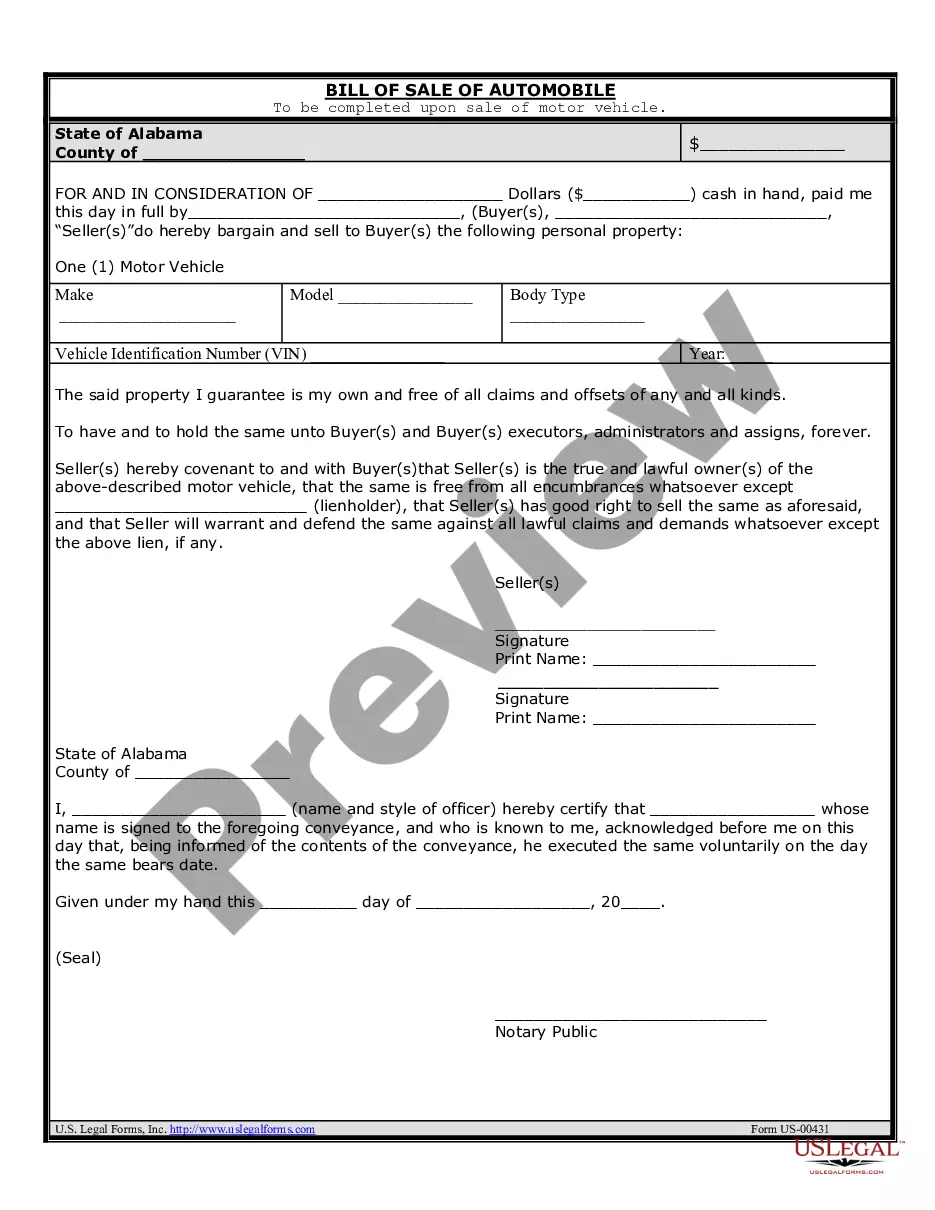

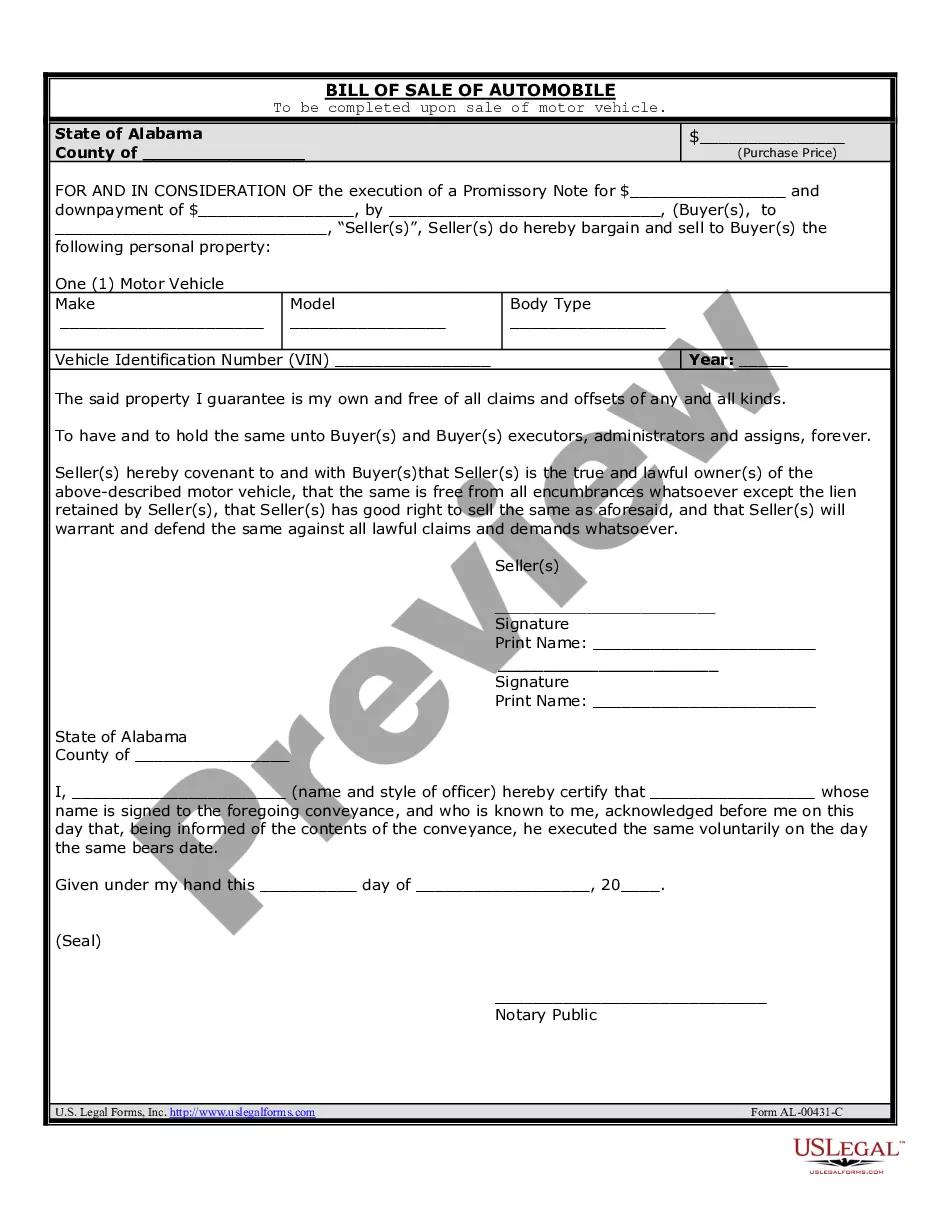

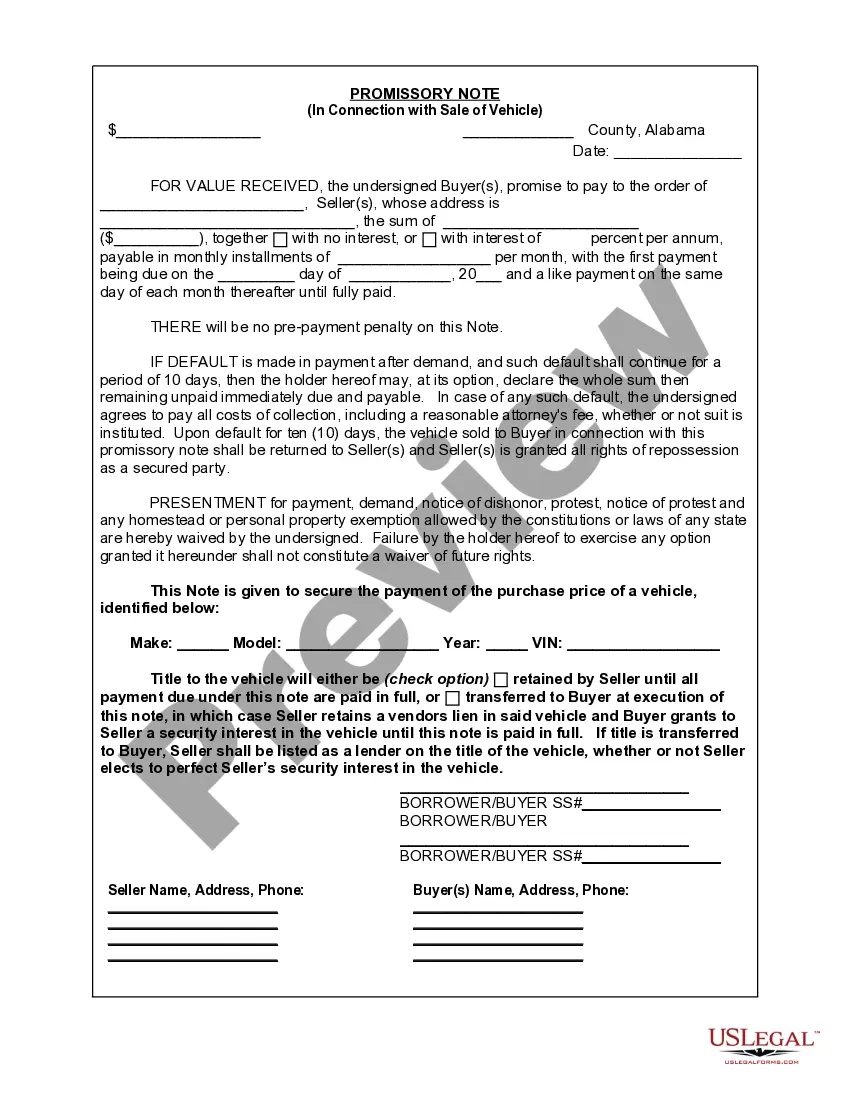

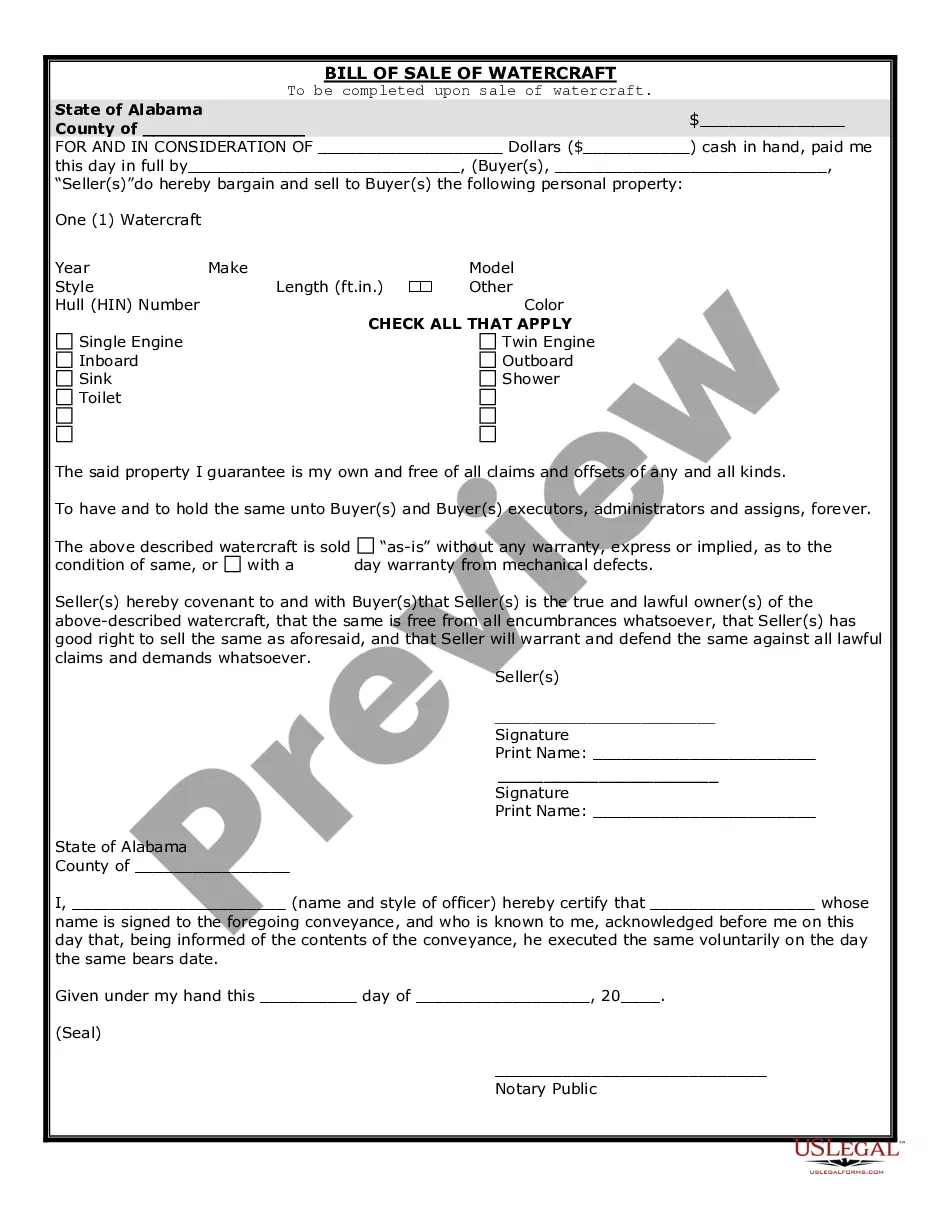

The San Diego California LLC Operating Agreement for Married Couple is a legal document that outlines the guidelines, rights, and obligations of a limited liability company (LLC) formed by a married couple in San Diego, California. This agreement serves as a crucial foundation for the smooth operation and management of the LLC, ensuring both partners are on the same page and providing protection for their investment. Keywords: San Diego California, LLC Operating Agreement, Married Couple, limited liability company, legal document, guidelines, rights, obligations, smooth operation, management, protection, investment. There are different types of San Diego California LLC Operating Agreement