The Cuyahoga Ohio LLC Operating Agreement for Husband and Wife is a legal document that outlines the specific terms and conditions under which a limited liability company (LLC) is operated by a married couple in Cuyahoga, Ohio. This agreement is designed to protect the rights and responsibilities of both spouses involved in the LLC. This operating agreement is crucial for establishing a clear understanding between the husband and wife regarding their roles, ownership percentages, decision-making authority, and profit sharing within the LLC. It ensures that both parties have a say in the management of the business and prevents future conflicts or misunderstandings. The Cuyahoga Ohio LLC Operating Agreement for Husband and Wife typically covers various key aspects, including but not limited to: 1. Ownership and Management: This section specifies the ownership percentages of each spouse in the LLC and outlines their respective management roles and responsibilities. It also clarifies whether both spouses will actively participate in day-to-day operations or if one will primarily handle managerial duties. 2. Capital Contributions: This clause outlines the initial financial contributions made by each spouse to establish the LLC. It may also cover additional contributions required in the future and how they will be treated in terms of ownership percentages and profit distribution. 3. Profits and Losses: This section defines how profits and losses will be allocated between the husband and wife, based on their ownership interests. It may specify whether these distributions will be made on a monthly, quarterly, or annual basis. 4. Decision-Making: The operating agreement outlines how decisions within the LLC will be made. It may require unanimous agreement, or it may grant decision-making authority to one spouse or a designated manager. This section can also cover the decision-making process for major business matters, such as taking on debt, entering contracts, or selling assets. 5. Dissolution and Buyout: In the event of divorce, separation, or the desire to terminate the LLC, this section outlines the process for dissolving the company and settling any outstanding financial obligations. It may also explain the terms and conditions for one spouse buying out the other's ownership interest. Different types of Cuyahoga Ohio LLC Operating Agreements for Husband and Wife may include: — Single-Member LLC Operating Agreement: This agreement is used when there is only one member in the LLC, who happens to be the husband or the wife. — Multi-Member LLC Operating Agreement: This operating agreement is utilized when the husband and wife both have an ownership interest in the LLC and there are additional members involved. — Equal Ownership Agreement: This type of operating agreement is drafted when both spouses have an equal ownership interest in the LLC. — Unequal Ownership Agreement: If one spouse has a greater ownership stake compared to the other, this operating agreement ensures that the division is proportionate and reflects their contributions and roles within the LLC. It is important to consult with a qualified attorney to draft a Cuyahoga Ohio LLC Operating Agreement for Husband and Wife that accurately reflects the unique circumstances and goals of the couple involved.

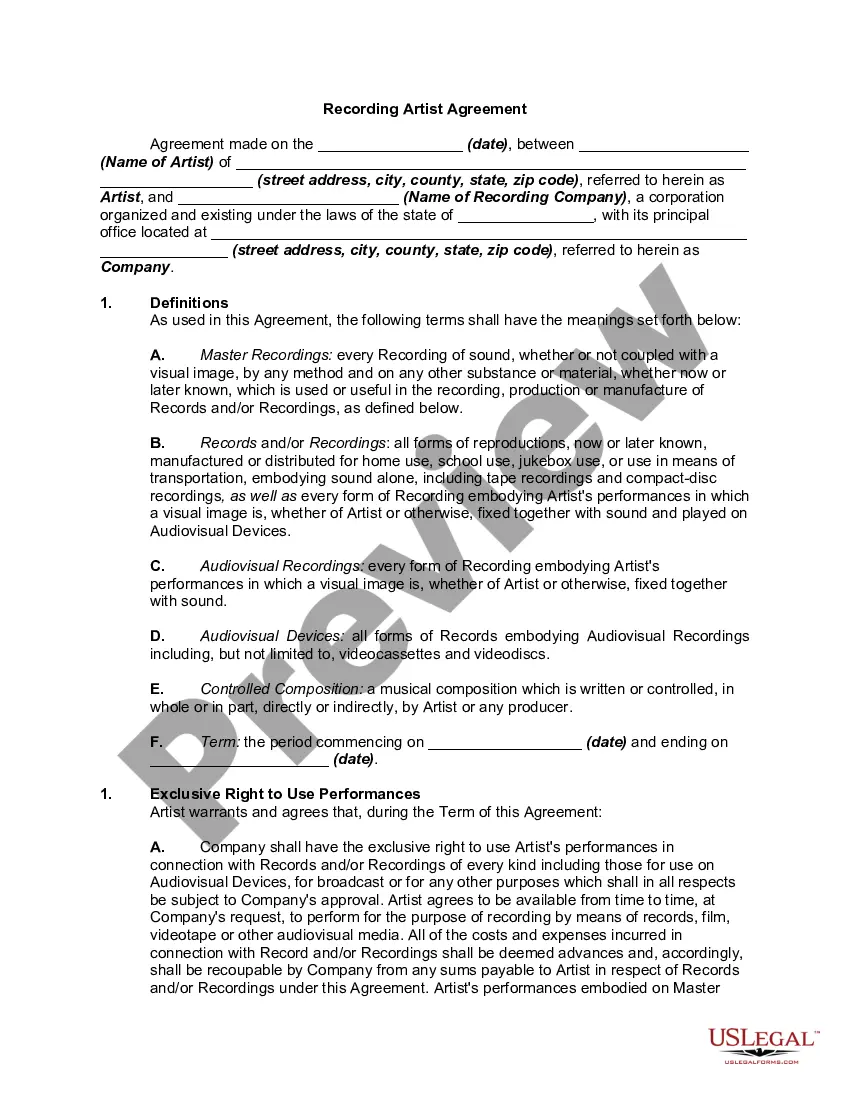

Cuyahoga Ohio LLC Operating Agreement for Husband and Wife

Description

How to fill out Cuyahoga Ohio LLC Operating Agreement For Husband And Wife?

If you need to find a reliable legal document provider to find the Cuyahoga LLC Operating Agreement for Husband and Wife, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of learning materials, and dedicated support make it easy to find and complete various papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply type to search or browse Cuyahoga LLC Operating Agreement for Husband and Wife, either by a keyword or by the state/county the form is created for. After locating required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Cuyahoga LLC Operating Agreement for Husband and Wife template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be instantly ready for download once the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less expensive and more affordable. Set up your first business, organize your advance care planning, draft a real estate agreement, or execute the Cuyahoga LLC Operating Agreement for Husband and Wife - all from the comfort of your home.

Join US Legal Forms now!