internal governing documents for corporations, while an operating agreement lays out internal operating procedures for an LLC.

Similarly, corporations (S corps and C corps) are not legally required by any state to have an operating agreement. Still, experts advise owners of these businesses to create and execute their version of an operating agreement, called bylaws.

The S corp shareholder agreement is a contract between the shareholders of an S corporation. The contents of the shareholder agreement differ from one S corporation to another. The shareholders are also able to decide what goes into the shareholder agreement, which is also referred to as the stockholder agreement.

Your operating agreement is the governing document of your Texas LLC. While not technically required by law, it should be considered a necessary document for your business. An operating agreement lays out the ownership of your company and basic management structure. Who Your Members Are & Their Ownership Percentages.

Texas does not require LLCs to have operating agreements, but it is highly recommended. An operating agreement will help protect your limited liability status, prevent financial and managerial misunderstandings, and ensure that you decide on the rules governing your business instead of state law by default.

The state of Texas does not require an operating agreement for a business to engage in trade; however, it will be unwise to operate a business without an operating agreement as it is designed to protect your personal assets in the event that the company incurs liabilities.

The operating agreement for an LLC does not need to be notarized. If you make changes to the operating agreement once it has been agreed to by all members/owners, retain the original copy and save the changes as a new version.

The state of Texas does not require an operating agreement for a business to engage in trade; however, it will be unwise to operate a business without an operating agreement as it is designed to protect your personal assets in the event that the company incurs liabilities.

The larger your distribution, the less employment tax you'll pay. The S corporation is the only business form that makes it possible for its owners to save on Social Security and Medicare taxes. Historically, this has been the main reason S corporations have been popular.

An S corp operating agreement is a business entity managing document. Typically, an operating agreement is a document that defines how a limited liability company will be managed. An S corp actually uses corporate bylaws and articles of incorporation for the purpose of organizing the business operation.

More info

For more information on C-Corporation and LLC structure see the following articles for the General Assembly: C-Corporation: New Business Entity; C-Corporation Registration; and a brief overview of the LLC structure in Maryland: A Look at the LLC Structure in Maryland to see the changes Maryland's filing deadline and how that could impact you

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.