A Phoenix Arizona LLC Operating Agreement for Husband and Wife is a legally binding document that outlines the rights, responsibilities, and operating guidelines for a limited liability company (LLC) owned by a married couple in Phoenix, Arizona. This agreement sets forth the terms under which the couple will conduct business, manage finances, and make decisions regarding their LLC. The operating agreement typically includes important provisions such as ownership percentages, profit and loss allocations, management roles, and dispute resolution mechanisms. These provisions help establish a clear understanding between the husband and wife regarding their roles and responsibilities within the company. There are different types of Phoenix Arizona LLC Operating Agreements for Husband and Wife that may be tailored to the specific needs and objectives of the couple. Some of these variations include: 1. Standard LLC Operating Agreement: This is the most common type of operating agreement and covers the basic provisions needed for the efficient operation of the LLC. It typically includes sections on member contributions, profit and loss sharing, decision-making processes, management structure, and dispute resolution. 2. Separate Property LLC Operating Agreement: This type of agreement is suitable for couples who wish to keep their individual assets separate from the LLC's assets. It outlines how assets, revenue, and liabilities related to the LLC will be treated in terms of ownership, control, and distribution. 3. Community Property LLC Operating Agreement: In Arizona, all property acquired during a marriage is generally considered community property. This operating agreement addresses how community property is handled within the LLC, including ownership percentages and distribution of profits and losses. 4. Power of Attorney LLC Operating Agreement: This agreement grants one spouse the authority to act on behalf of the other spouse in specific situations, such as signing contracts or making financial decisions. It outlines the limitations, responsibilities, and liabilities associated with this power of attorney arrangement. 5. Asset Protection LLC Operating Agreement: This agreement focuses on protecting the couple's personal assets from potential liabilities of the LLC. It includes provisions that shield certain assets from being targeted in the event of legal claims or bankruptcy related to the LLC. In conclusion, a Phoenix Arizona LLC Operating Agreement for Husband and Wife is a crucial document for married couples starting an LLC in Phoenix. It establishes the rules, responsibilities, and ownership structure of the company, ensuring both parties have a clear understanding of their rights and obligations. Different types of operating agreements exist to cater to the unique needs and preferences of the couple, such as standard agreements, separate property agreements, community property agreements, power of attorney agreements, and asset protection agreements.

Phoenix Arizona LLC Operating Agreement for Husband and Wife

Description

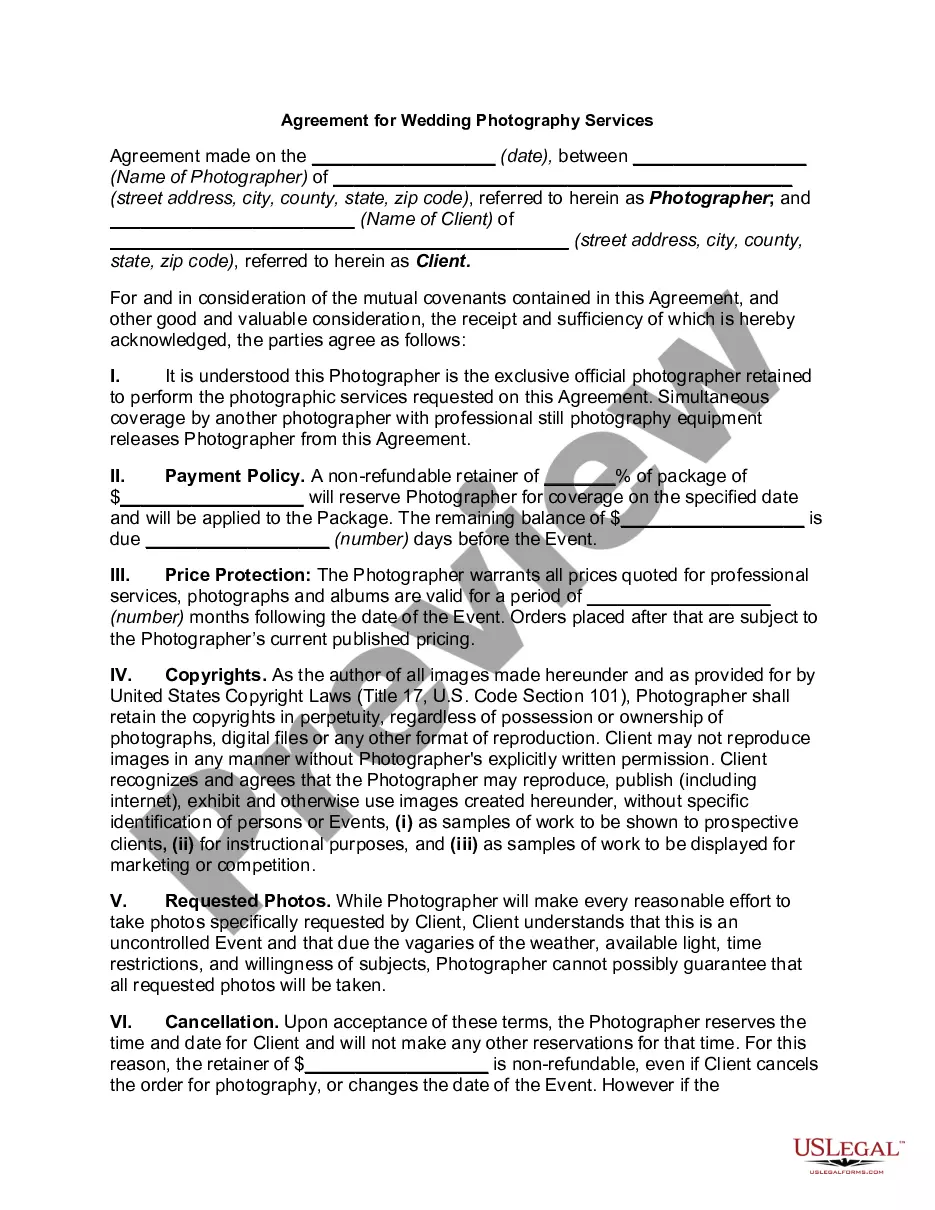

How to fill out Phoenix Arizona LLC Operating Agreement For Husband And Wife?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a lawyer to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Phoenix LLC Operating Agreement for Husband and Wife, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Therefore, if you need the recent version of the Phoenix LLC Operating Agreement for Husband and Wife, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Phoenix LLC Operating Agreement for Husband and Wife:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Phoenix LLC Operating Agreement for Husband and Wife and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!