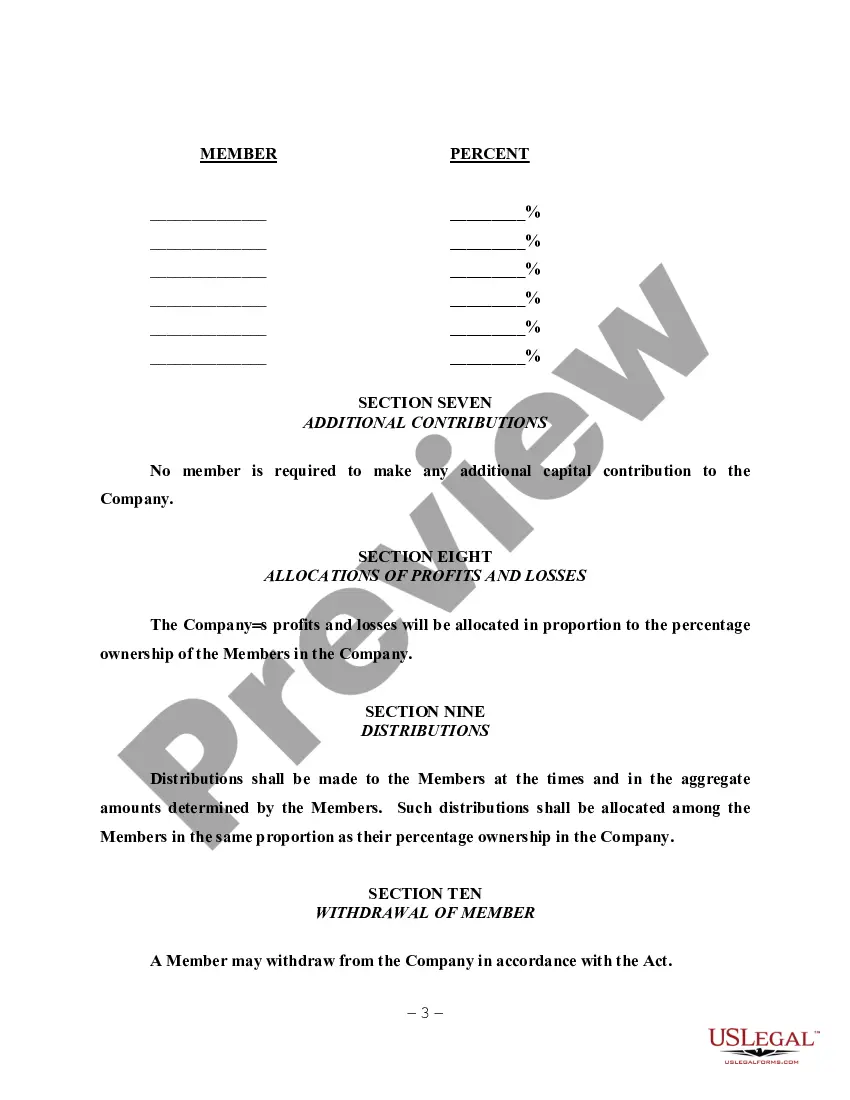

The Hillsborough Florida Sample LLC Operating Agreement is a legally binding document that outlines the rules, regulations, and internal workings of a limited liability company (LLC) in Hillsborough, Florida. This agreement serves as a blueprint for managing the LLC's operations, decision-making processes, profit distribution, and member responsibilities. In its essence, the Hillsborough Florida Sample LLC Operating Agreement is crucial for defining the relationships between the LLC's members and clarifying their rights and obligations. It provides a solid framework for running the LLC smoothly and minimizes the potential for disputes or misunderstandings. Key elements typically covered in the Hillsborough Florida Sample LLC Operating Agreement may include: 1. LLC Name and Purpose: Clearly stating the name of the LLC and its primary purpose or business activities. 2. Contributions: Outlining the initial capital contributions made by each member, whether in cash or assets, and specifying the ownership percentage assigned to each member. 3. Management Structure: Detailing the management structure of the LLC, whether it is member-managed or manager-managed. In a member-managed LLC, all members have the authority to make decisions collectively. On the other hand, in a manager-managed LLC, members appoint one or more managers to handle the day-to-day operations. 4. Voting and Decision-Making: Describing the decision-making process, including voting rights, quorum requirements, and the types of decisions that require unanimous consent or a majority vote. 5. Profit and Loss Distribution: Defining how profits and losses will be allocated among the members, based on their ownership percentage or other agreed-upon formula. 6. Membership Changes: Outlining the procedures for admitting new members or removing existing members, including the conditions under which a member can voluntarily withdraw or be expelled. 7. Transfer of Ownership: Establishing the rules and restrictions on transferring ownership interests, such as obtaining consent from other members or offering the interests first to existing members. 8. Dissolution: Specifying the circumstances under which the LLC may be dissolved, as well as the process for winding down its affairs and distributing assets. It is important to note that there may be several types of Hillsborough Florida Sample LLC Operating Agreements, each tailored to specific industries or circumstances. For example, there could be a Hillsborough Florida Sample LLC Operating Agreement for real estate ventures, professional service providers, or technology startups. The specific terminology and clauses within these agreements may vary to suit the unique needs of different businesses operating within Hillsborough, Florida.

Hillsborough Florida Sample LLC Operating Agreement

Description

How to fill out Hillsborough Florida Sample LLC Operating Agreement?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal documentation that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business objective utilized in your region, including the Hillsborough Sample LLC Operating Agreement.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Hillsborough Sample LLC Operating Agreement will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Hillsborough Sample LLC Operating Agreement:

- Make sure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Hillsborough Sample LLC Operating Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!