San Jose, California LLC Operating Agreement for Married Couple: A Comprehensive Guide When embarking on a business venture as a married couple in San Jose, California, it is crucial to establish a legally binding operating agreement for your limited liability company (LLC). An LLC Operating Agreement acts as a contract between the members of the LLC, outlining their rights, responsibilities, and the internal operations of the business. By having an Operating Agreement in place, couples can protect their assets, define their roles, and ensure a smooth operation for their venture. Here, we will delve into the main components of a San Jose, California LLC Operating Agreement for a married couple, outlining its relevance and various types. 1. San Jose, California Community Property LLC Operating Agreement: For married couples residing in San Jose, California, following community property laws, this specific type of LLC Operating Agreement is tailored to protect the community property interests of both spouses. Community property laws generally dictate that any assets acquired during the marriage are considered jointly owned, thus emphasizing the need for a well-drafted operating agreement to ensure the fair distribution of assets and liabilities in the event of divorce or dissolution of the LLC. 2. San Jose, California Separate Property LLC Operating Agreement: In circumstances where married couples opt to maintain separate property ownership, this operating agreement accommodates the unique needs of each spouse. It defines how the profits and losses are allocated based on each spouse's proportionate ownership interests, safeguarding their individual investments and avoiding potential disputes in case of divorce or separation. Key Components of a San Jose, California LLC Operating Agreement for a Married Couple: a. Ownership and Capital Contributions: The operating agreement should clearly outline the ownership percentages of each spouse and detail their individual capital contributions to the LLC. b. Roles and Responsibilities: Specify the roles and responsibilities of each spouse within the company. This section delineates decision-making authority, managerial duties, and the division of labor to avoid any conflicts or misunderstandings. c. Profit and Loss Allocation: Describe how profits and losses will be allocated between the spouses to reflect their respective ownership interests. This section ensures equitable distribution of financial gains and helps avoid potential disputes in the future. d. Management and Voting: Define the decision-making process, voting procedures, and whether each spouse has equal voting power or if voting is based on proportionate ownership interests. Clearly articulating the decision-making structure ensures smooth operations and avoids impasses in the decision-making process. e. Transfer of Ownership: Address the conditions and procedures for transferring ownership interests, whether between spouses, heirs, or third parties. This section minimizes conflicts and provides a clear roadmap for the process. f. Dissolution and Buyout: Outline the process and terms for dissolution of the LLC and how a buyout will be conducted. This protects both spouses' interests in the case of business closure or divorce, preventing any potential legal battles. g. Tax Considerations: Mention any tax considerations unique to the LLC and the couple's situation. Consultation with a tax professional is highly recommended ensuring compliance with San Jose, California tax laws and to optimize tax planning strategies. Having a comprehensive San Jose, California LLC Operating Agreement specifically tailored for married couples is essential to set expectations, outline each spouse's rights and duties, protect assets, and maintain harmony within the business partnership. By considering the unique needs of married couples, such as community property laws and separate property ownership, these agreements provide a solid foundation for fruitful partnerships.

San Jose California LLC Operating Agreement for Married Couple

Description

How to fill out San Jose California LLC Operating Agreement For Married Couple?

