A Sacramento California LLC Operating Agreement for a married couple is a legally binding document that outlines the terms and conditions under which a limited liability company (LLC) will be operated and managed by a married couple in Sacramento, California. This agreement is essential for couples looking to start a business together while also ensuring both parties' rights, responsibilities, and liabilities are clearly defined and protected. Key elements typically included in a Sacramento California LLC Operating Agreement for a married couple may involve: 1. Ownership and Contributions: This section specifies the ownership percentage of each spouse in the LLC and details the contributions made by each party, such as capital, assets, or services provided. 2. Management Structure: Here, the agreement outlines how the management of the LLC will be structured. It may specify if both spouses will act as managing members or whether they will appoint a designated manager to handle the day-to-day operations. Roles, decision-making processes, and responsibilities should be defined. 3. Profit and Loss Distribution: This section explains how profits and losses will be allocated among the married couple. The agreement may outline how they will share the company's earnings and how any potential losses will be distributed. 4. Capital Accounts: The LLC Operating Agreement may establish capital accounts for each spouse, which track the amount of capital contributed and the share in the company's profits or losses. 5. Decision-Making: This aspect determines how decisions will be made within the LLC. It may describe whether decisions require unanimous agreement, a majority vote, or if one spouse can make certain decisions alone but must inform the other. 6. Membership Changes and Dissolution: The agreement should outline procedures for handling changes in membership, such as the addition or removal of a spouse from the LLC, as well as the dissolution or termination of the LLC in the event of divorce or death. 7. Dispute Resolution: To prevent conflicts between spouses, this section may address how any disputes will be resolved, either through mediation, arbitration, or through the court system. Different types of Sacramento California LLC Operating Agreements for married couples may include: 1. Husband-Wife Operating Agreement: This agreement is suitable for husbands and wives wanting to establish an LLC together, defining their roles, responsibilities, and profit-sharing arrangements. 2. Community Property Operating Agreement: In California, where community property laws apply, couples may choose this agreement type to outline how community property will be attributed to the LLC and how it affects ownership and profit distribution. 3. Joint-Venture Agreement: Sometimes, instead of forming an LLC, married couples opt for a joint venture. This agreement details their collaboration, specifies their responsibilities, and outlines the profit-sharing mechanisms. In conclusion, a Sacramento California LLC Operating Agreement for a married couple is a crucial legal document that helps ensure a smooth and transparent operation of a jointly owned business. It serves to protect the rights and interests of both spouses while providing clarity on ownership, management, profit-sharing, and dispute resolution. It is essential to consult with a qualified attorney to tailor the agreement to the specific needs and circumstances of the married couple.

Sacramento California LLC Operating Agreement for Married Couple

Description

How to fill out Sacramento California LLC Operating Agreement For Married Couple?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Sacramento LLC Operating Agreement for Married Couple, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Sacramento LLC Operating Agreement for Married Couple from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Sacramento LLC Operating Agreement for Married Couple:

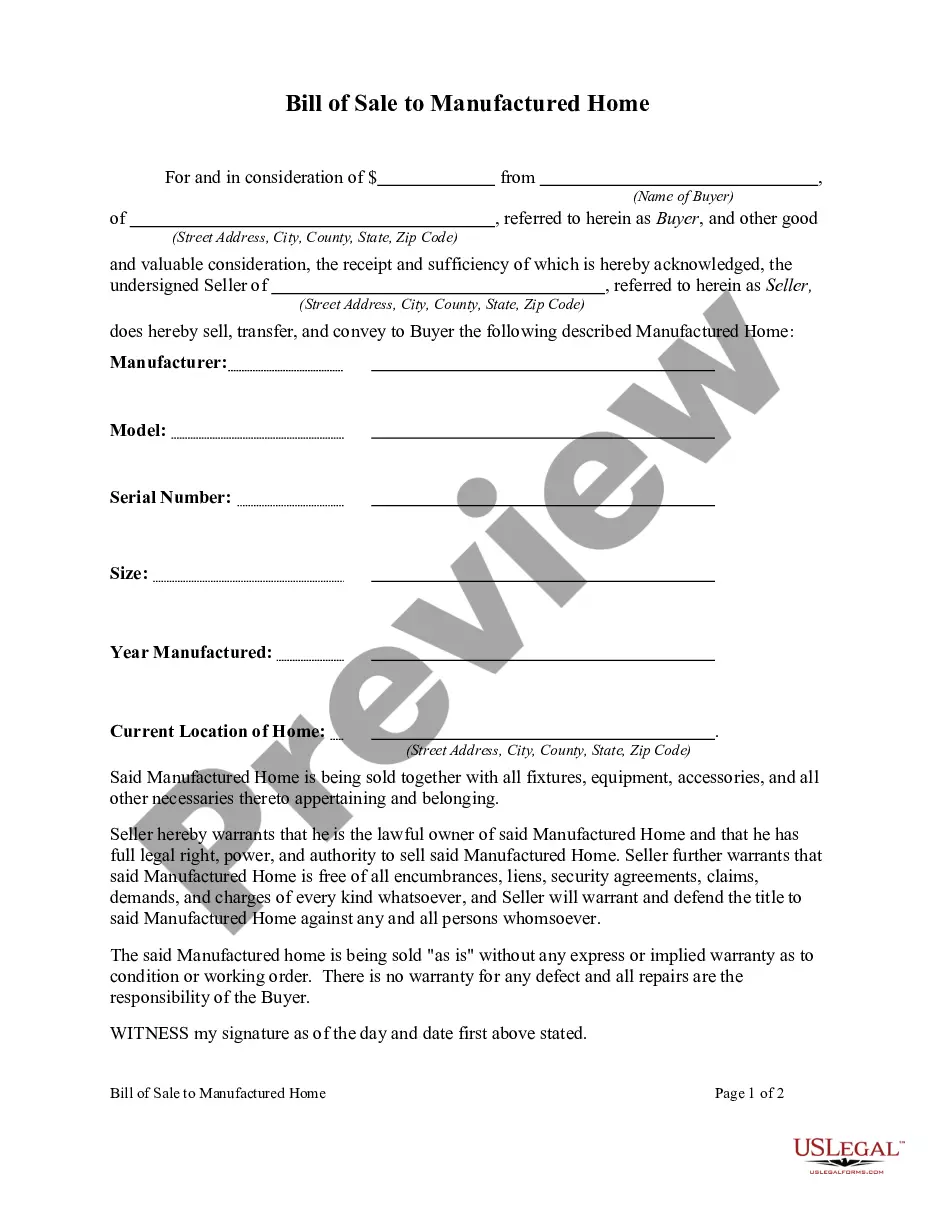

- Analyze the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!