for Married Couple that can be tailored to meet specific needs and circumstances. Here are a few examples: 1. Basic LLC Operating Agreement: This agreement outlines the essential provisions necessary for an LLC formed by a married couple in San Diego, California. It covers aspects such as ownership percentages, capital contributions, profit distribution, decision-making, management roles, and dispute resolution. 2. Distribution of Property Agreement: In case the married couple decides to transfer property or assets into the LLC, this agreement specifies the terms and conditions regarding the ownership, use, and management of these assets within the company. 3. Estate Planning Operating Agreement: This agreement includes provisions related to estate planning and succession in the event of one or both spouses' incapacitation, death, or divorce. It may detail the procedures for transferring ownership and the rights and responsibilities of any successors or beneficiaries. 4. Operating Agreement with Tax Management: This type of agreement focuses on incorporating tax strategies and compliance within the LLC. It outlines the allocation and reporting of income, losses, deductions, and tax liabilities, helping the couple maximize tax benefits and stay in compliance with San Diego and California tax laws. 5. Dissolution Agreement: In the unfortunate event that the married couple needs to dissolve the LLC, this agreement outlines the procedures, distribution of assets, and settlement of liabilities. It helps ensure a fair and orderly dissolution process, avoiding potential disagreements or disputes. By customizing the San Diego California LLC Operating Agreement for Married Couple according to their specific needs, couples can establish clear guidelines, protect their interests, and foster a successful and harmonious business partnership.

San Diego California LLC Operating Agreement for Married Couple

Description

How to fill out San Diego California LLC Operating Agreement For Married Couple?

Drafting papers for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft San Diego LLC Operating Agreement for Married Couple without expert assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid San Diego LLC Operating Agreement for Married Couple on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step guide below to get the San Diego LLC Operating Agreement for Married Couple:

- Look through the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that fits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any situation with just a few clicks!