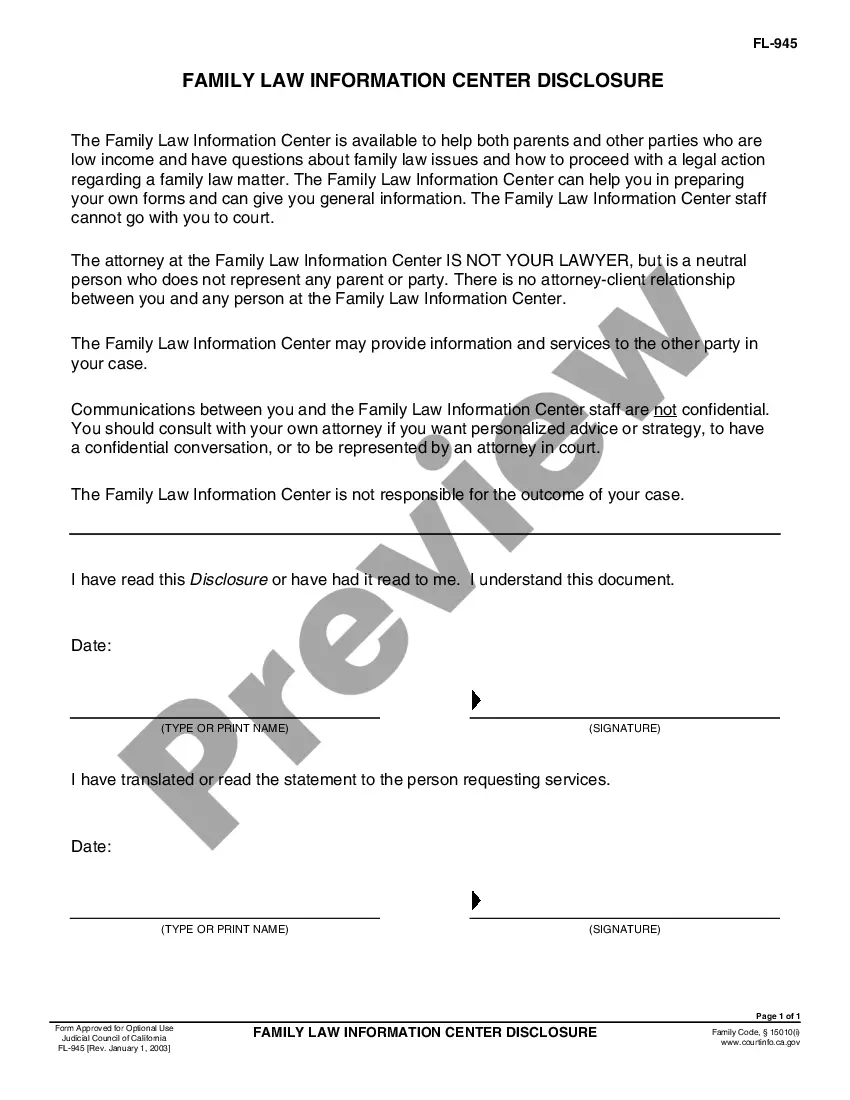

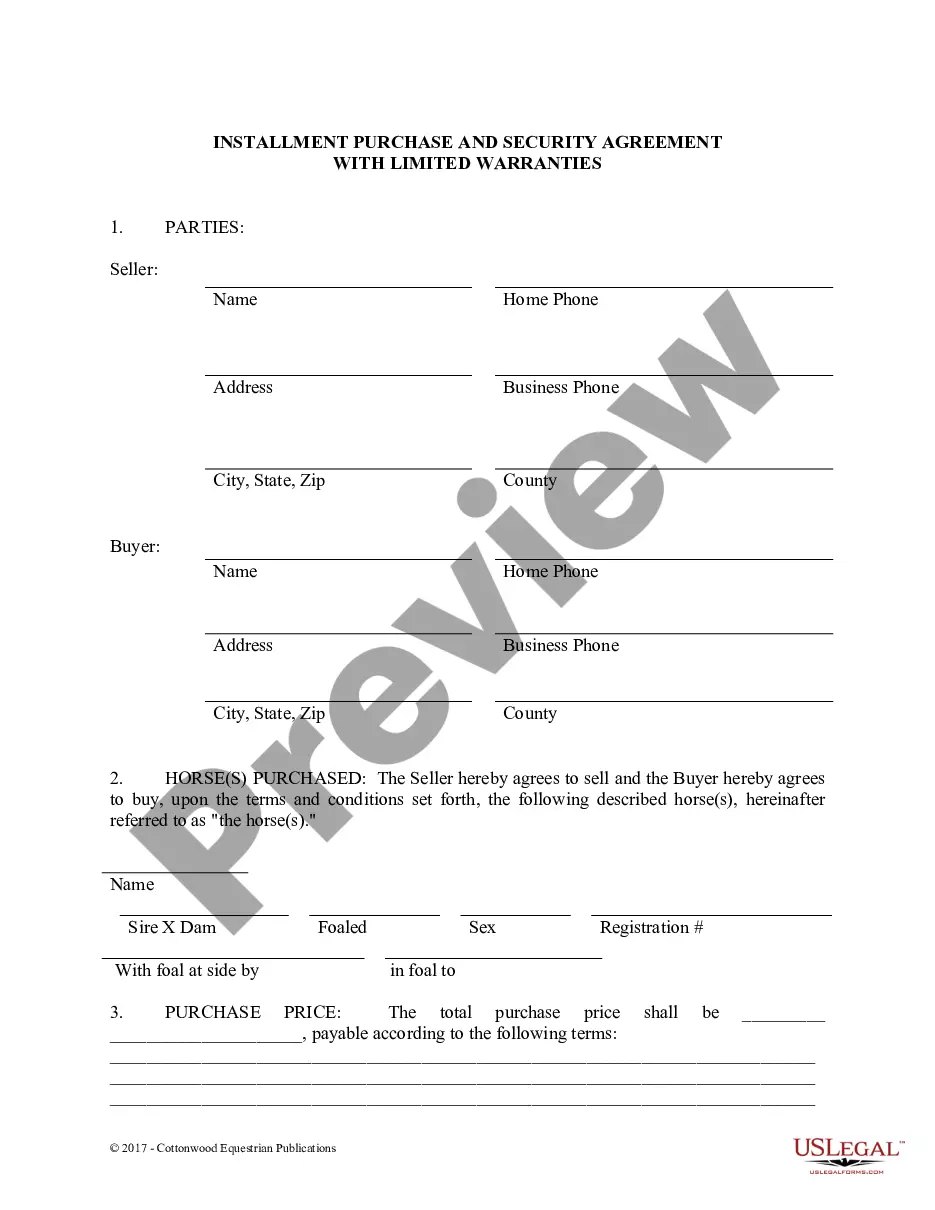

Are you looking to quickly draft a legally-binding San Jose LLC Operating Agreement for Married Couple or maybe any other document to handle your personal or corporate matters? You can select one of the two options: hire a professional to draft a legal document for you or create it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you get professionally written legal documents without paying unreasonable prices for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-specific document templates, including San Jose LLC Operating Agreement for Married Couple and form packages. We provide documents for a myriad of use cases: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- First and foremost, carefully verify if the San Jose LLC Operating Agreement for Married Couple is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to check what it's suitable for.

- Start the searching process again if the template isn’t what you were seeking by utilizing the search box in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the San Jose LLC Operating Agreement for Married Couple template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. In addition, the paperwork we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!