The Hennepin Minnesota LLC Operating Agreement for a Married Couple is a legal document that outlines the rights, responsibilities, and obligations of a married couple who choose to operate a Limited Liability Company (LLC) in Hennepin County, Minnesota. This agreement is designed to provide clarity and structure to the couple's business operations, ensuring a harmonious working relationship and protecting their individual and joint assets. The Hennepin Minnesota LLC Operating Agreement for a Married Couple includes various essential provisions that address critical aspects of the LLC's operation. These provisions typically cover areas such as ownership interests, decision-making authority, profit and loss distribution, management structure, dispute resolution, and the dissolution of the LLC. It serves as a vital tool for the couple to ensure their business functions smoothly and efficiently. While the basic framework of the Hennepin Minnesota LLC Operating Agreement for a Married Couple remains the same, there may be different types or variations of this agreement depending on the specific needs and goals of the couple. Some commonly available types of Hennepin Minnesota LLC Operating Agreement for a Married Couple may include: 1. Traditional Hennepin Minnesota LLC Operating Agreement for a Married Couple: This is the standard operating agreement that covers the essential provisions mentioned above. It provides a comprehensive framework for the management and operation of the LLC while protecting the interests of both spouses. 2. Customized Hennepin Minnesota LLC Operating Agreement for a Married Couple: In certain cases, couples may require a more customized agreement tailored to their specific business requirements. This type of agreement allows for additional clauses or modifications to address unique circumstances or specific arrangements between the couple. 3. Hennepin Minnesota LLC Operating Agreement with Separate Property Provisions: Often, married couples bring different assets into the LLC, some of which may be categorized as separate property. This type of operating agreement would include provisions outlining how these separate properties are treated within the LLC, ensuring proper identification and protection of each spouse's personal assets. 4. Hennepin Minnesota LLC Operating Agreement for Estate Planning: In instances where couples may want to utilize the LLC as part of their estate planning strategy, a specialized operating agreement can be crafted. This agreement may include provisions related to the transfer or inheritance of ownership interests or appointment of successor members in case of death or incapacity of one spouse. It is crucial for married couples considering the formation of an LLC in Hennepin County, Minnesota, to consult with an experienced attorney to draft an operating agreement tailored specifically to their unique circumstances. By doing so, they can ensure that their business and personal interests are protected and that their LLC operates within the bounds of the law.

Hennepin Minnesota LLC Operating Agreement for Married Couple

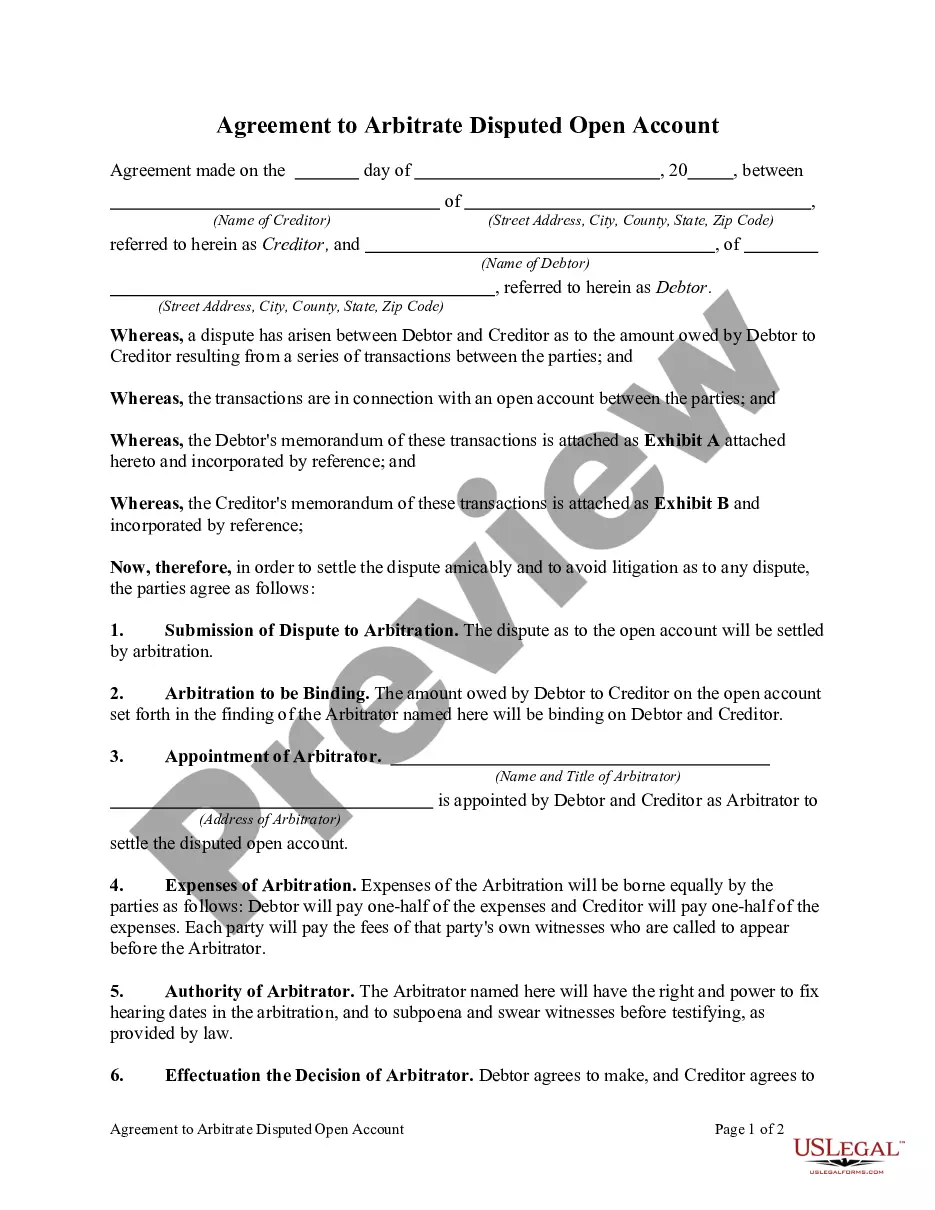

Description

How to fill out Hennepin Minnesota LLC Operating Agreement For Married Couple?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare formal paperwork that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any personal or business objective utilized in your county, including the Hennepin LLC Operating Agreement for Married Couple.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Hennepin LLC Operating Agreement for Married Couple will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to obtain the Hennepin LLC Operating Agreement for Married Couple:

- Make sure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Hennepin LLC Operating Agreement for Married Couple on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!