A Clark Nevada LLC Operating Agreement for a married couple is a legal document that outlines the specific terms and conditions relevant to managing their Limited Liability Company (LLC). This agreement acts as a crucial framework to define ownership rights, responsibilities, decision-making processes, and profit-sharing mechanisms within the business structure. One type of Clark Nevada LLC Operating Agreement for a married couple is the General Operating Agreement. This agreement is a comprehensive document that covers all aspects of operating the LLC. It includes provisions related to member contributions, distribution of profits and losses, management structure, decision-making procedures, voting rights, transfer of ownership, dissolution procedures, dispute resolution, and any other important details regarding the LLC. Another type of Clark Nevada LLC Operating Agreement for married couples is the Single-Member Operating Agreement. This agreement is suitable if only one spouse intends to be the sole member of the LLC while the other spouse typically takes a non-member position. The Single-Member Operating Agreement would outline the non-member spouse's limited involvement, their rights, and the extent of their liability. The Clark Nevada LLC Operating Agreement for married couples can also include provisions specifically tailored to their unique circumstances. These provisions may address matters such as taxes, spousal consent on financial decisions, division of labor, the process of adding new members in case of a growing family, and management succession planning. Key terms that are relevant to this agreement include "LLC operating agreement," "married couple," "Clark Nevada," "LLC management," "member contributions," "profit-sharing," "voting rights," "decision-making procedures," "ownership transfer," "dissolution procedures," "dispute resolution," "single-member," "spousal consent," and "management succession planning." It is important for married couples forming an LLC in Clark Nevada to consult legal professionals who specialize in business and martial law to ensure their operating agreement is compliant with state laws and addresses their specific needs and goals.

Clark Nevada LLC Operating Agreement for Married Couple

Description

How to fill out Clark Nevada LLC Operating Agreement For Married Couple?

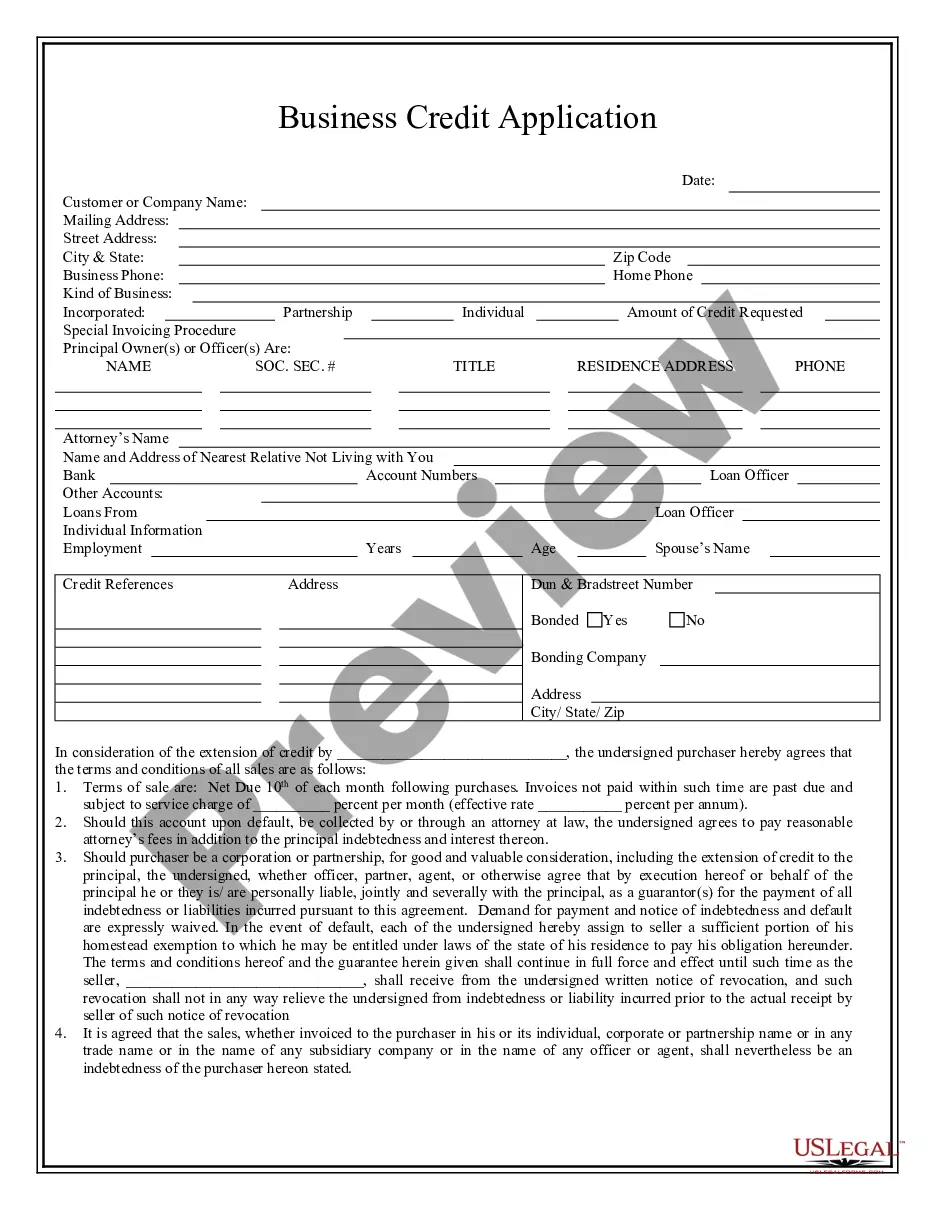

If you need to get a reliable legal form provider to find the Clark LLC Operating Agreement for Married Couple, look no further than US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can select from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support make it easy to find and execute various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply select to search or browse Clark LLC Operating Agreement for Married Couple, either by a keyword or by the state/county the form is intended for. After finding the required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Clark LLC Operating Agreement for Married Couple template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly ready for download once the payment is processed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less costly and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate contract, or execute the Clark LLC Operating Agreement for Married Couple - all from the convenience of your home.

Join US Legal Forms now!

Form popularity

FAQ

The straightforward answer is no: You are not required to name your spouse anywhere in the LLC documents, especially if they aren't directly involved in the business.

If an LLC is owned by a husband and wife in a non-community property state the LLC should file as a partnership. However, in community property states you can have your multi-member (husband and wife owners) and that LLC can get treated as a SMLLC for tax purposes.

To make the election, income, deductions, asset gain, or loss must be divided between each spouse based on the percentage of their ownership in the LLC. Then each spouse must file a separate Schedule C or C-EZ and will also file a Schedule SE to pay any self-employment tax.

Since the default rule for multi-members LLCs is that the LLC is treated as a partnership, an LLC composed solely of a husband and wife will be a partnership for tax purposes unless the members choose to have it elect to be treated as a corporation. There is one exception to the general rule, however.

Overview. If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC.

Since the default rule for multi-members LLCs is that the LLC is treated as a partnership, an LLC composed solely of a husband and wife will be a partnership for tax purposes unless the members choose to have it elect to be treated as a corporation. There is one exception to the general rule, however.

If you choose to set up your LLC with just one spouse as a member, you can classify it as a sole proprietorship or a corporation. If your LLC has more than one member, you can classify it as a partnership or corporation.

Under this rule, a married couple can treat their jointly owned business as a disregarded entity for federal tax purposes if: the LLC is wholly owned by the husband and wife as community property under state law.