The San Antonio Texas LLC Operating Agreement for S Corp is a comprehensive legal document that outlines the rules, regulations, and procedures that govern the operations of a limited liability company (LLC) operating as an S Corporation. This agreement serves as a crucial tool in establishing and maintaining the structure and management of an S Corp in compliance with the laws and regulations of the state of Texas, specifically in the vibrant city of San Antonio. The key purpose of this agreement is to provide a clear framework for the internal functions, decision-making processes, rights, and responsibilities of the LLC's members, managers, and officers. It addresses crucial areas such as the contributions of each member, the division of profits and losses, voting rights, allocation of assets, and decision-making protocols. By delineating these aspects, the agreement helps prevent disputes and provides a roadmap for the successful operation and growth of the S Corp. Different types of San Antonio Texas LLC Operating Agreements for S Corps may include specific provisions tailored to the unique needs of the business or the preferences of its members. These variations can be classified based on factors such as capital contributions, profit distribution arrangements, management structures, and dispute resolution mechanisms. 1. Capital Contribution Agreement: This type of agreement focuses on the initial and ongoing contributions made by each member to the S Corp. It outlines the capital investment required to establish and support the company's operations, including any additional contributions or buy-in requirements of new members over time. 2. Profit Distribution Agreement: This agreement specifies the manner in which profits and losses are allocated among the S Corp's members. It can be customized to reflect the varying levels of involvement or risk taken on by each member, ensuring a fair and equitable distribution of profits according to agreed-upon ratios or percentages. 3. Manager-Managed Agreement: In certain instances, an S Corp might appoint one or more managers to oversee the company's day-to-day operations, rather than having all members involved in the management. A manager-managed operating agreement outlines the authority, responsibilities, and decision-making powers vested in these managers, while still considering the input and voting rights of all members. 4. Dispute Resolution Agreement: Disputes between members can arise in any business, and an S Corp is no exception. A dispute resolution agreement establishes procedures to resolve disagreements through mediation, arbitration, or another mutually agreed-upon approach. This agreement can help avoid costly litigation and maintain a harmonious working environment within the S Corp. In conclusion, the San Antonio Texas LLC Operating Agreement for S Corp is a critical document that ensures the smooth functioning, management, and accountability of an LLC operating as an S Corporation in San Antonio. By tailoring the agreement to the specific requirements of the business, its members, and its organizational structure, the S Corp can establish a solid foundation for long-term success while complying with the laws and regulations of Texas.

San Antonio Texas LLC Operating Agreement for S Corp

Description

How to fill out San Antonio Texas LLC Operating Agreement For S Corp?

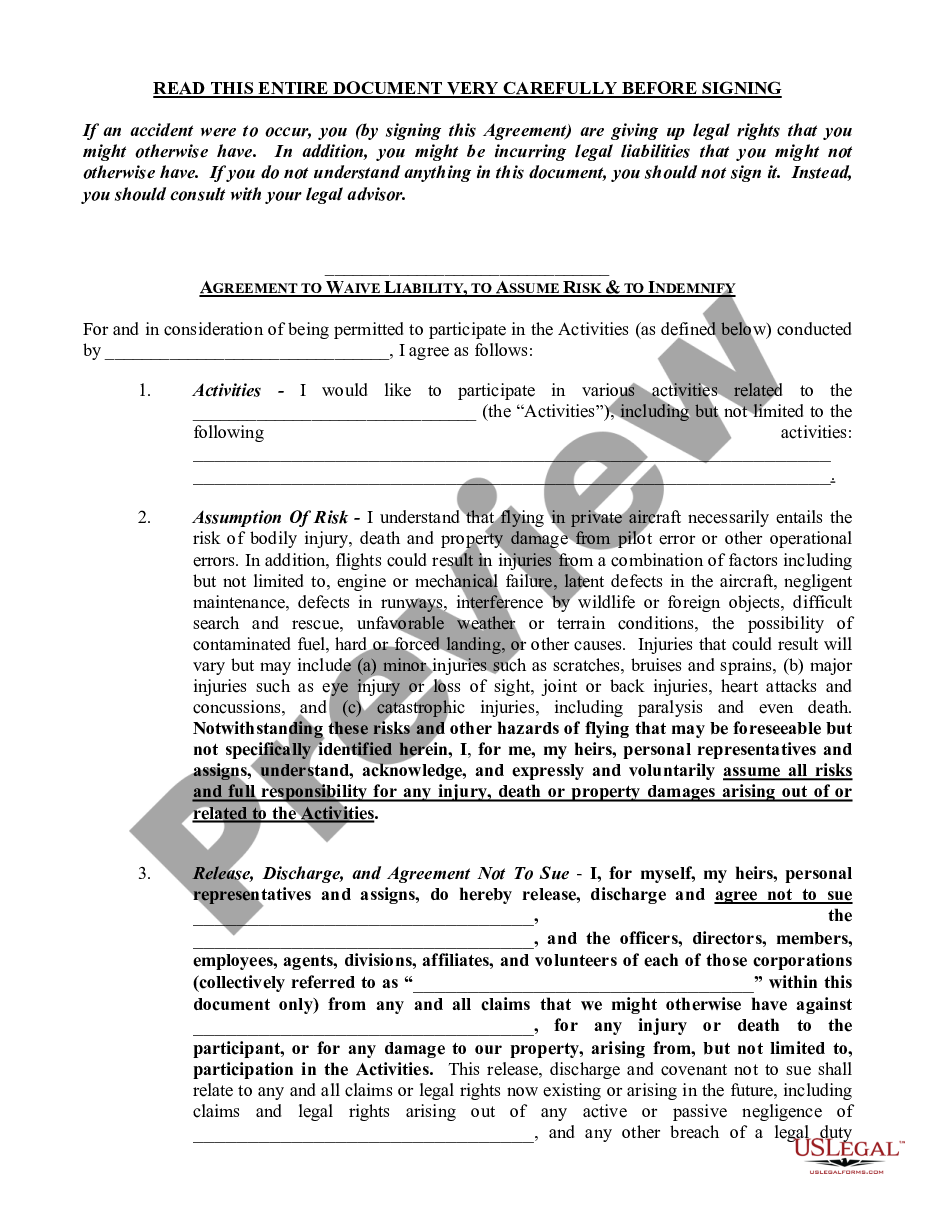

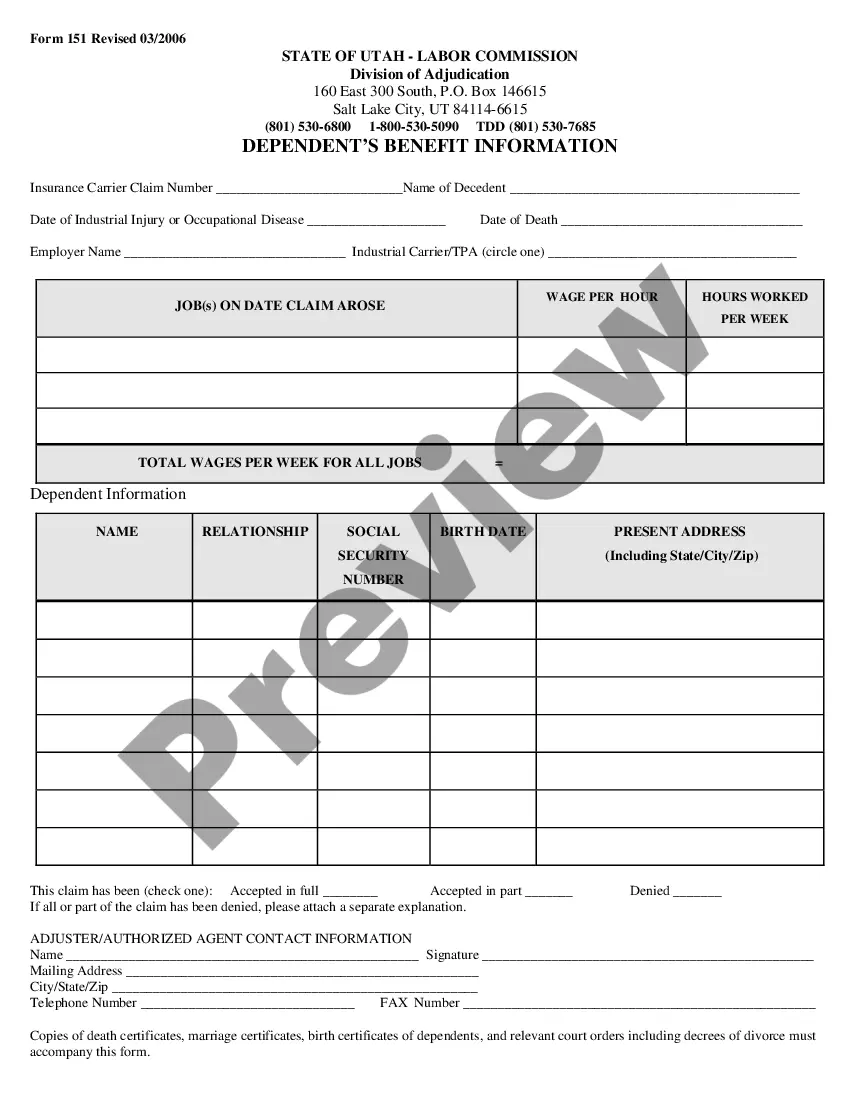

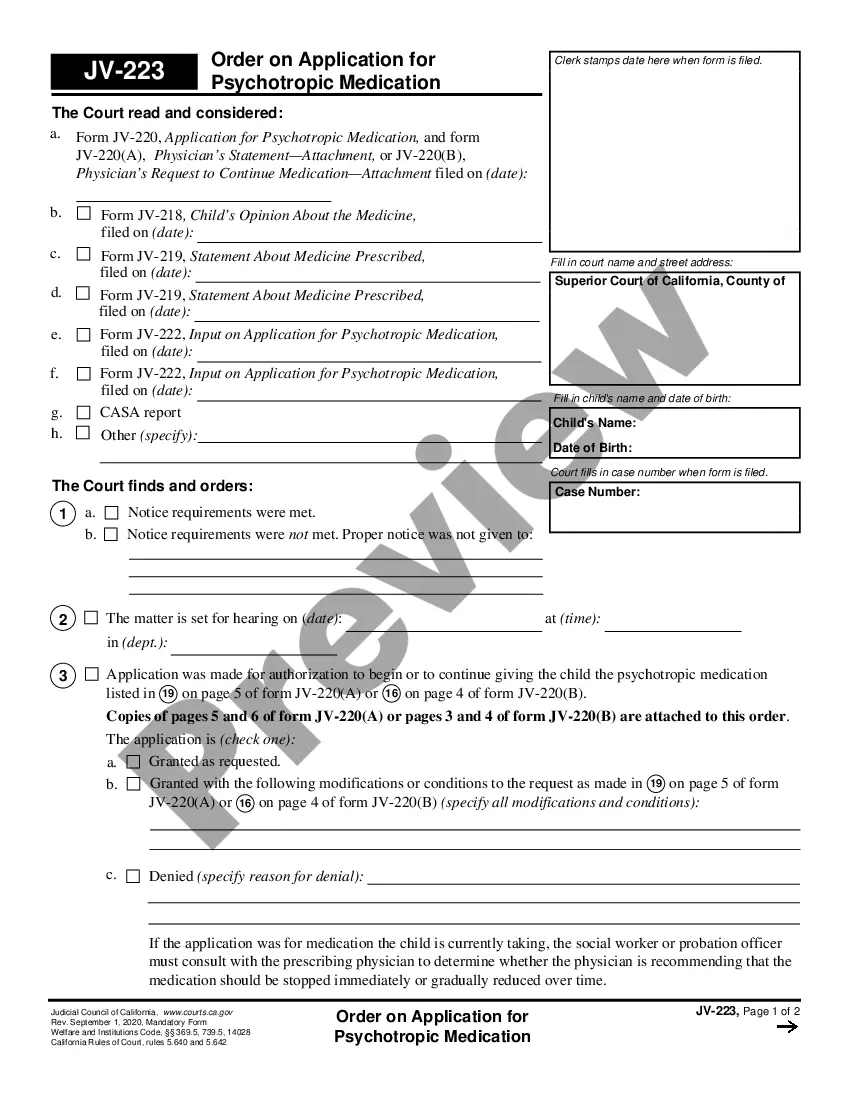

Preparing legal documentation can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the San Antonio LLC Operating Agreement for S Corp, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case collected all in one place. Therefore, if you need the latest version of the San Antonio LLC Operating Agreement for S Corp, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Antonio LLC Operating Agreement for S Corp:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your San Antonio LLC Operating Agreement for S Corp and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

How to Form an LLC in Texas (6 steps) Step 1 Registered Agent.Step 2 LLC Type.Step 3 File for Registration.Step 4 Pay the Fee.Step 5 Operating Agreement.Step 6 Employer Identification Number (EIN)

Yes. LLC owners can make changes to an Operating Agreement by mutual consent. One or more of the owners will propose some amendments to the agreement.

Every Texas LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Run both businesses under one LLC using a DBA Say you already have an LLC but you want to branch out to another service or focus area under the same niche. Rather than creating an entirely new LLC, you can set up a DBA (doing business as) or multiple DBA's.

Instead of using an operating agreement, which is specific to an LLC, an S corporation will rely on its corporate bylaws and articles of incorporation. All states require S corporations to use articles of incorporation.

An S corp operating agreement is a business entity managing document. Typically, an operating agreement is a document that defines how a limited liability company will be managed. An S corp actually uses corporate bylaws and articles of incorporation for the purpose of organizing the business operation.

Similarly, corporations (S corps and C corps) are not legally required by any state to have an operating agreement, but experts advise owners of these businesses to create and execute their version of an operating agreement, called bylaws.

The multimember operating agreement is specially designed for LLCs with more than one owner. It is the only document that designates an LLC's owners and the percentage of the company they own. Both members should sign the operating agreement in the presence of a notary public.

How do you change the operating agreement for an LLC? An LLC can change its operating agreement at any time. The operating agreement itself should include a process for making changes. A single-member LLC owner can work with their attorney to make the changes, making sure that the date of the changes is documented.